The Block Trade Request

The purpose of the bt request is to provide a specific market data information for a block trade, for example the price or quantity for a certain block trade.

The bt format

The bt request must be formed by three fields: bt keyword, instrument symbol and block trade field.

bt(SYMBOL, BLOCK_TRADE_FIELD)

The SYMBOL parameter is the instrument symbol used in QST for different types of products (futures, options, spreads).

Note

For futures, you can use either the standard symbol, e.g. EGCV20, or the corresponding perpetual symbol, e.g. EGC1- .

Likewise, for future spreads, the standard symbol can be used, e.g. ZCZ20:H21[SP], or the corresponding perpetual symbol, e.g. ZC1-:2-[SP] .

While for option instruments, you can either use the actual symbol of the option, e.g. EWZ20C3400 (E-mini S&P End of Month options), or using the underlying symbol instead, e.g. ESZ20{EW}C3400 .

ls – Block Trade Price

lssz – Block Trade Quantity

cd – Contract Description

date – Block Trade Date

tm – Trading Month

lsts – Block Trade Timestamp

Note

You can only request one specific piece of information per bt request, e.g. you can request the block trade price or quantity but not both in the same bt request.

Examples of bt request

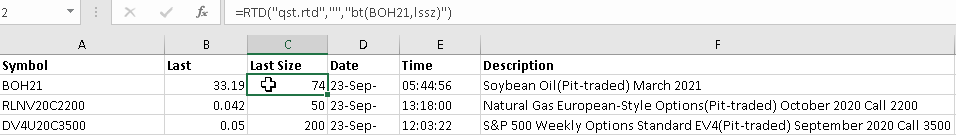

Requesting the block trade quantity from the BOH11 (CBOT Soybean Oil) future:

=RTD("qst.rtd","","bt(BOH21,lssz)")

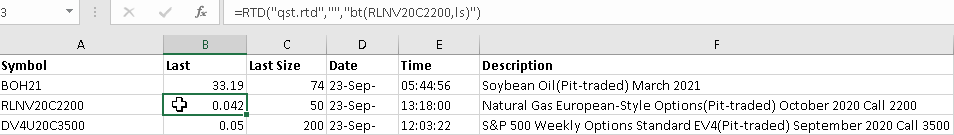

Requesting the block trade price from the RLNV20C2200 (NYMEX Natural Gas) European option:

=RTD("qst.rtd","","bt(RLNV20C2200,ls)")

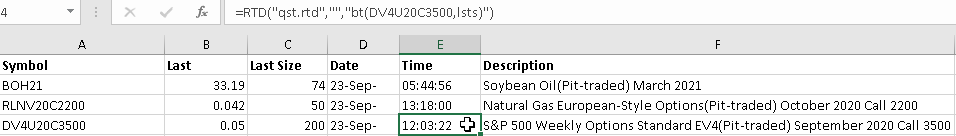

Requesting the timestamp of the block trade from the DV4U20C3500 (CME S&P) weekly option:

=RTD("qst.rtd","","bt(DV4U20C3500,lsts)")