Institutional

Traders

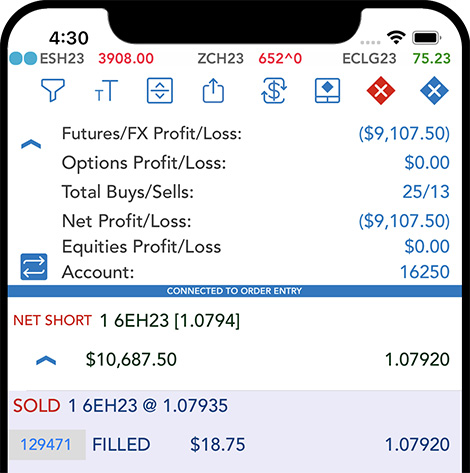

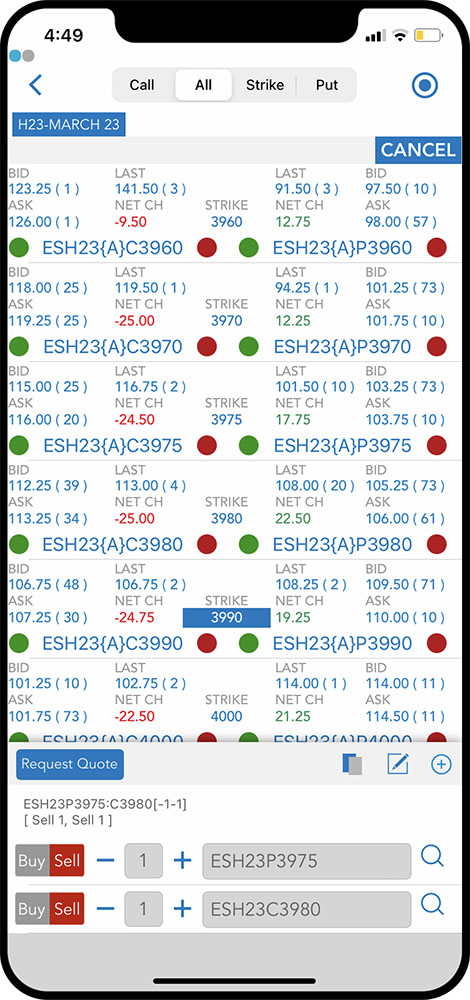

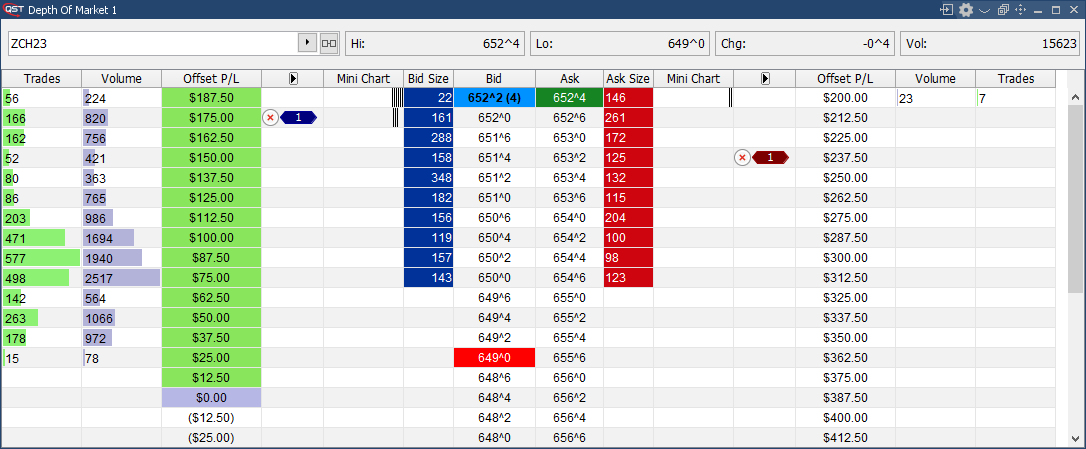

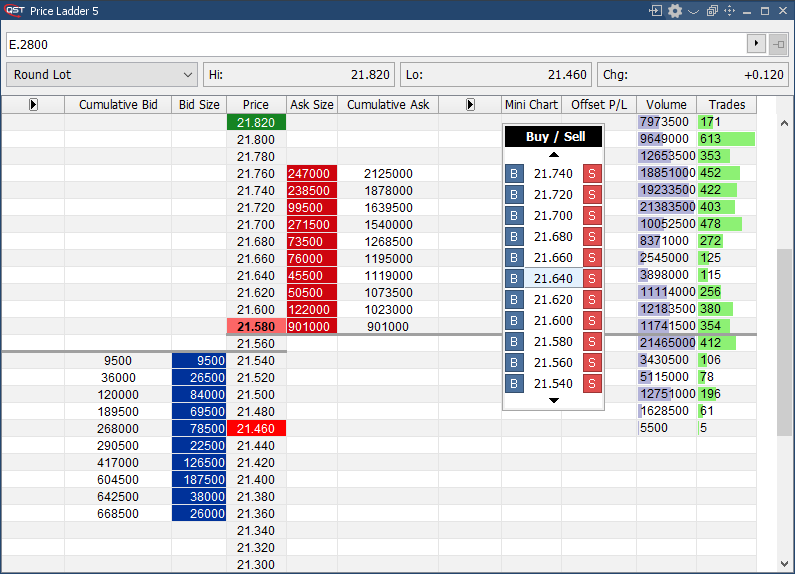

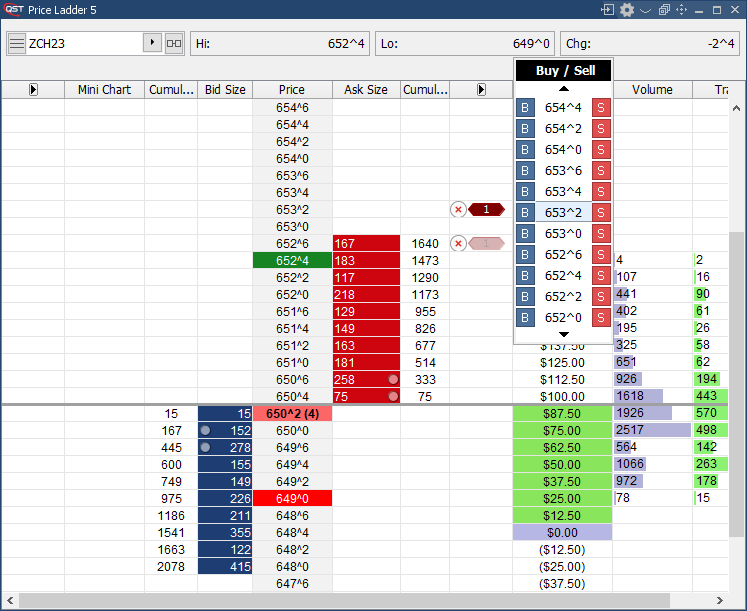

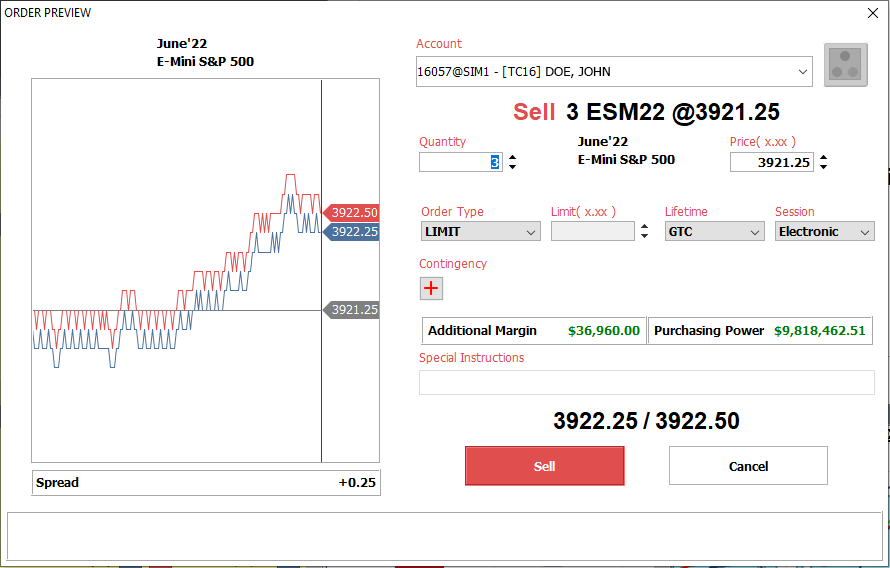

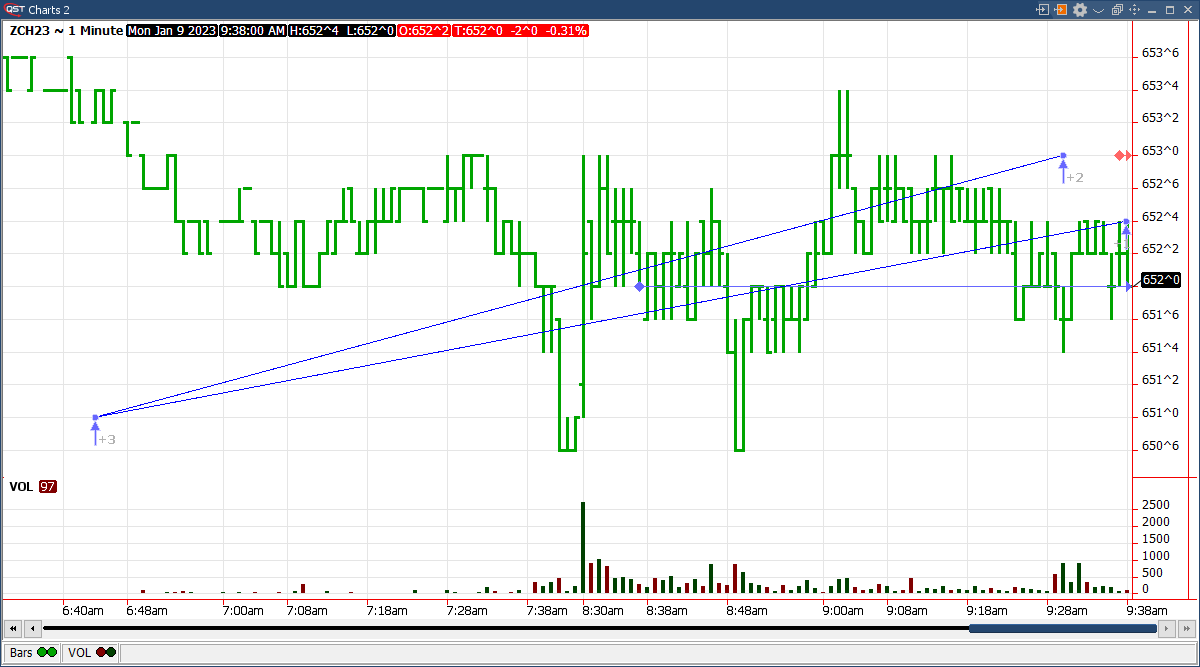

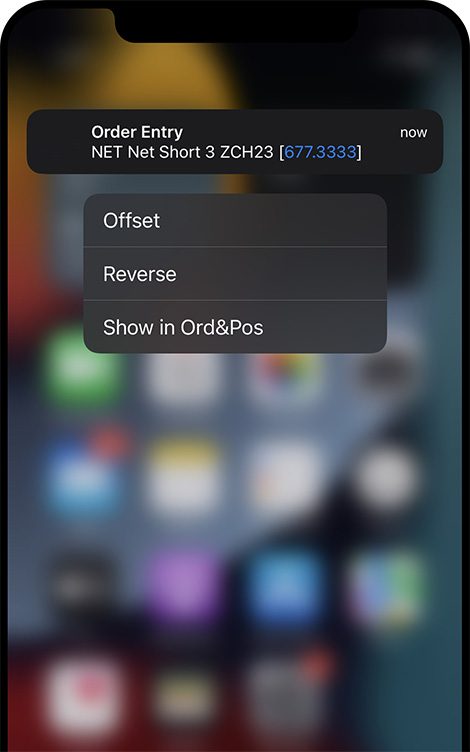

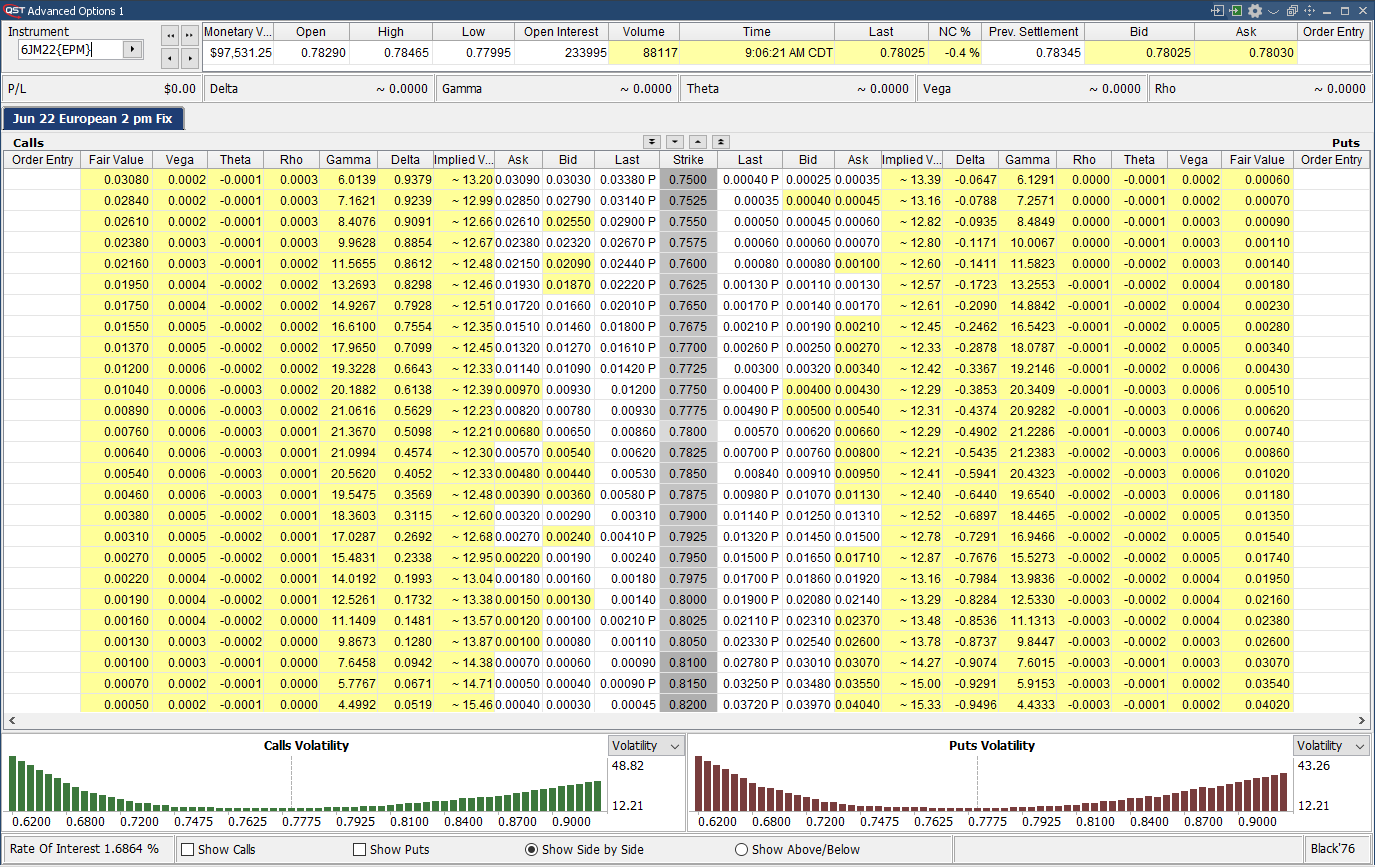

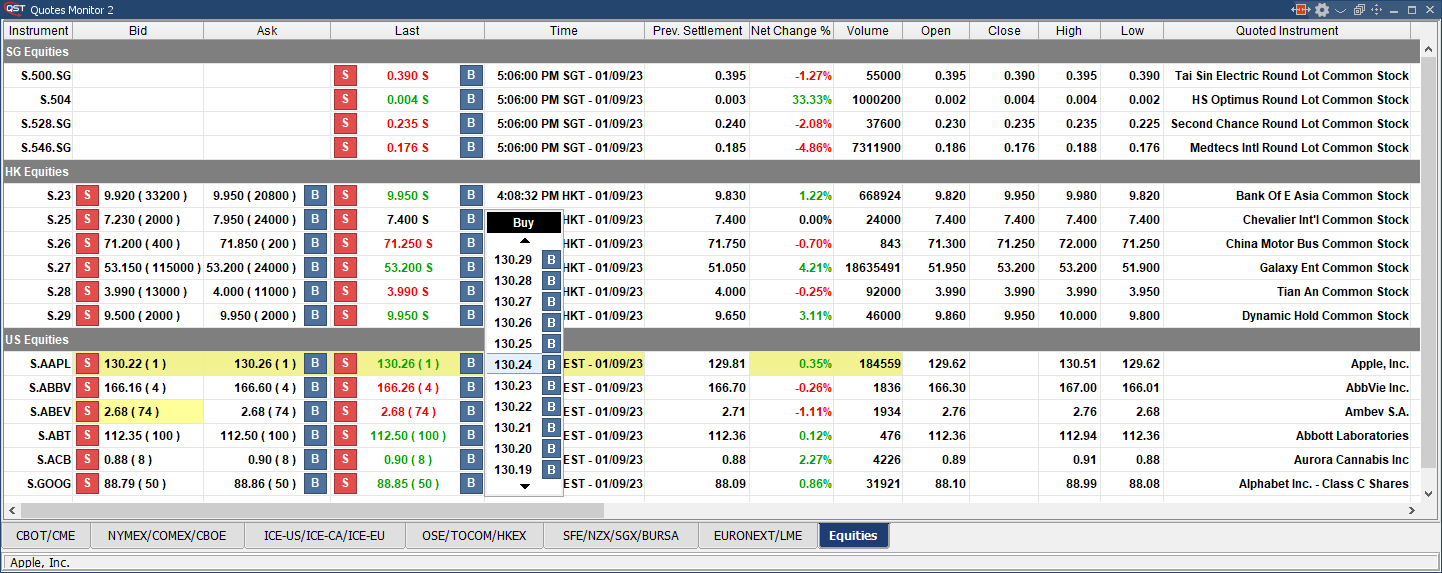

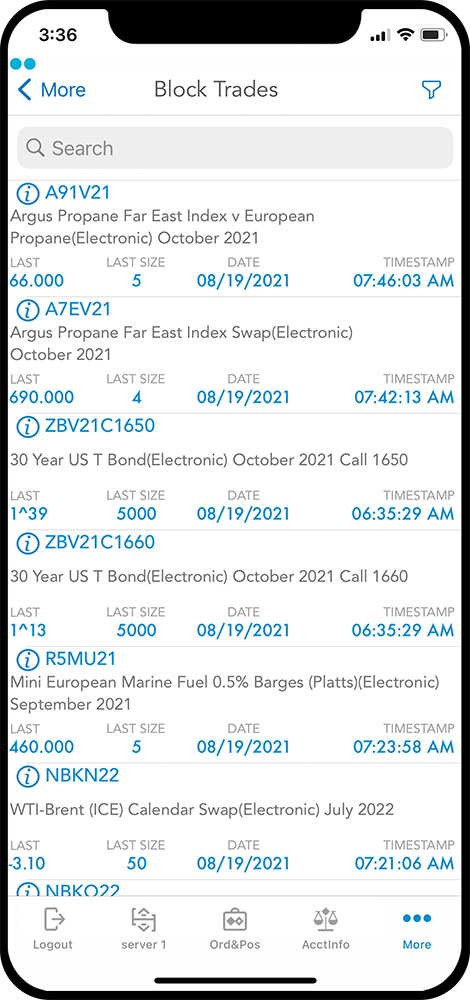

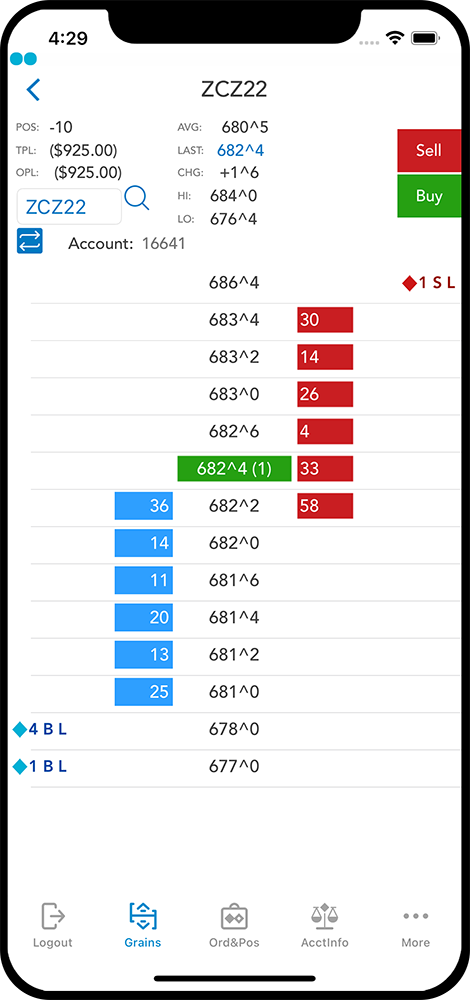

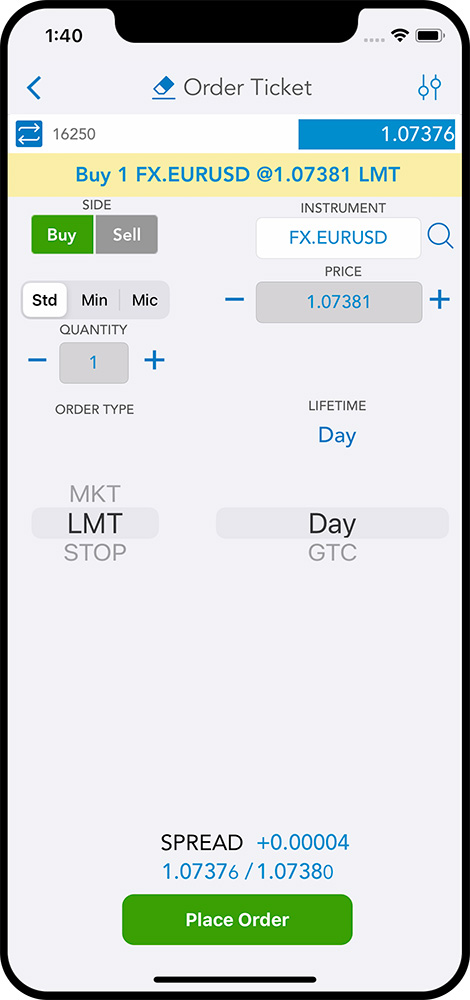

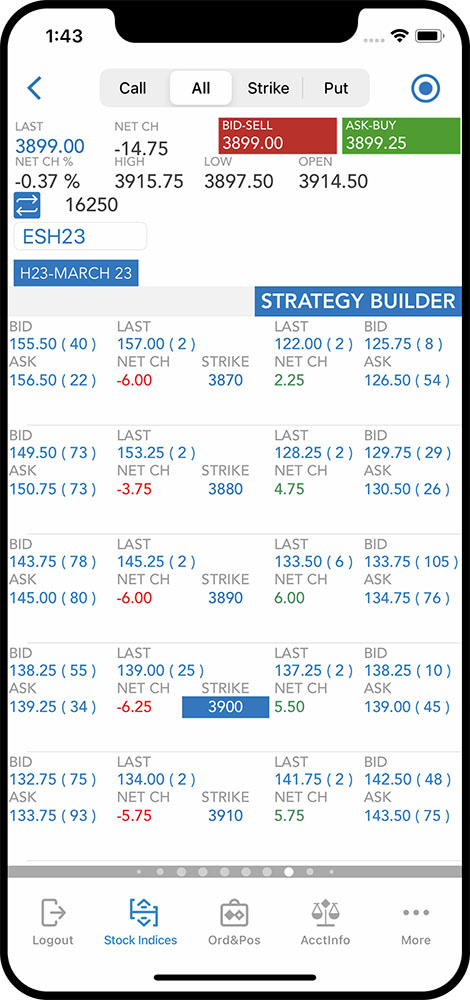

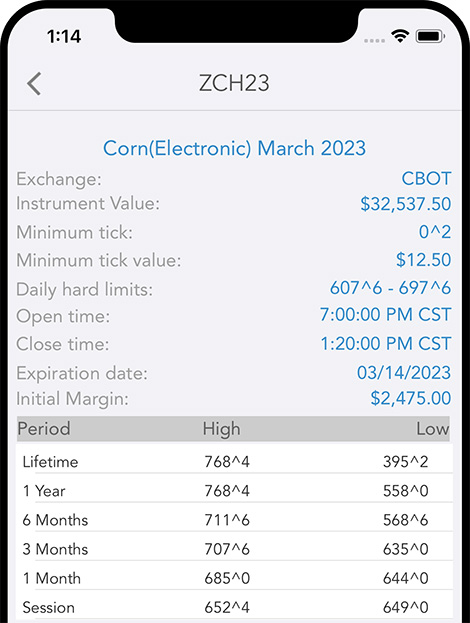

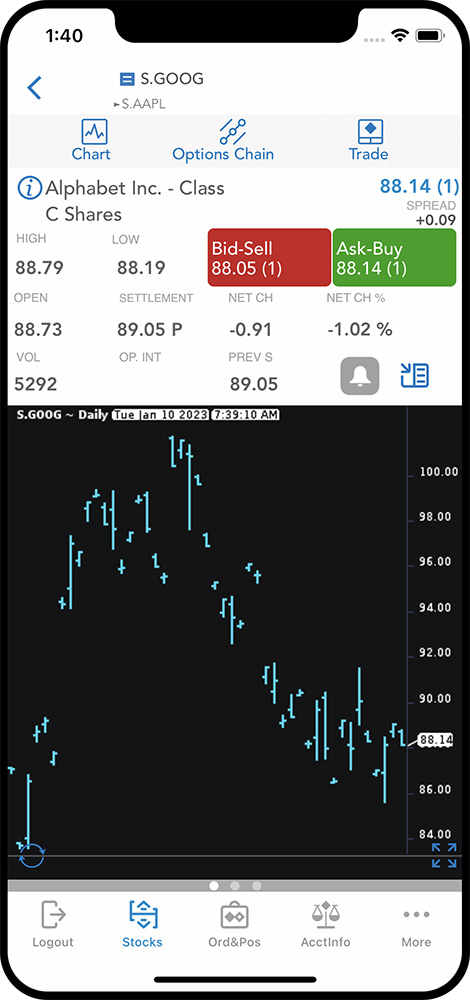

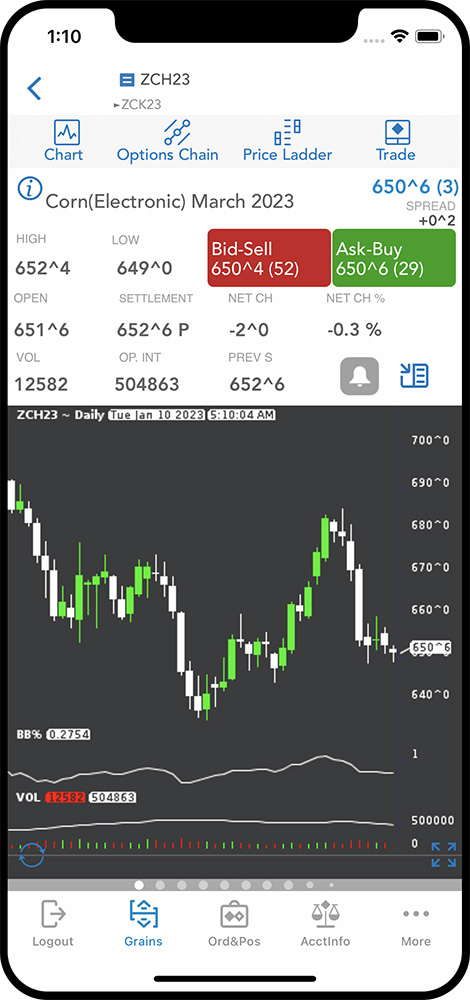

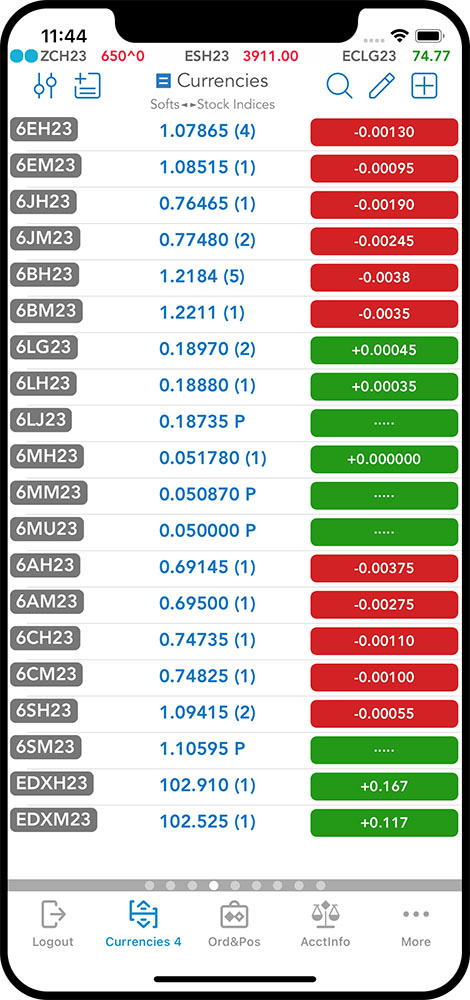

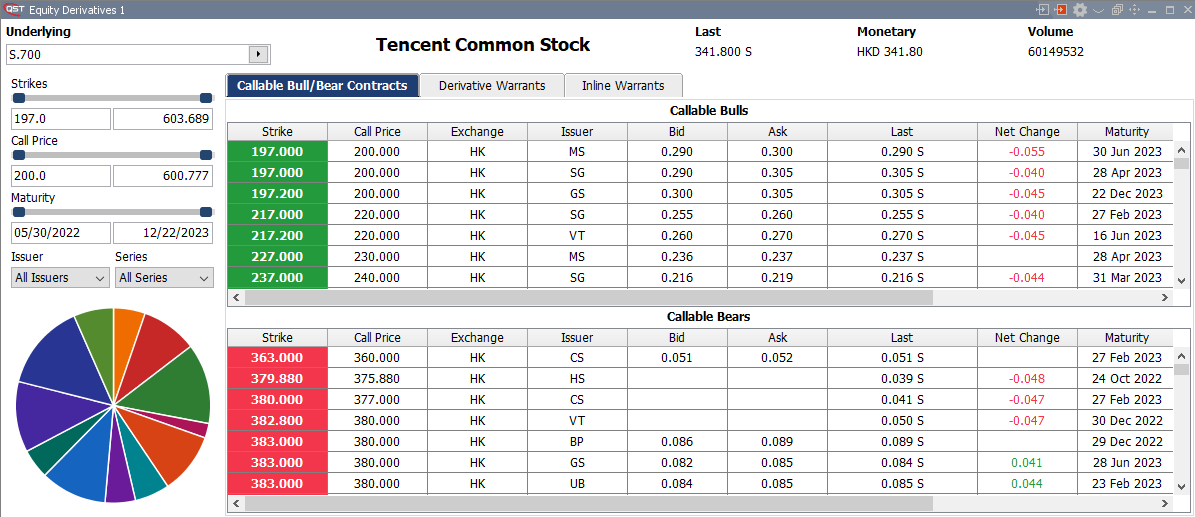

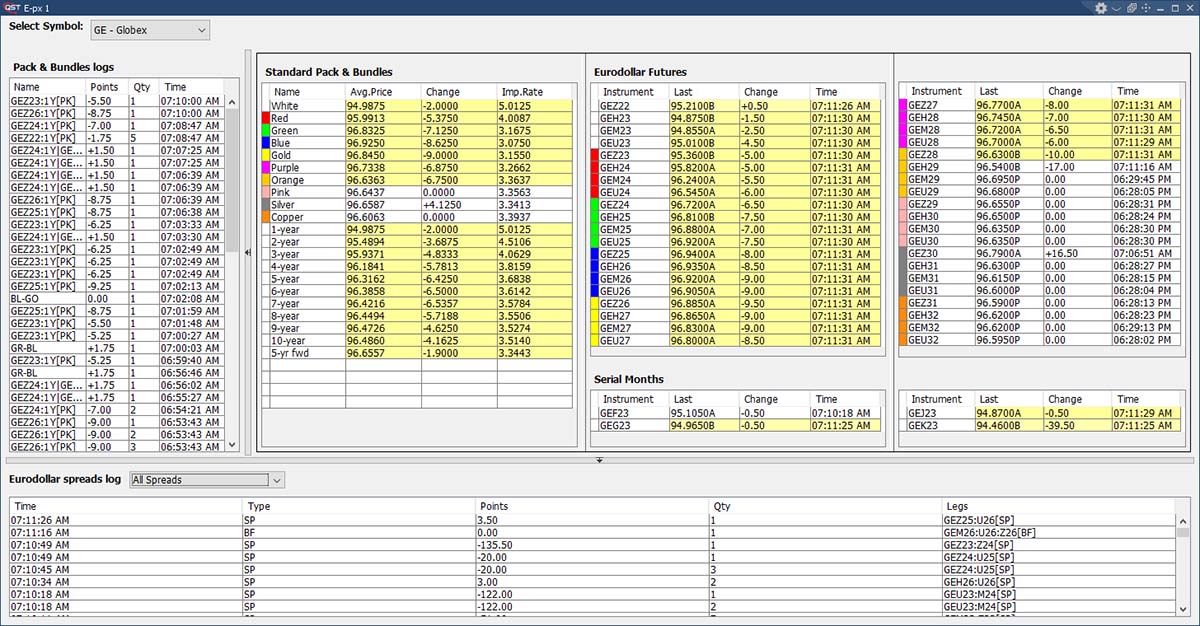

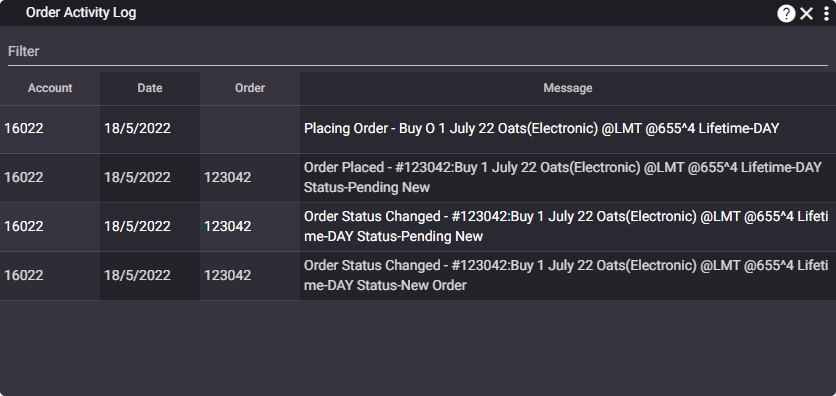

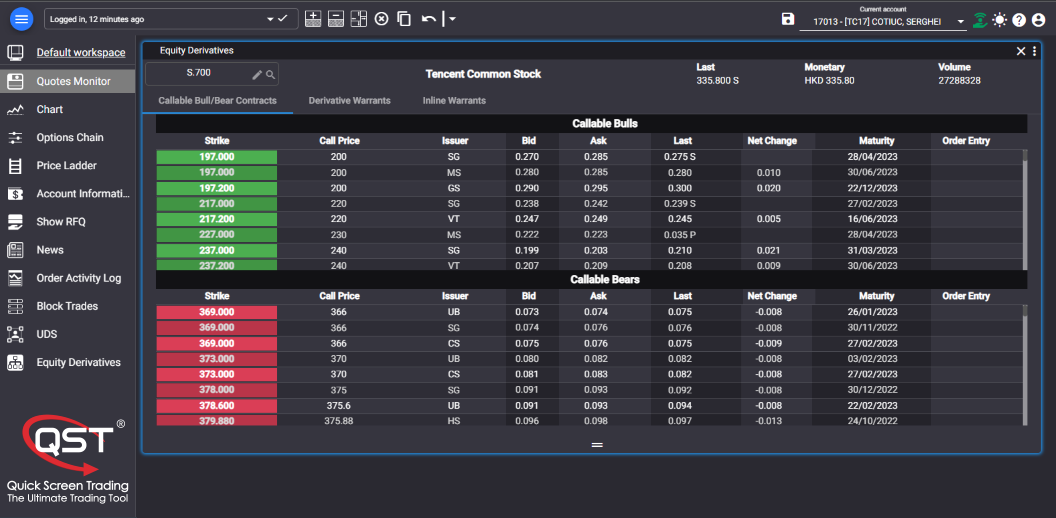

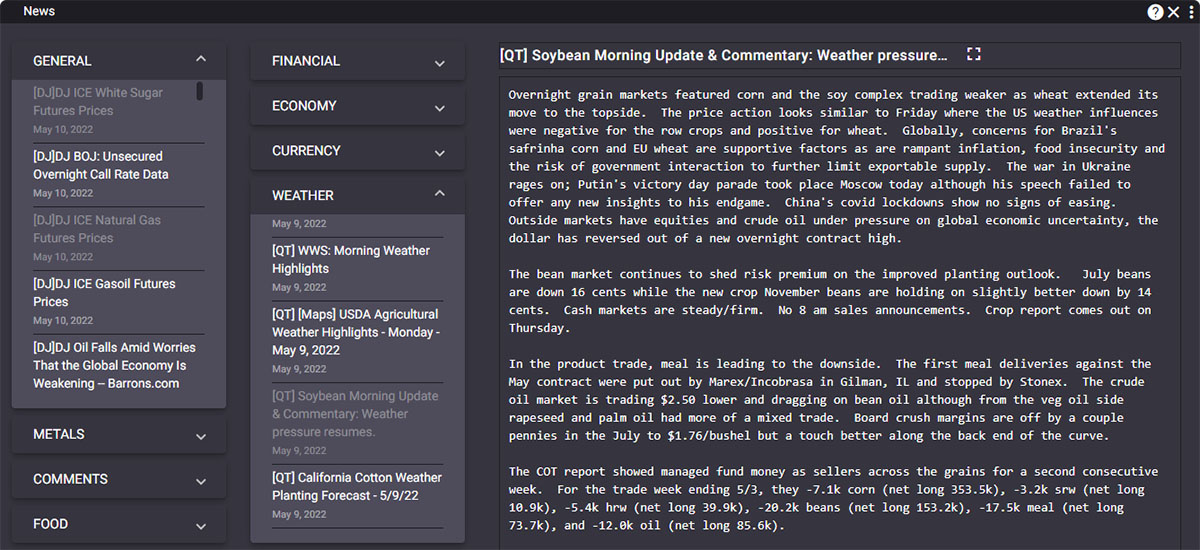

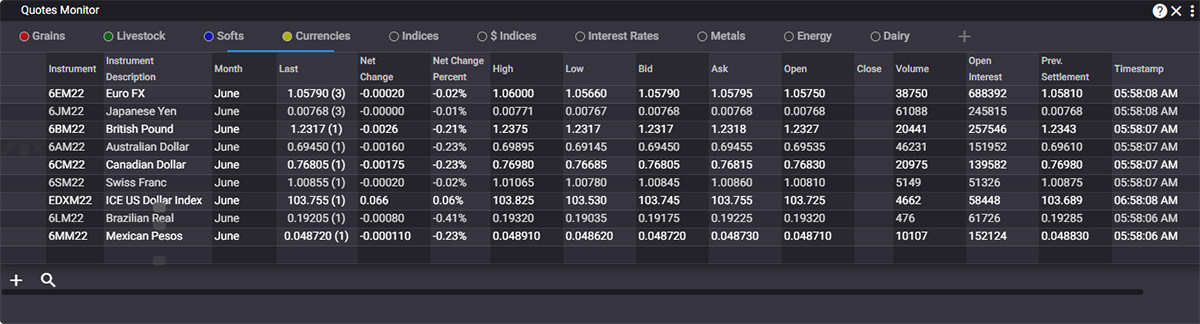

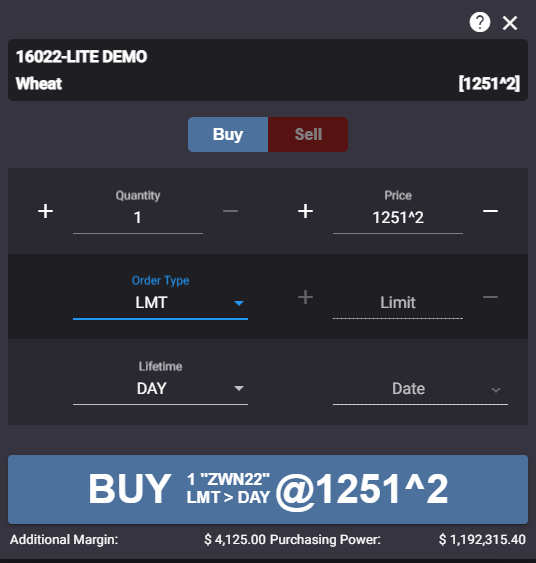

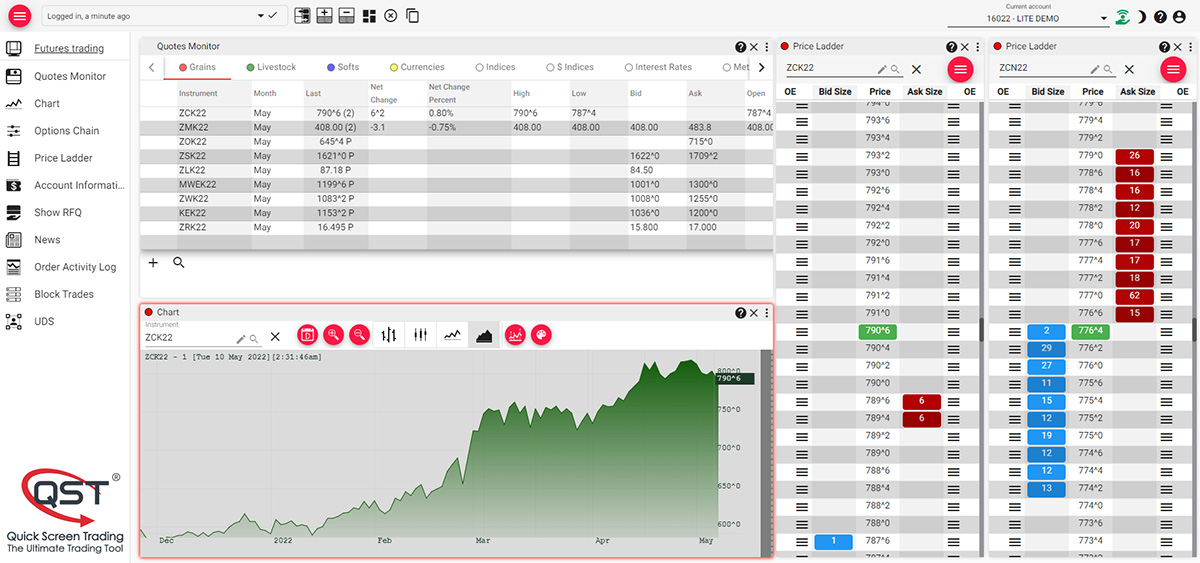

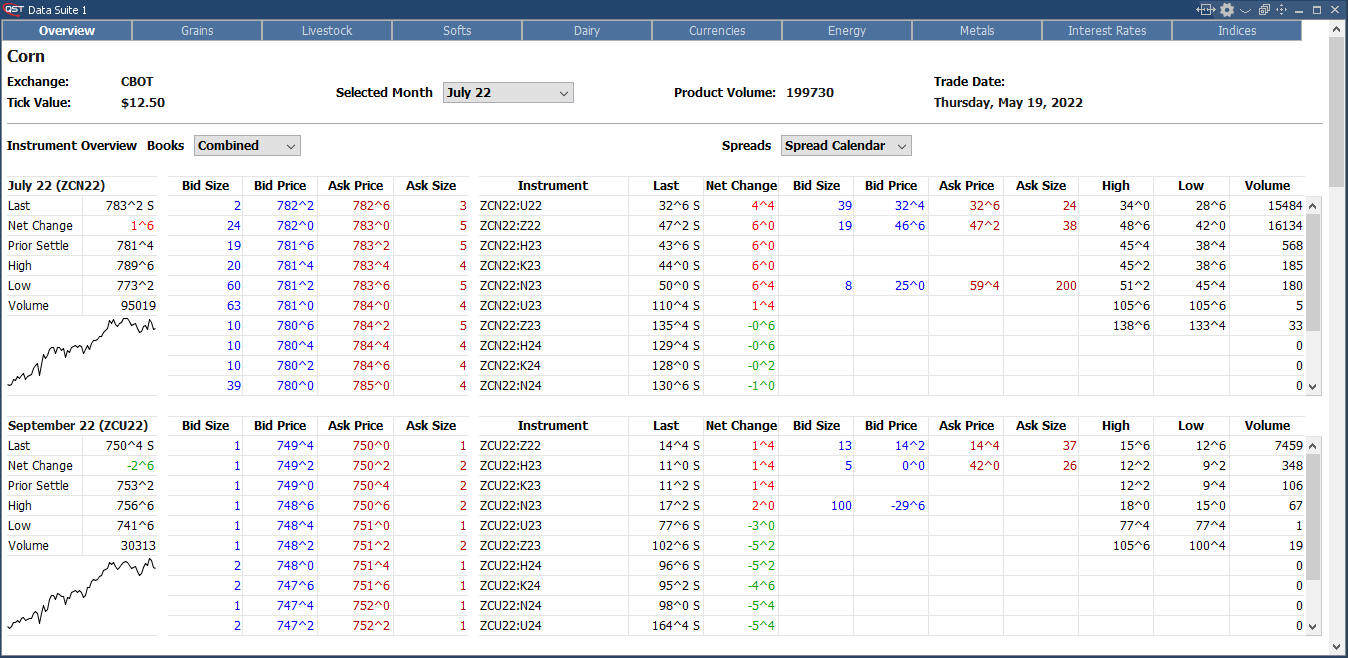

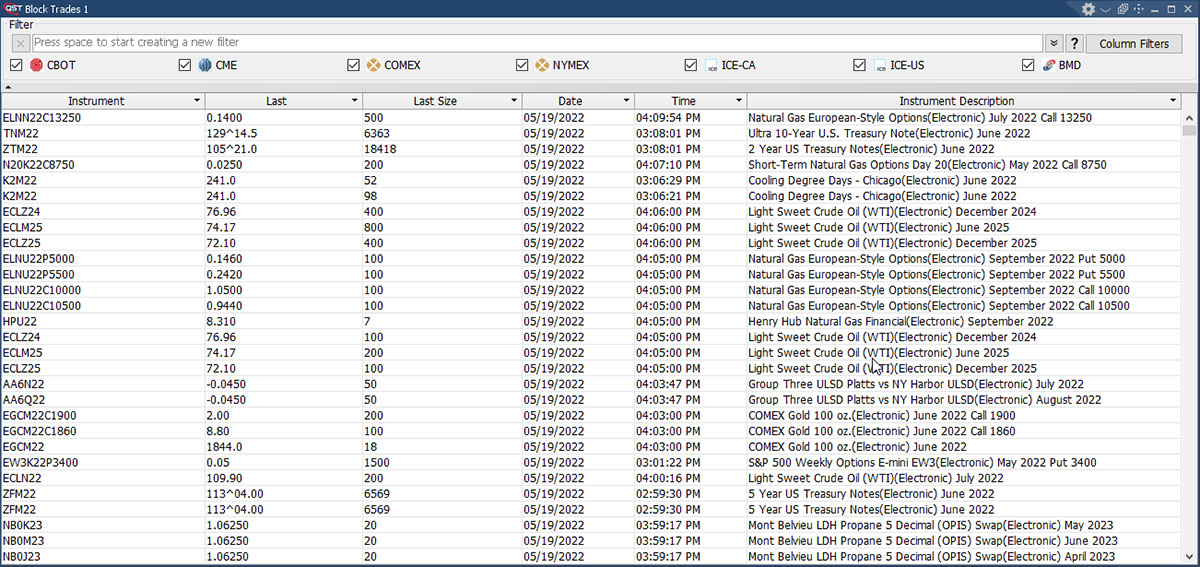

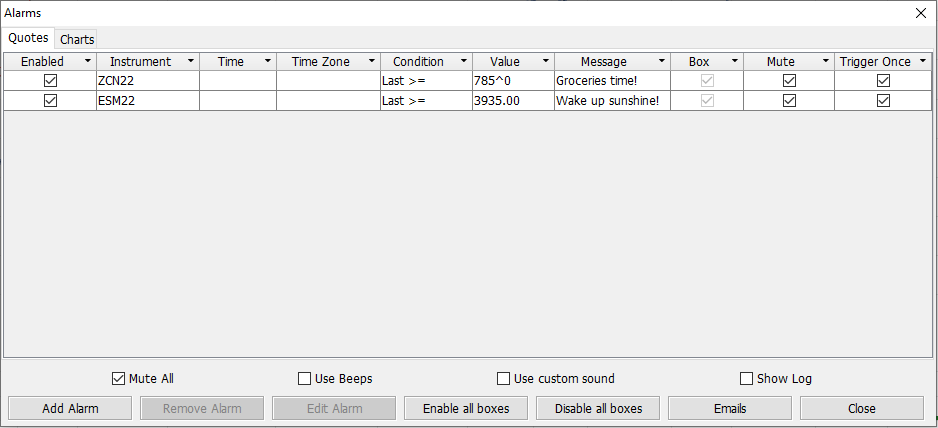

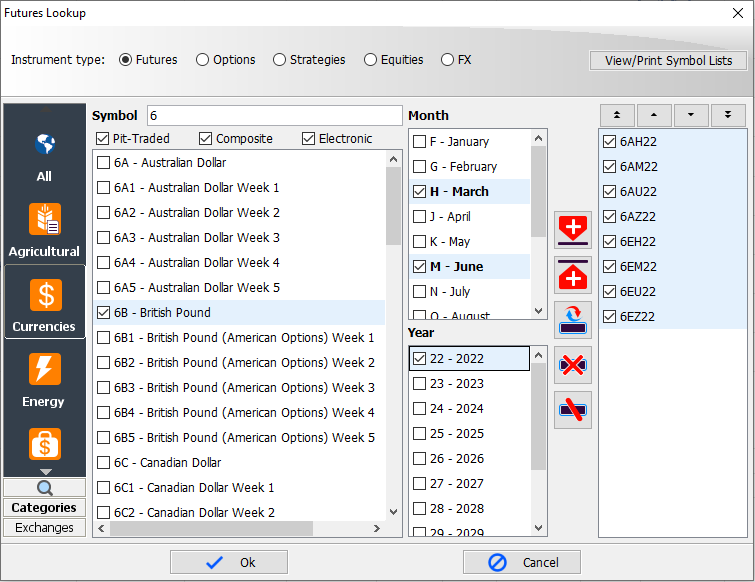

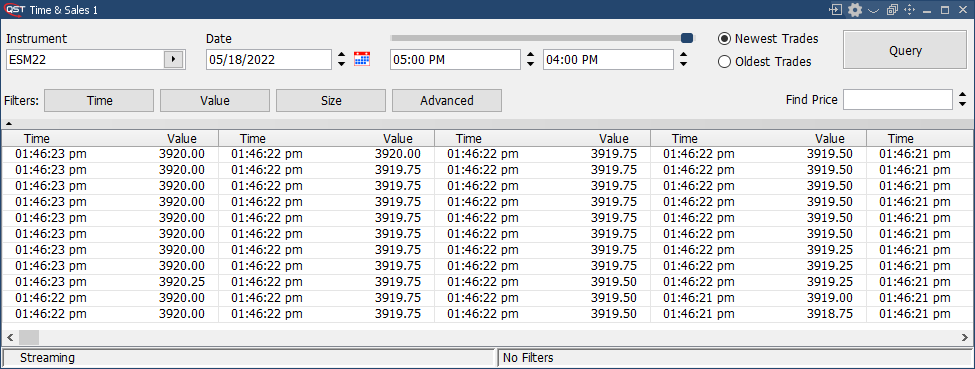

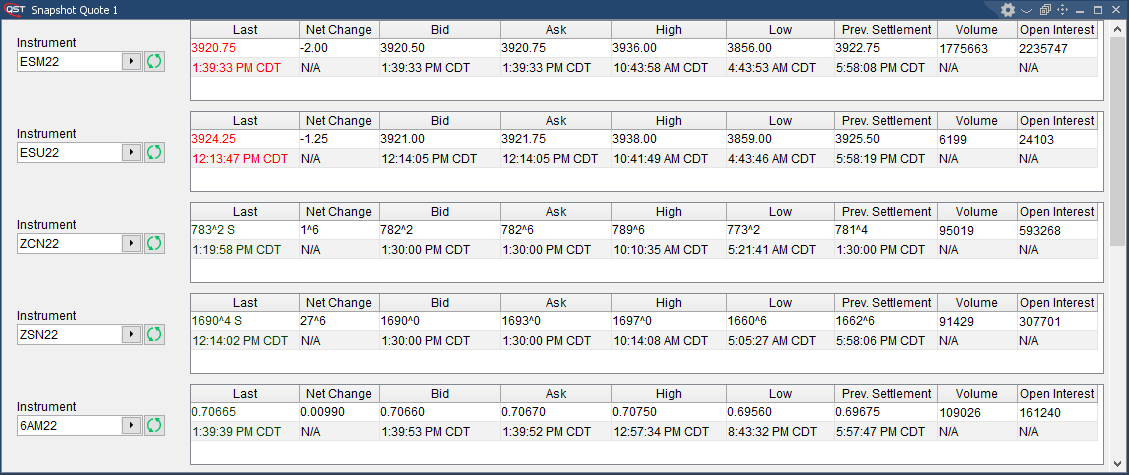

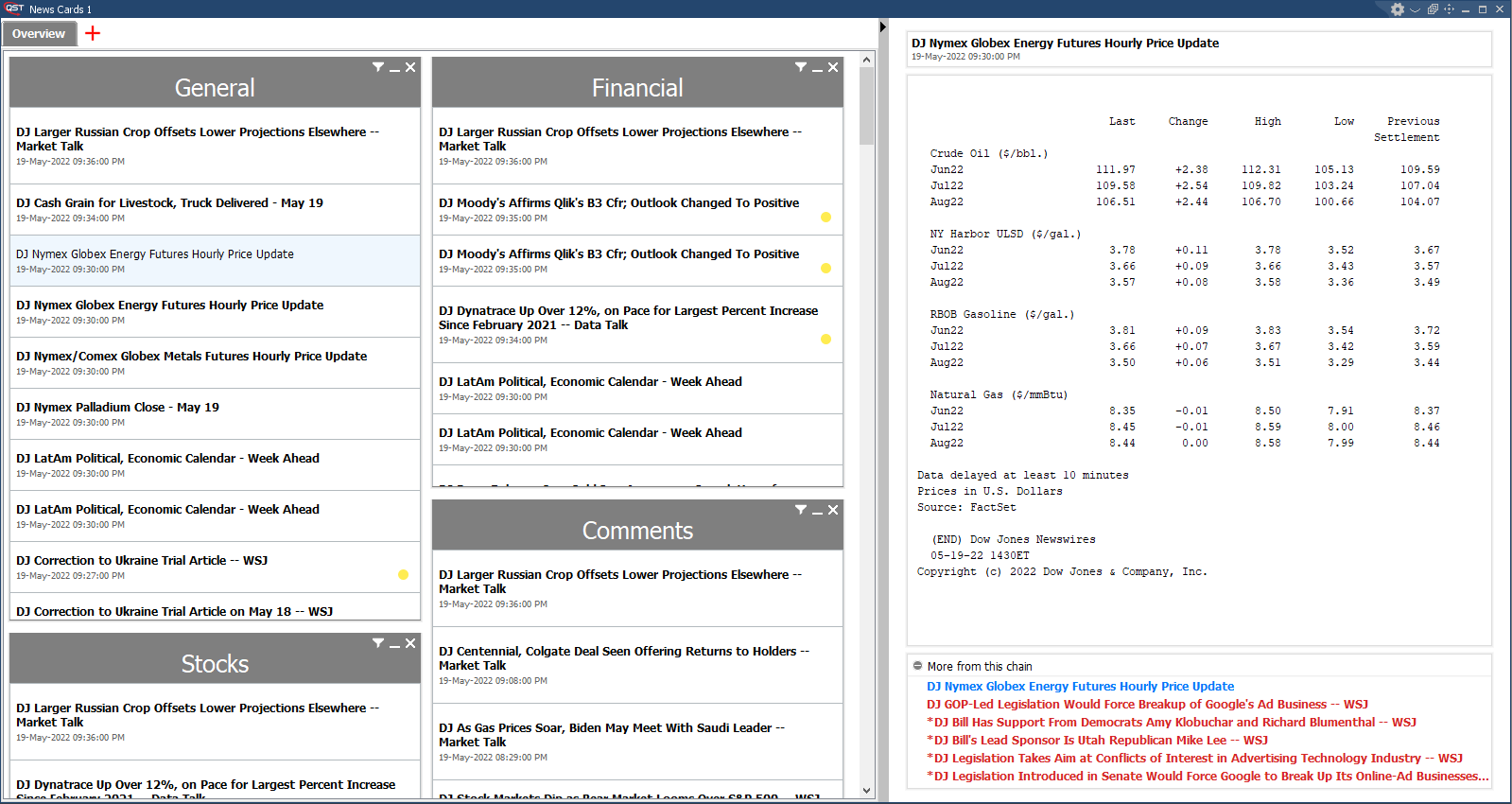

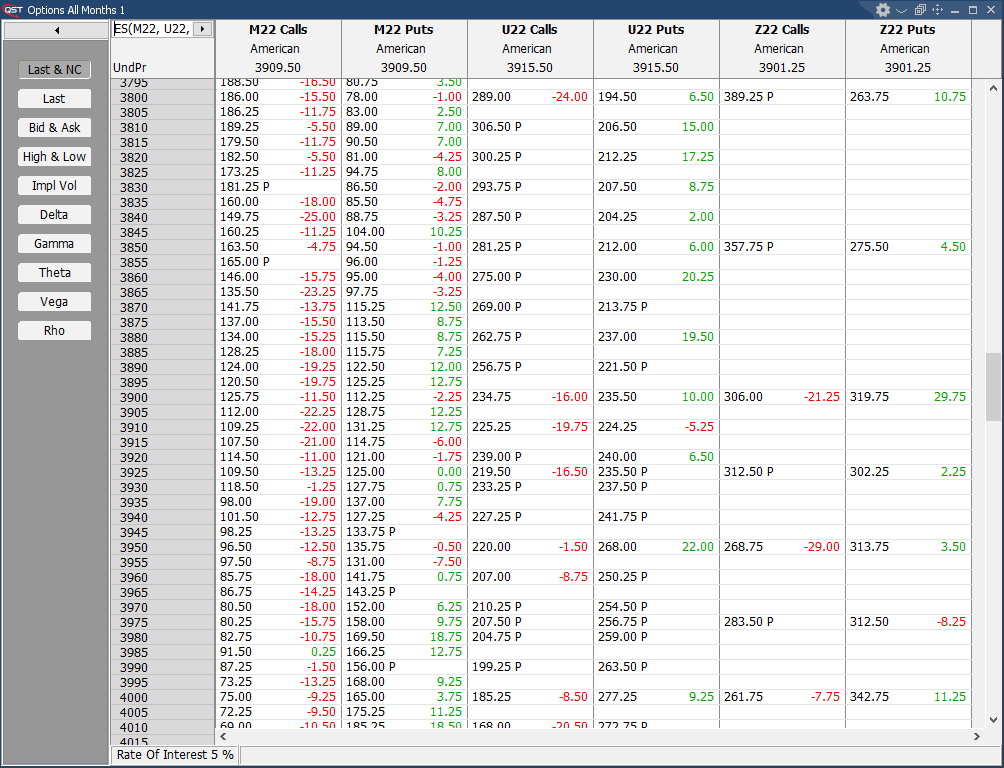

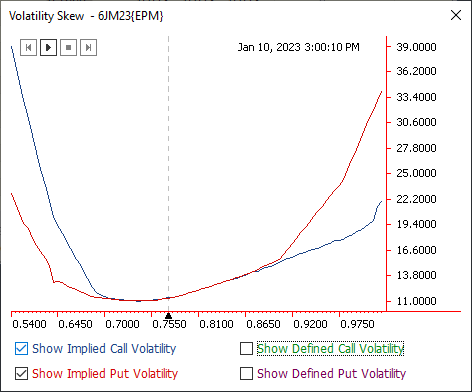

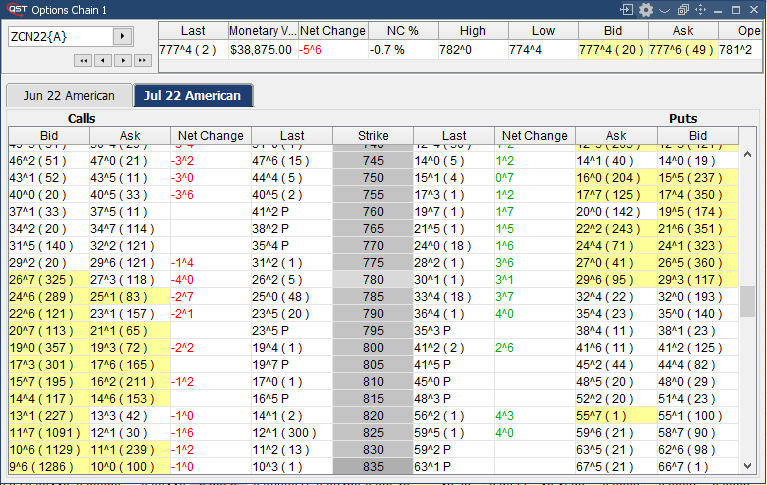

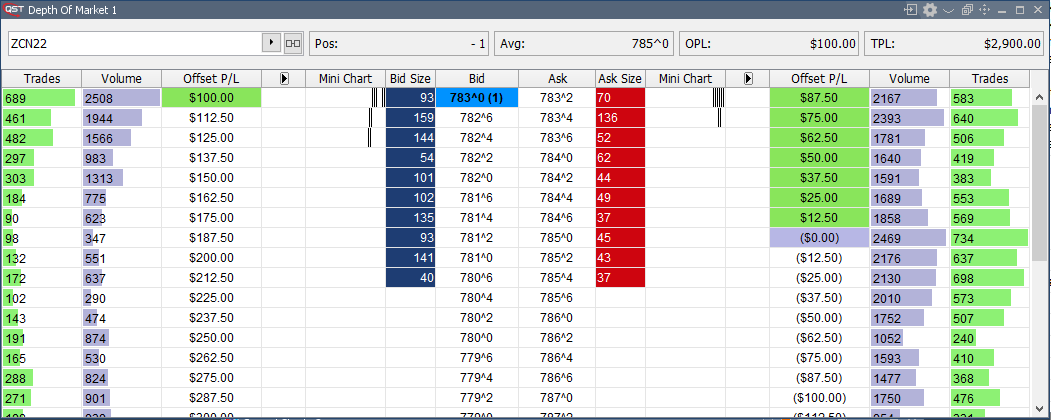

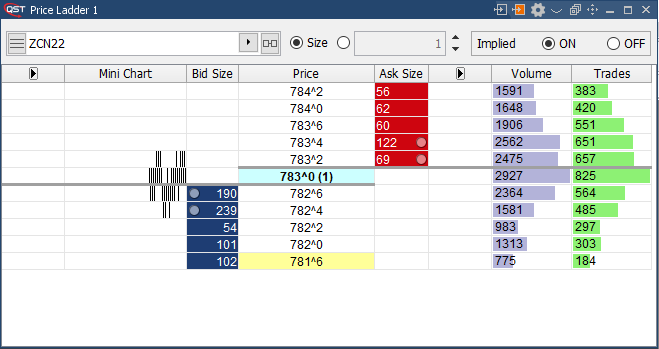

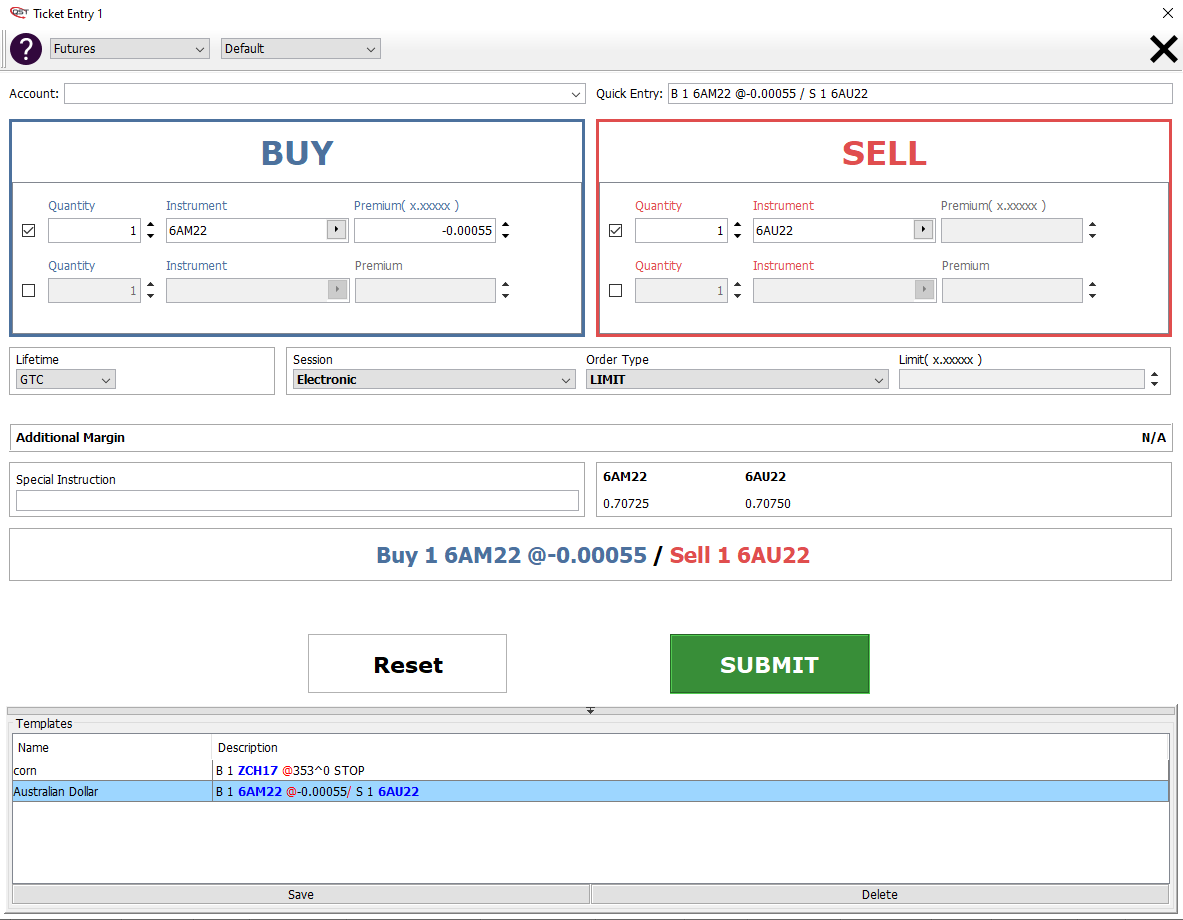

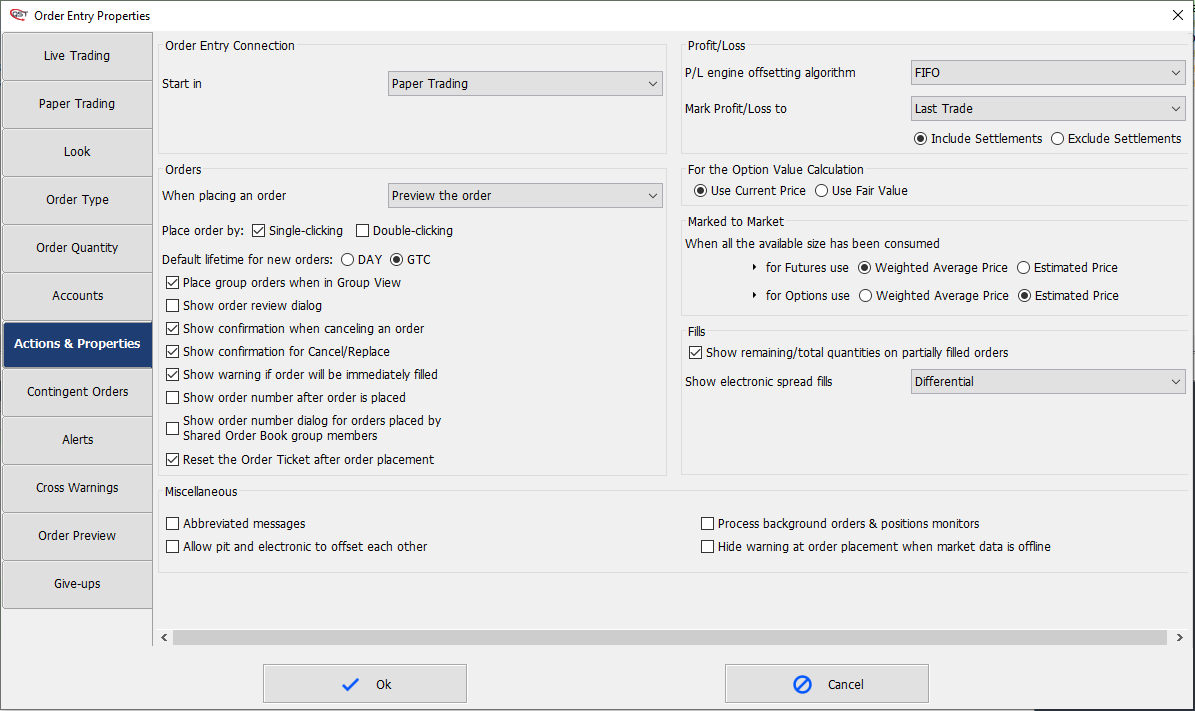

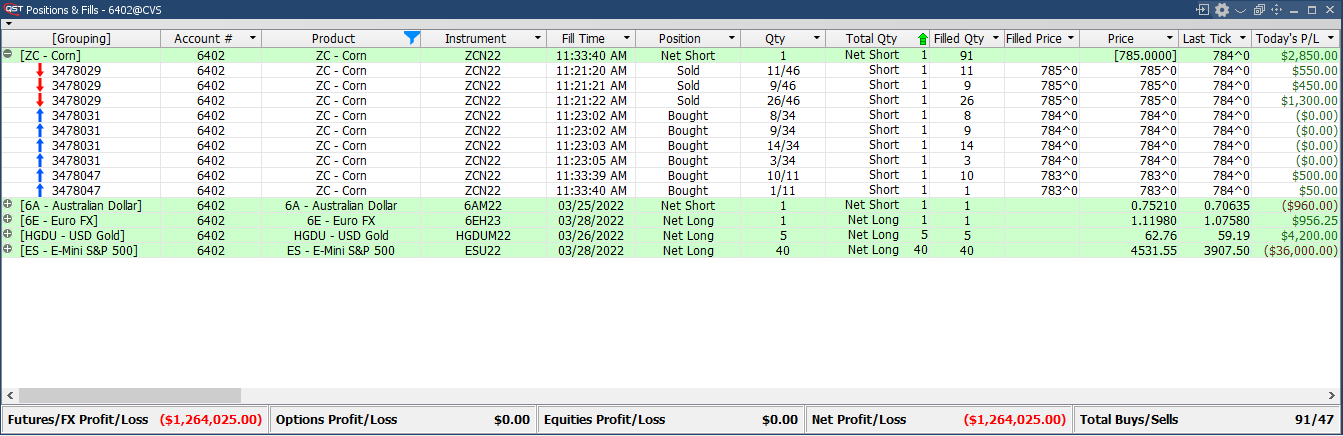

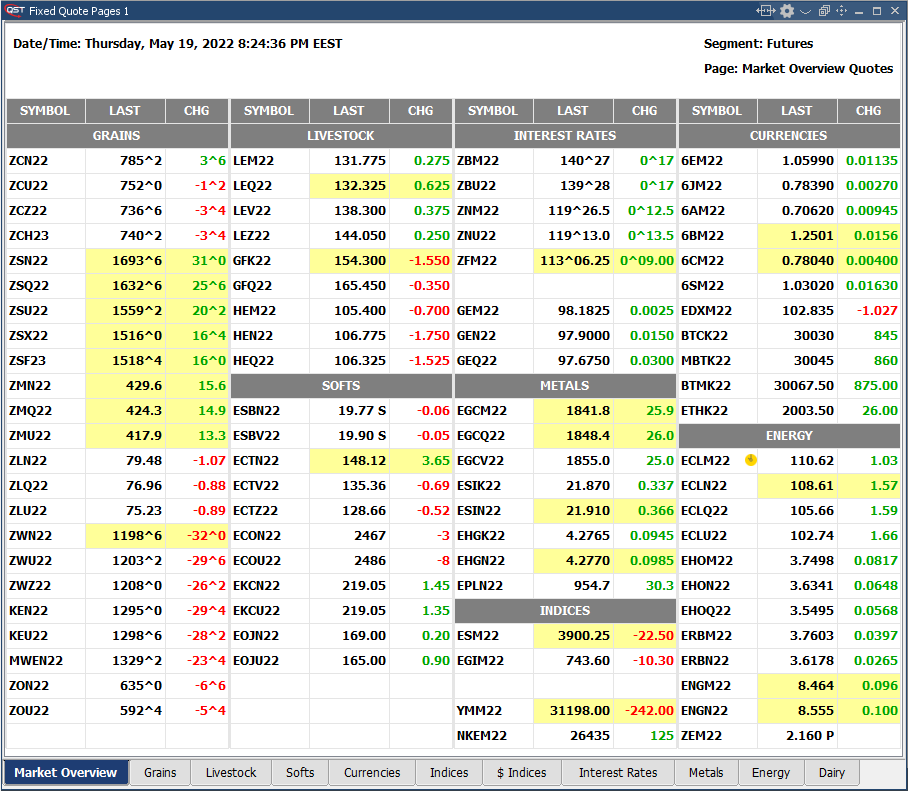

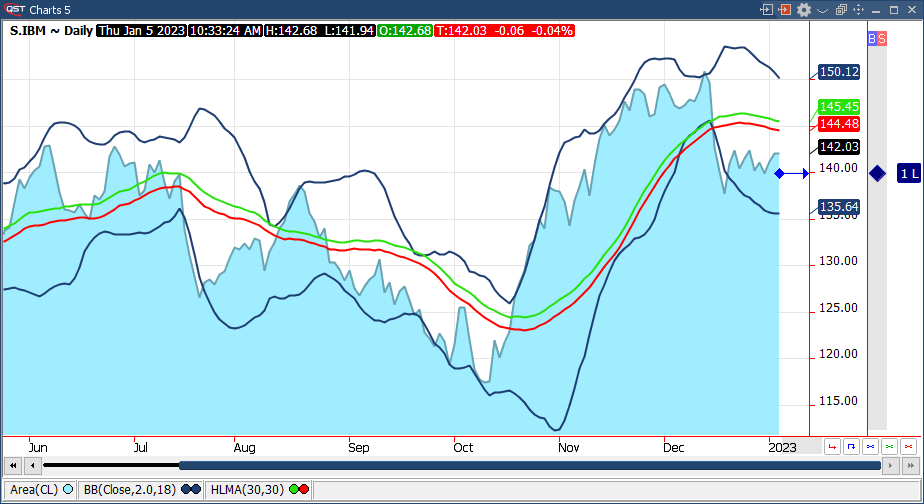

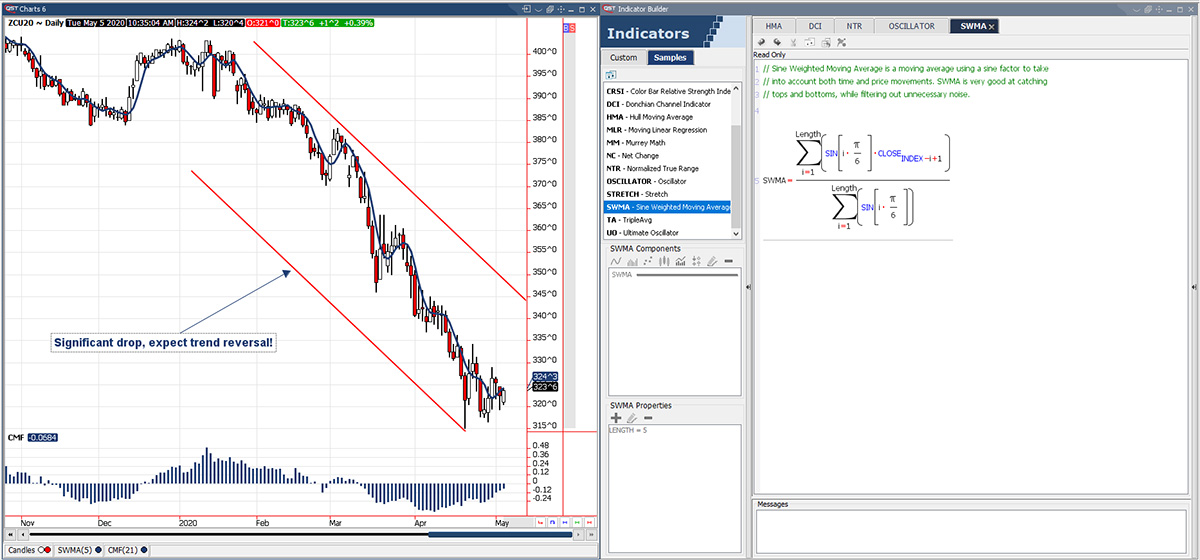

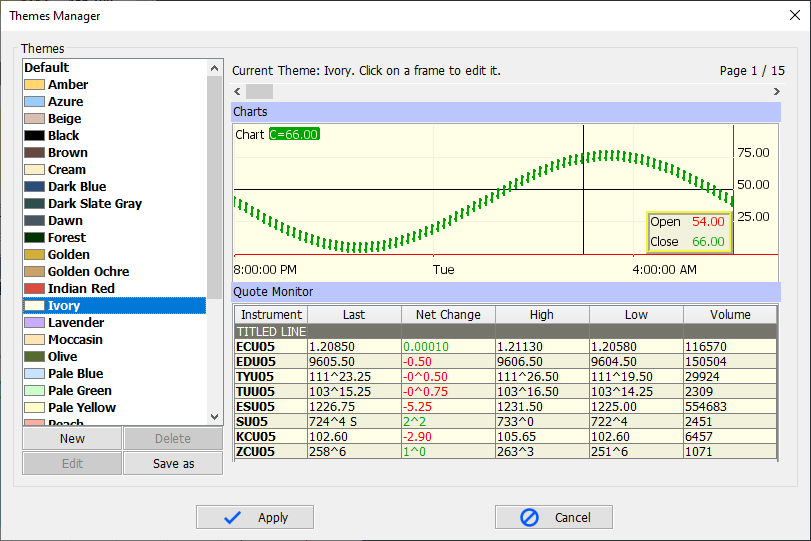

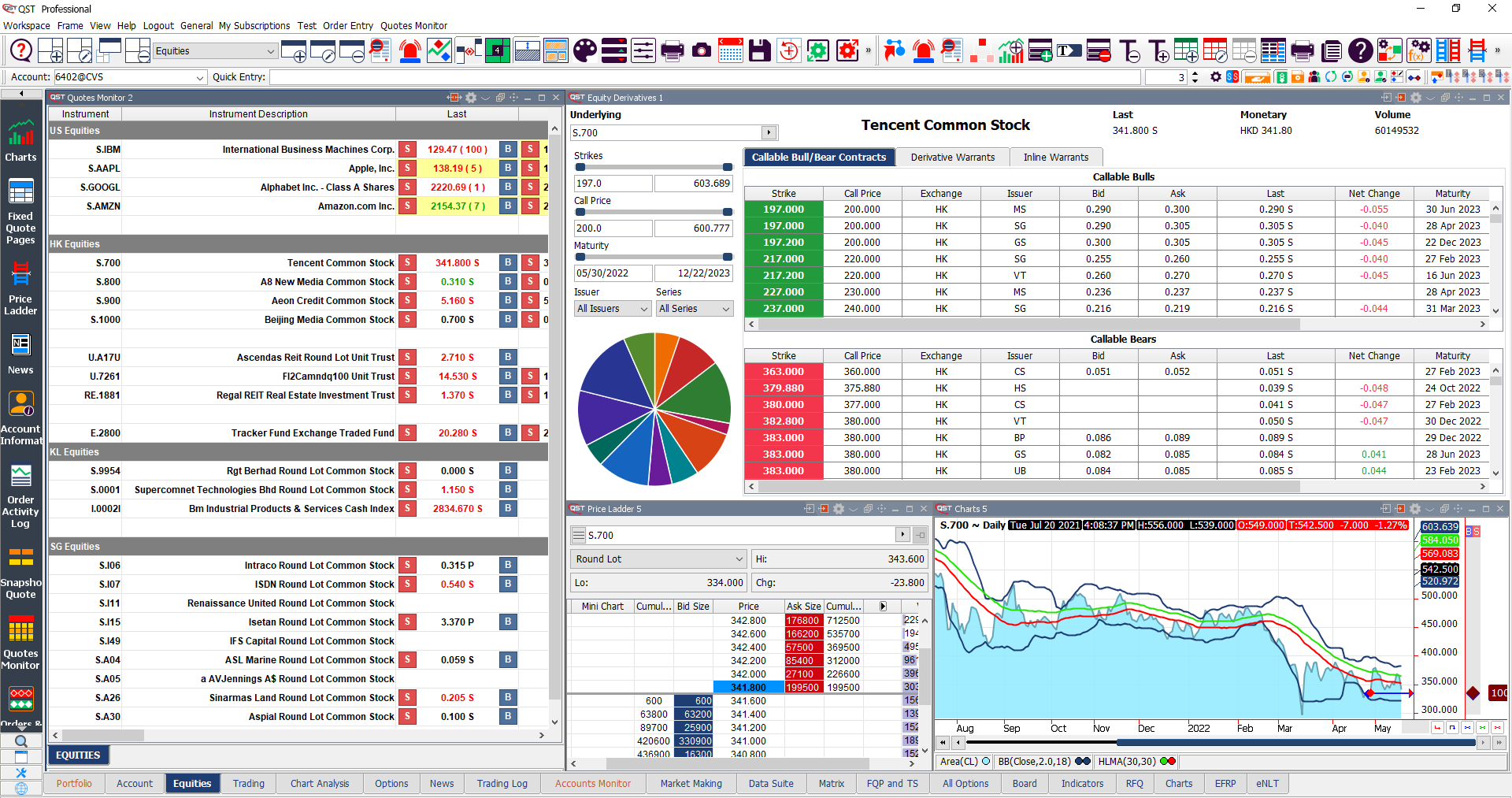

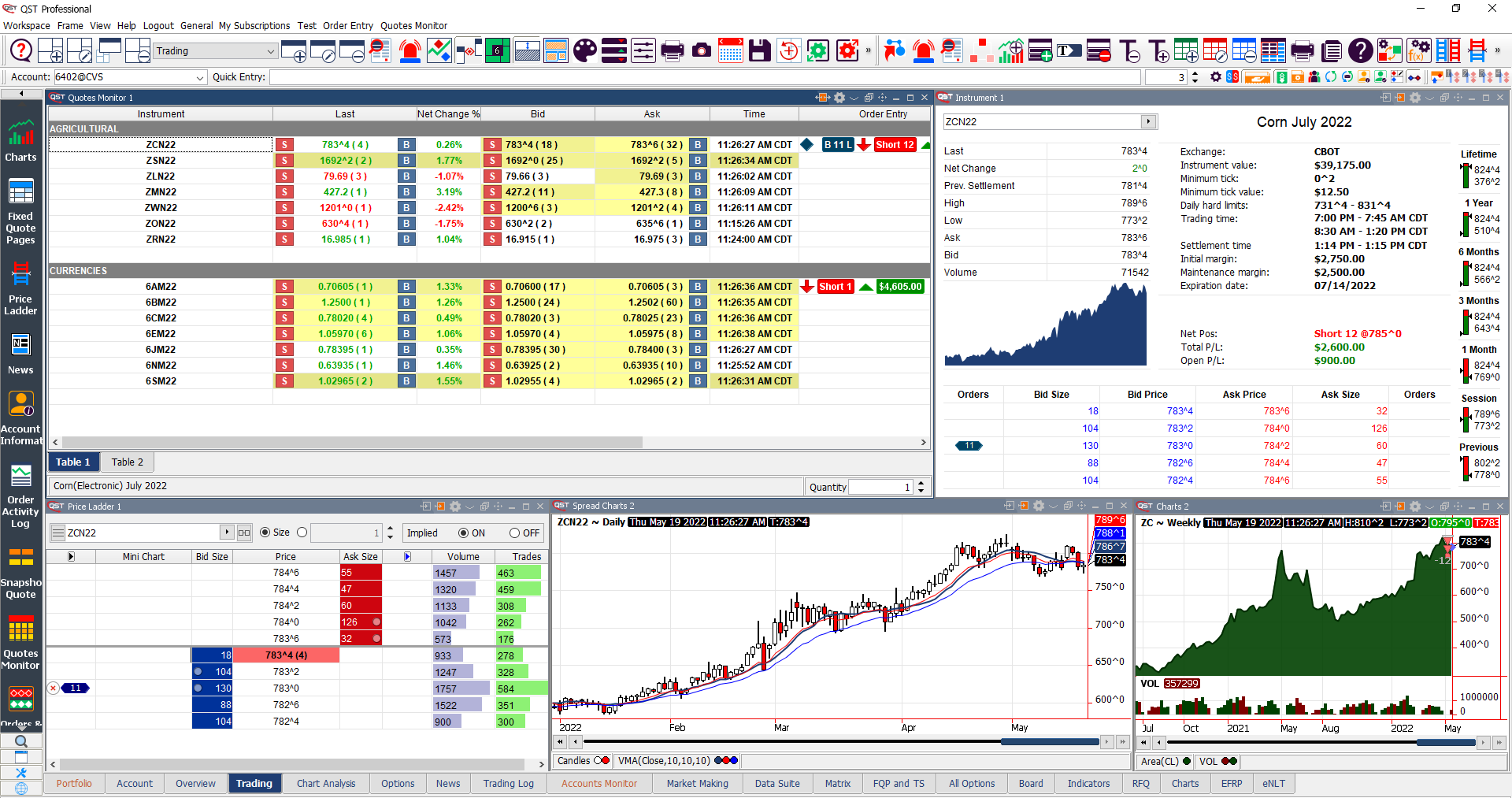

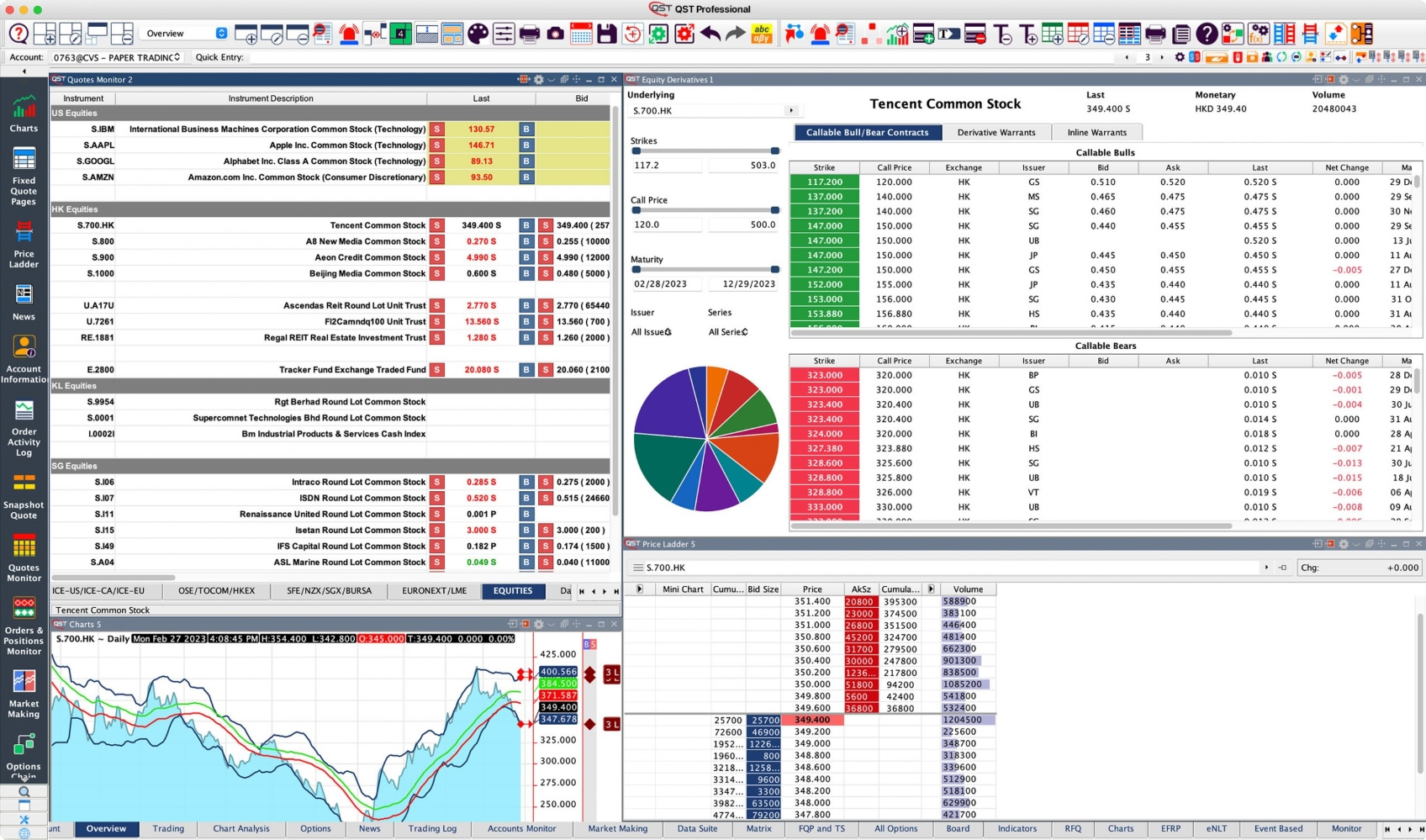

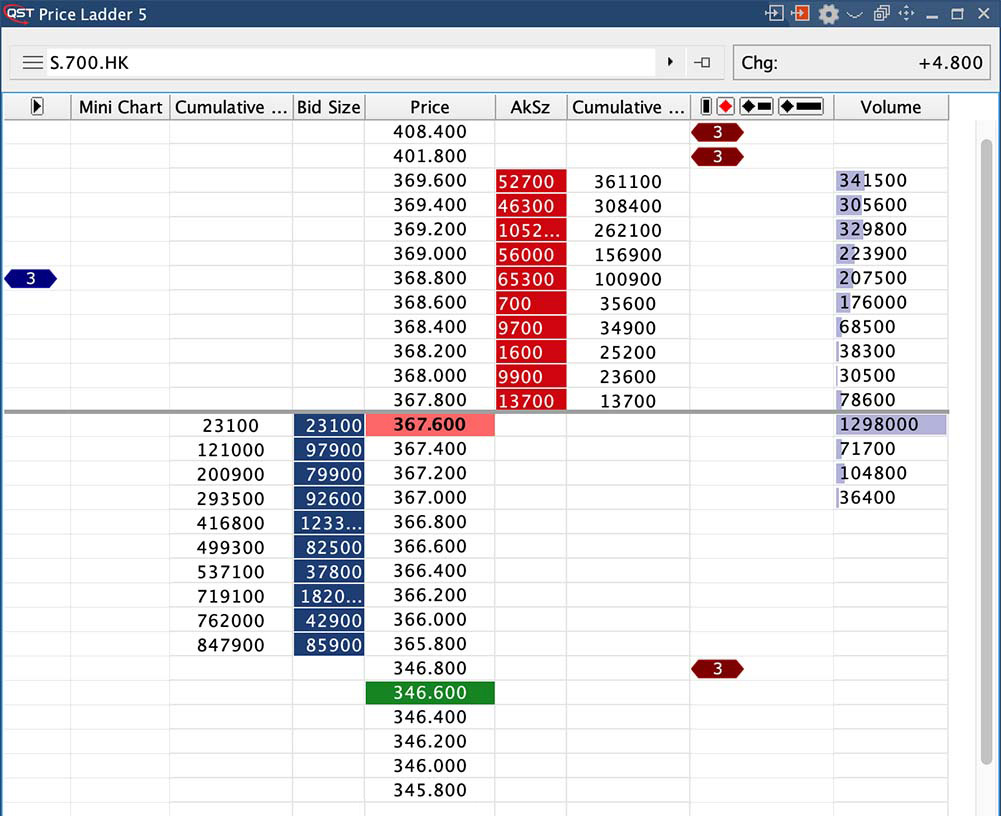

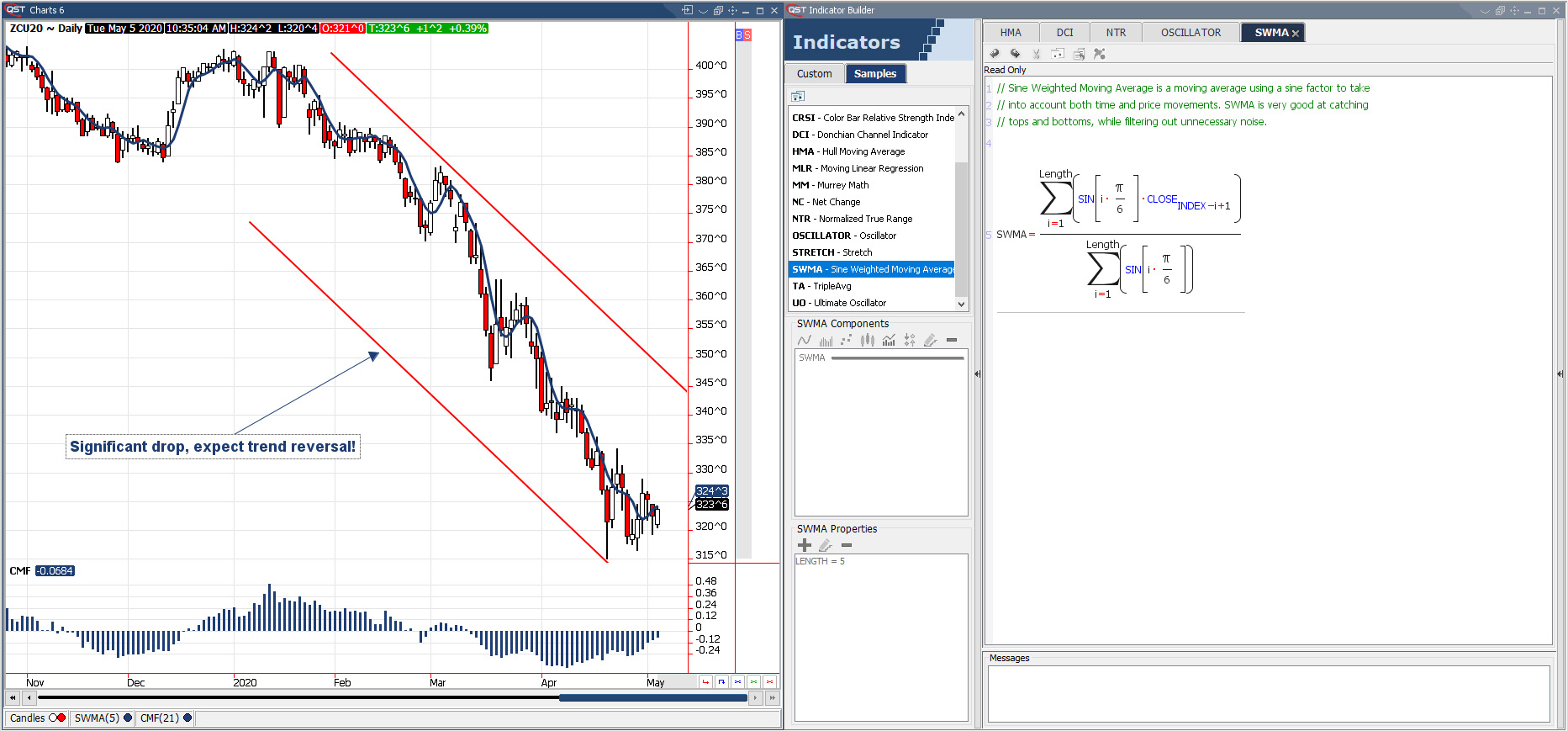

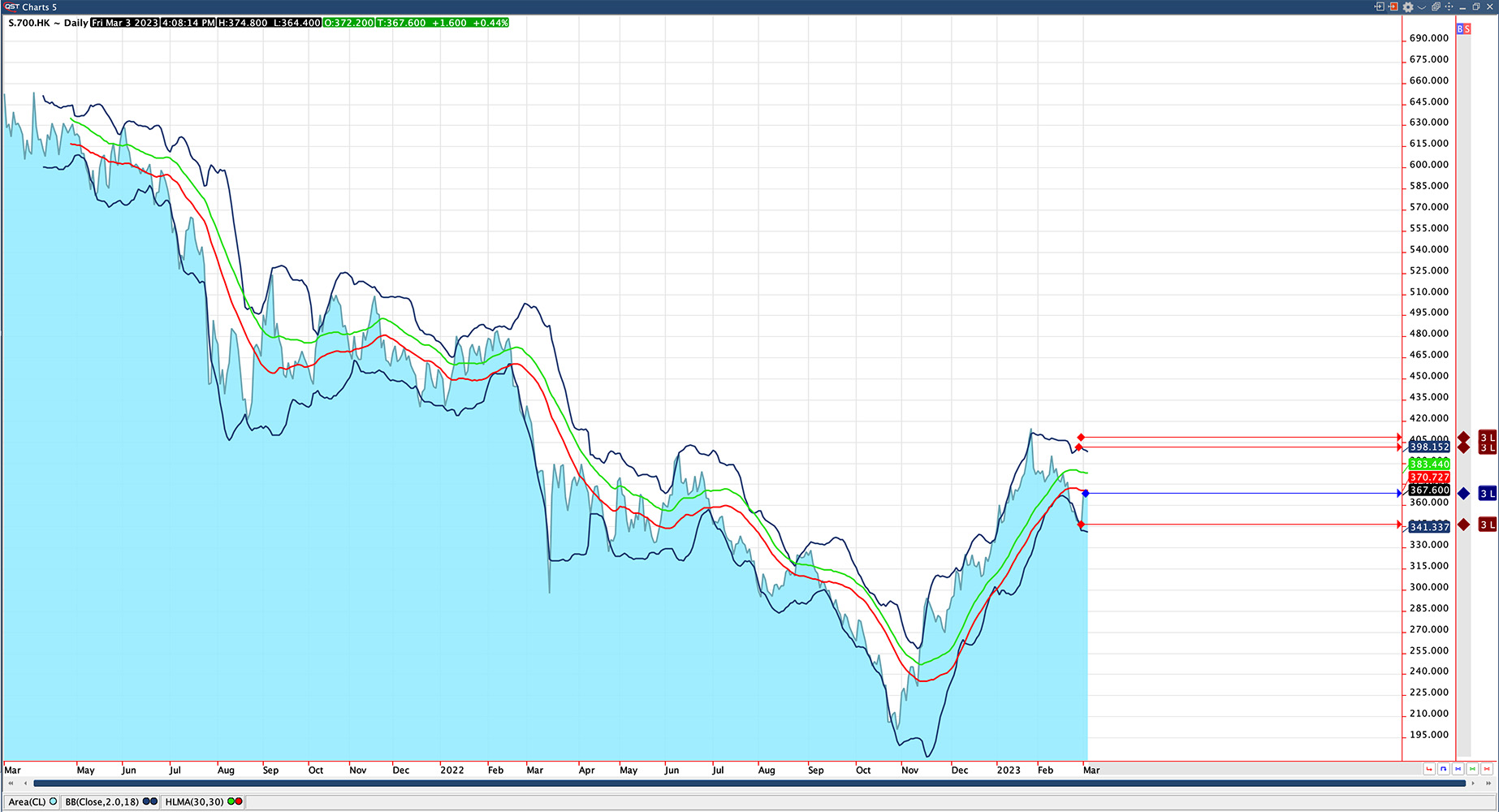

Professional traders rely on advanced trading technology to test, build and execute their trading strategies. QST provides a complete suite of trading tools to meet the needs of professional traders across asset classes

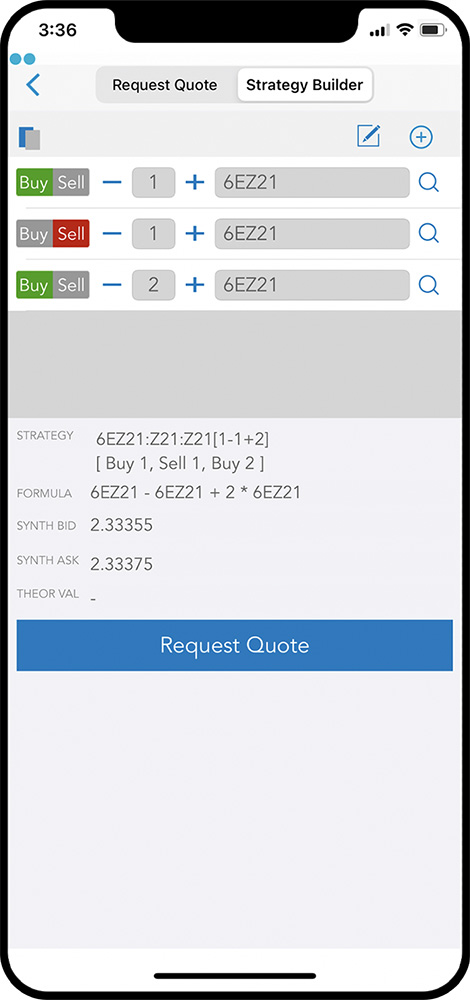

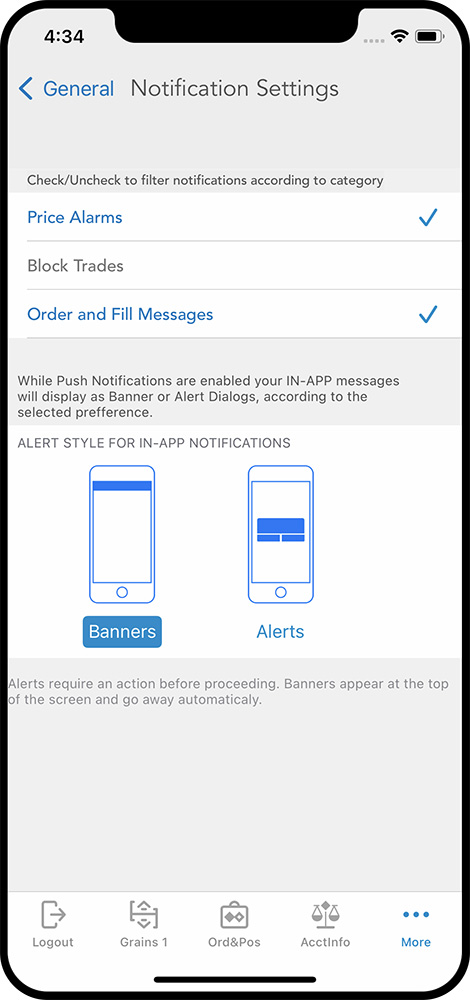

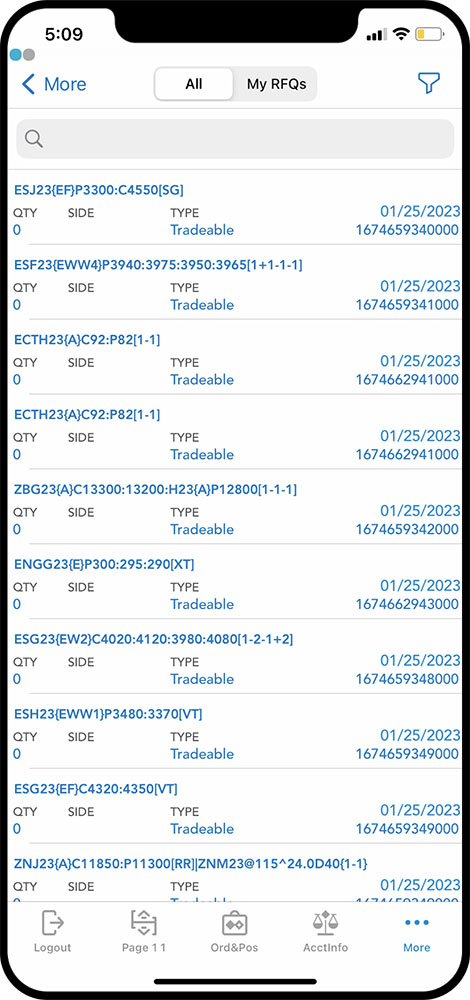

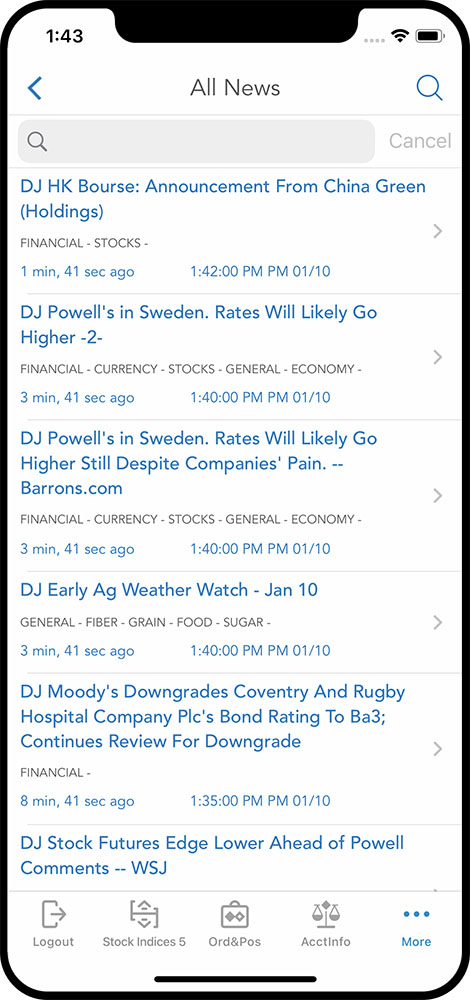

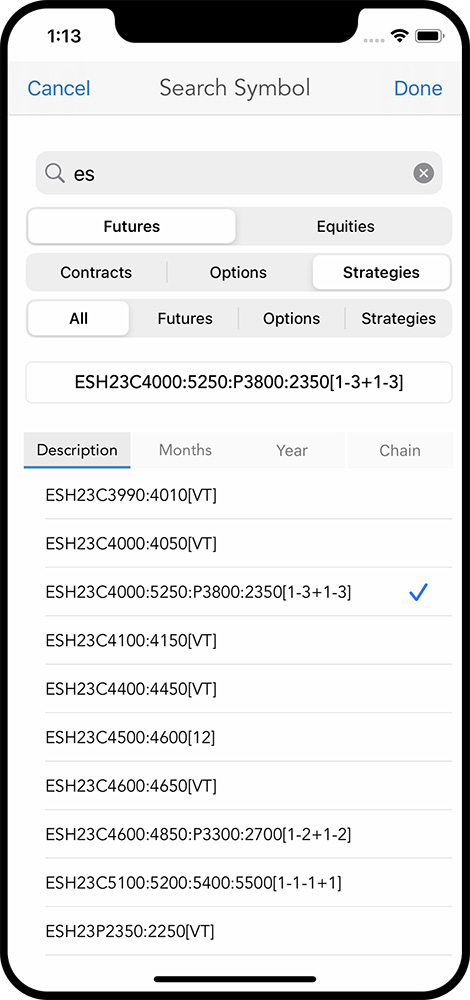

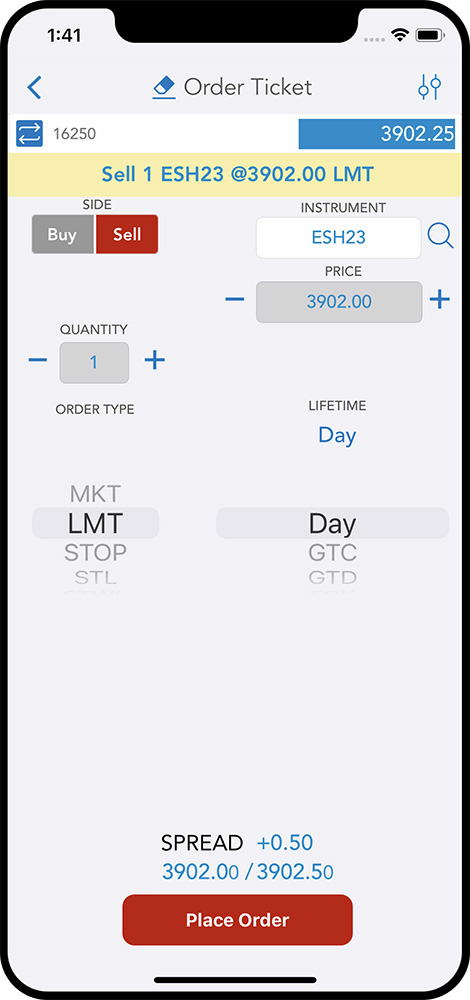

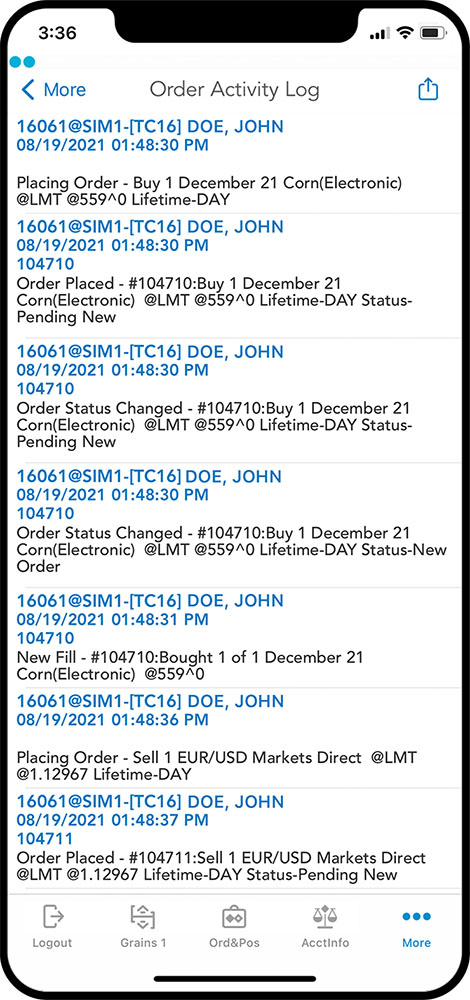

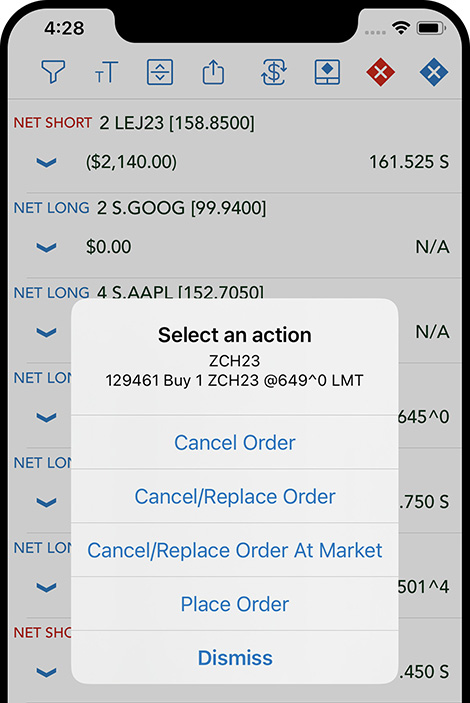

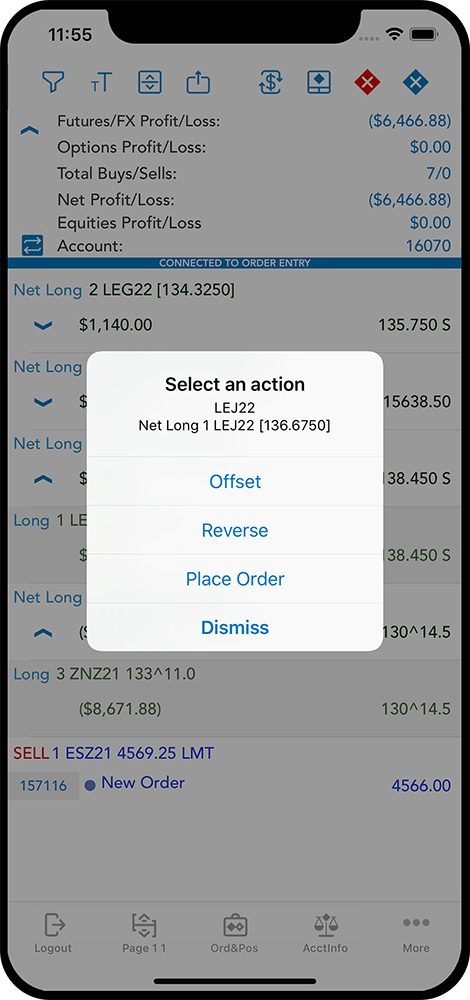

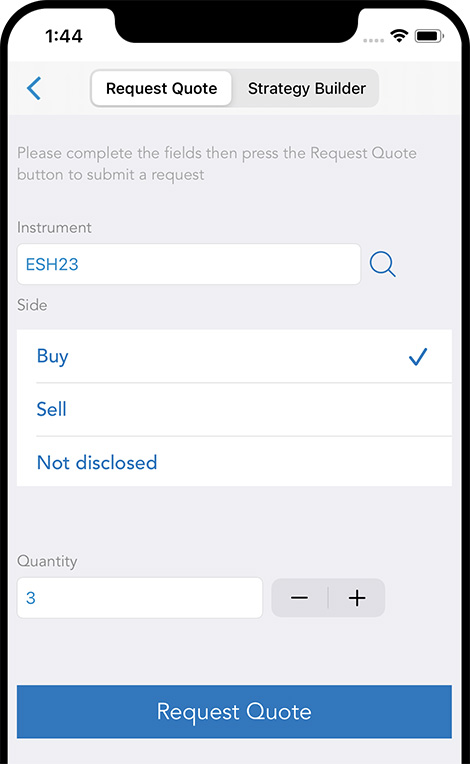

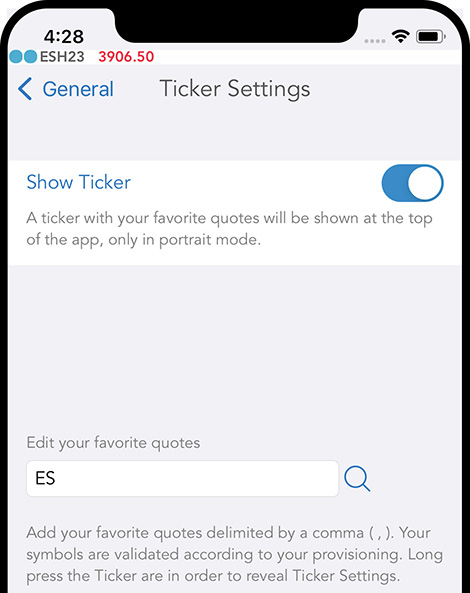

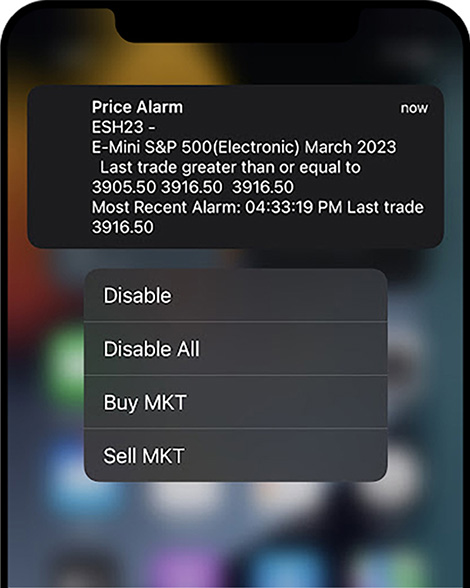

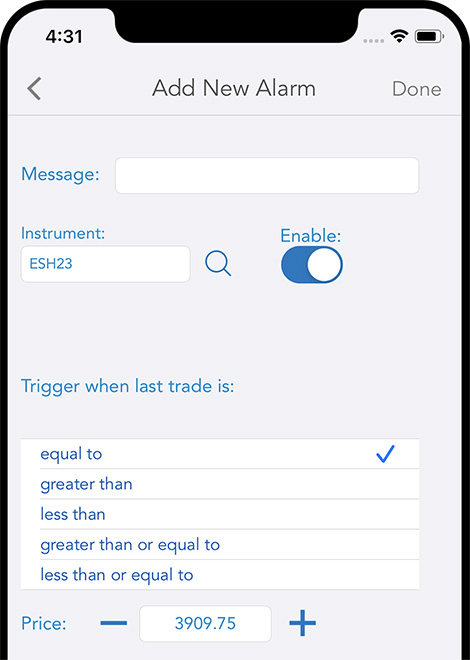

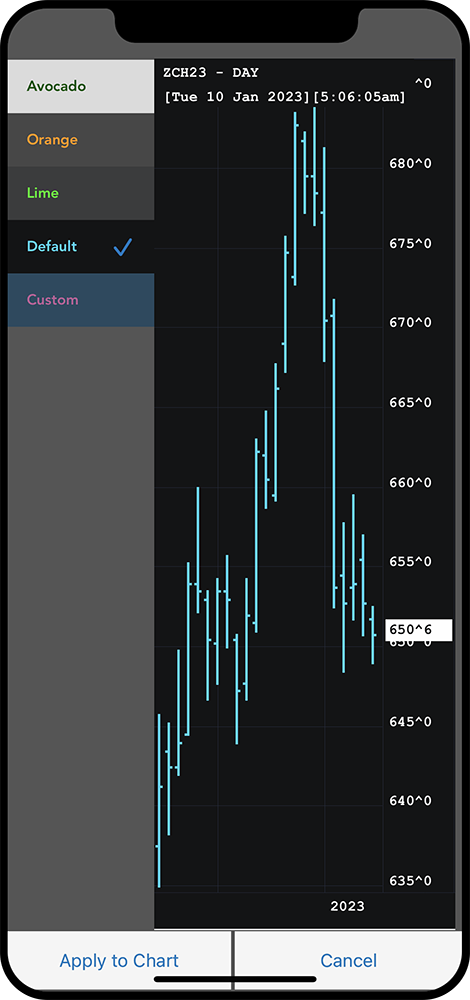

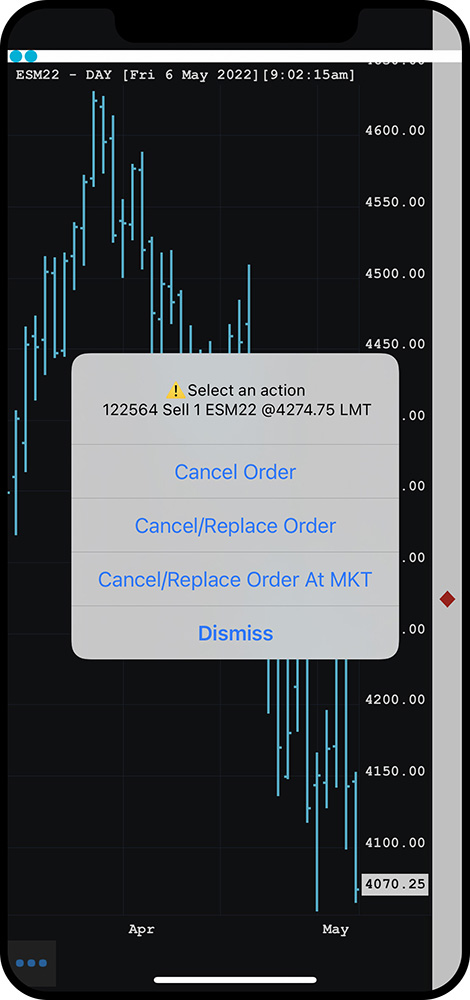

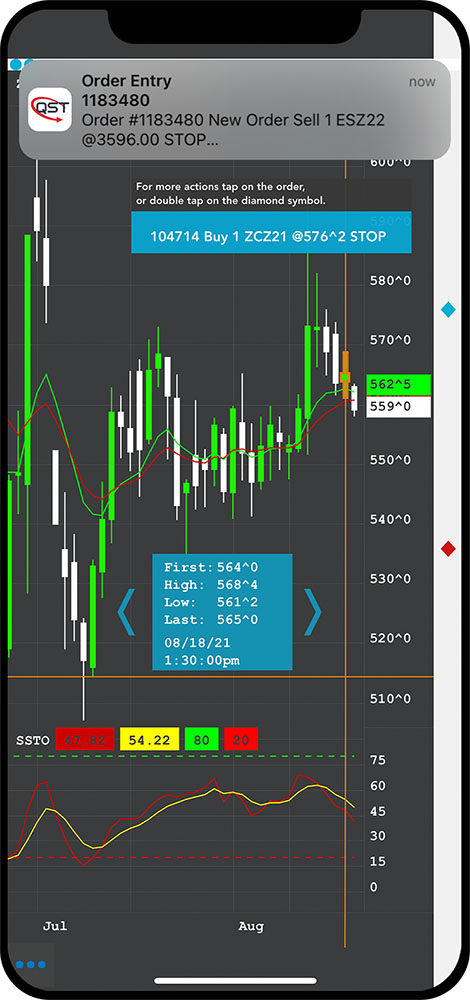

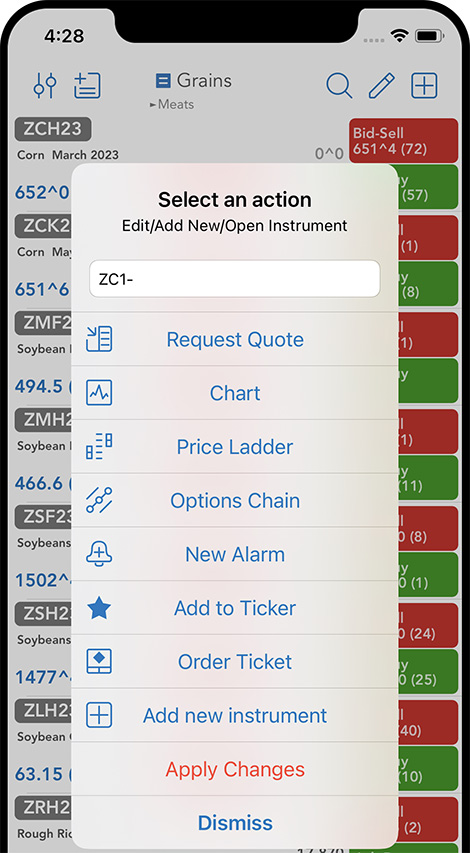

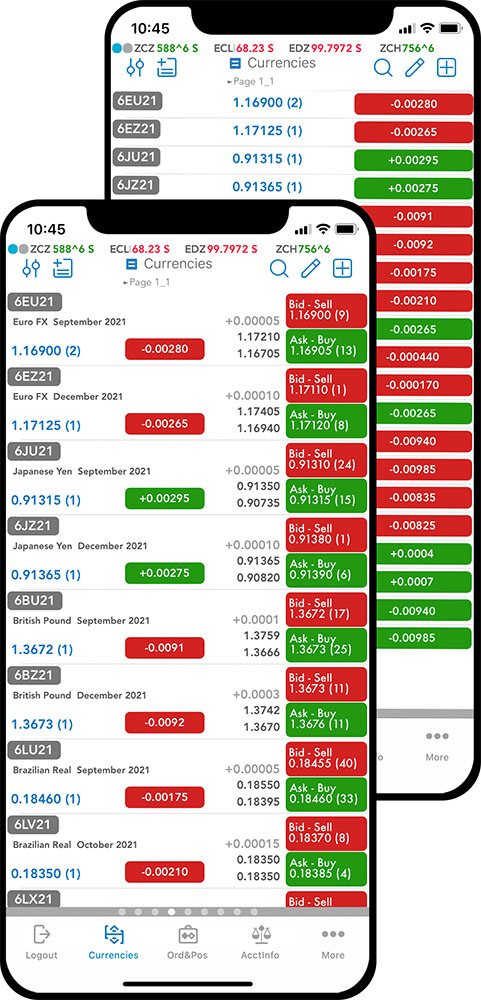

Multiple front-ends including desktop, web, and mobile apps

Tailor made solutions for specific institutional needs

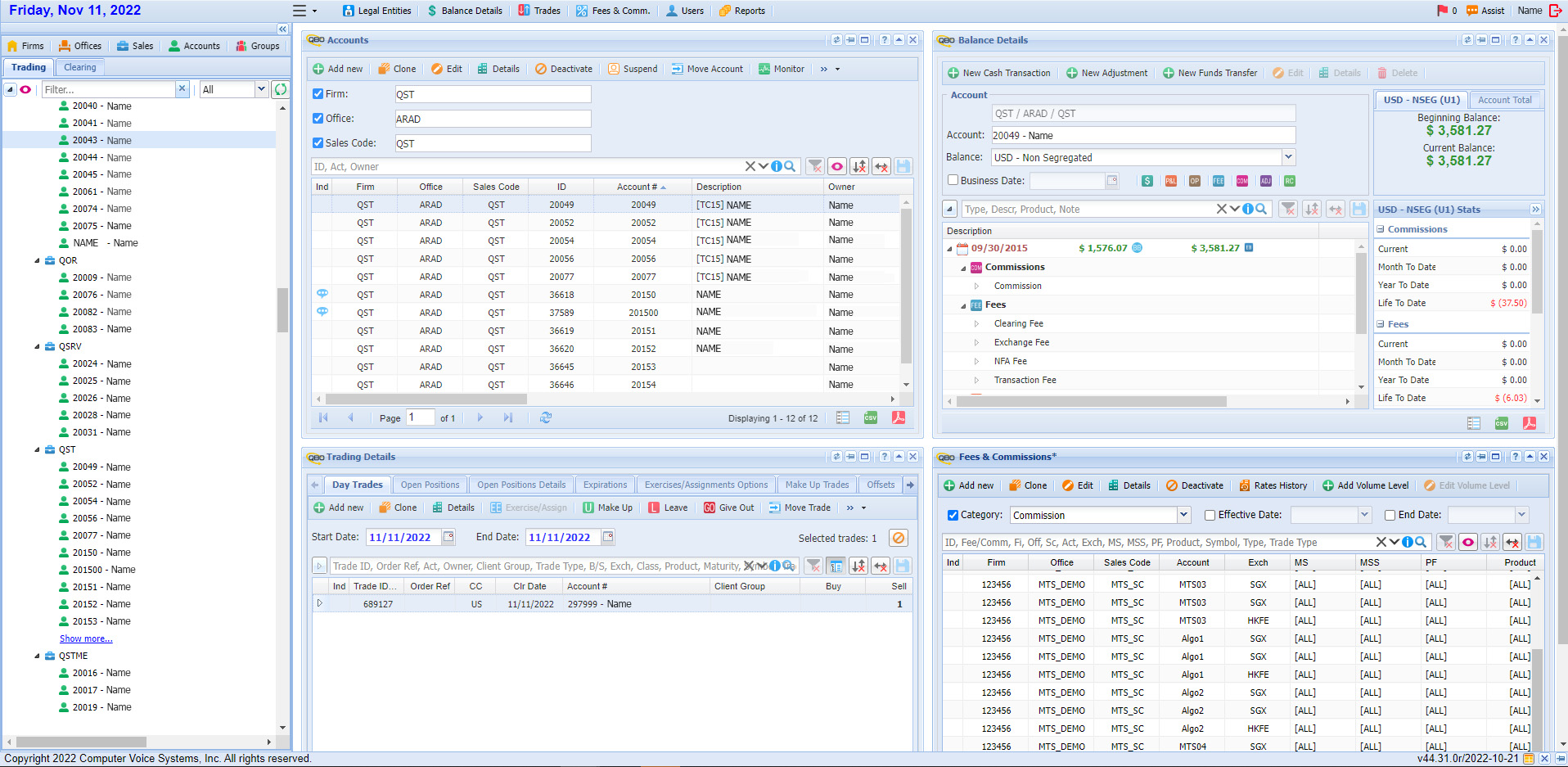

Front to back STP solutions supported by reliable customer service

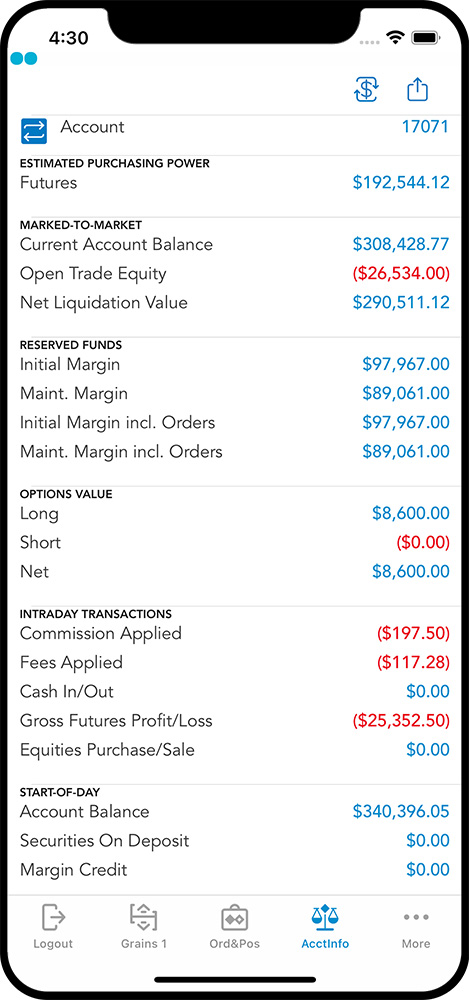

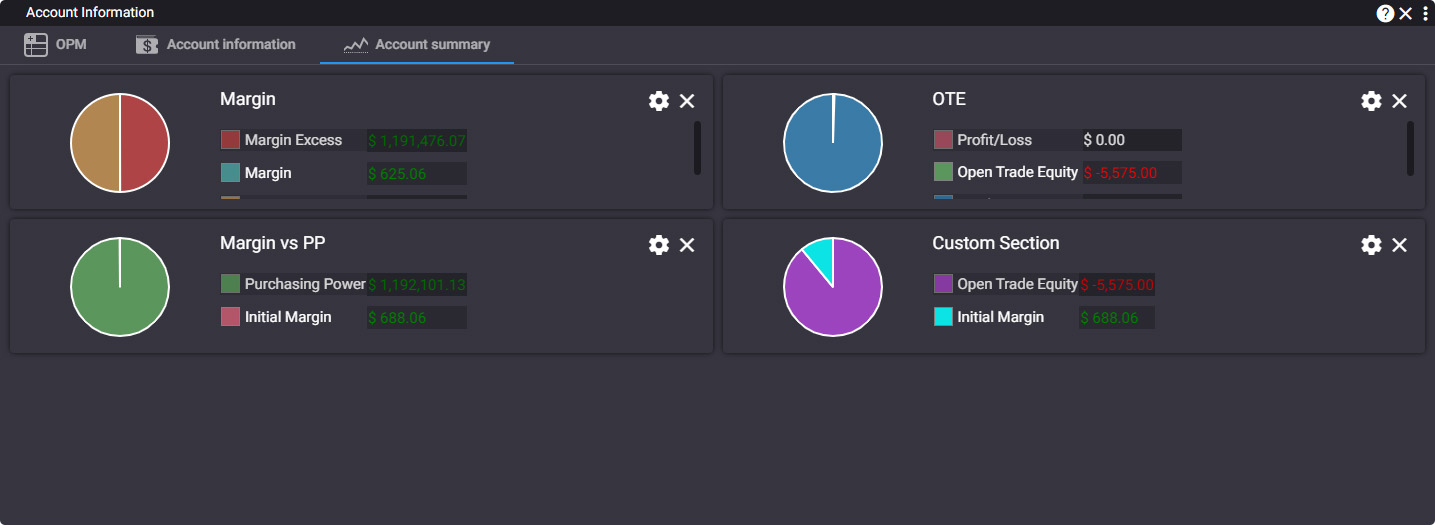

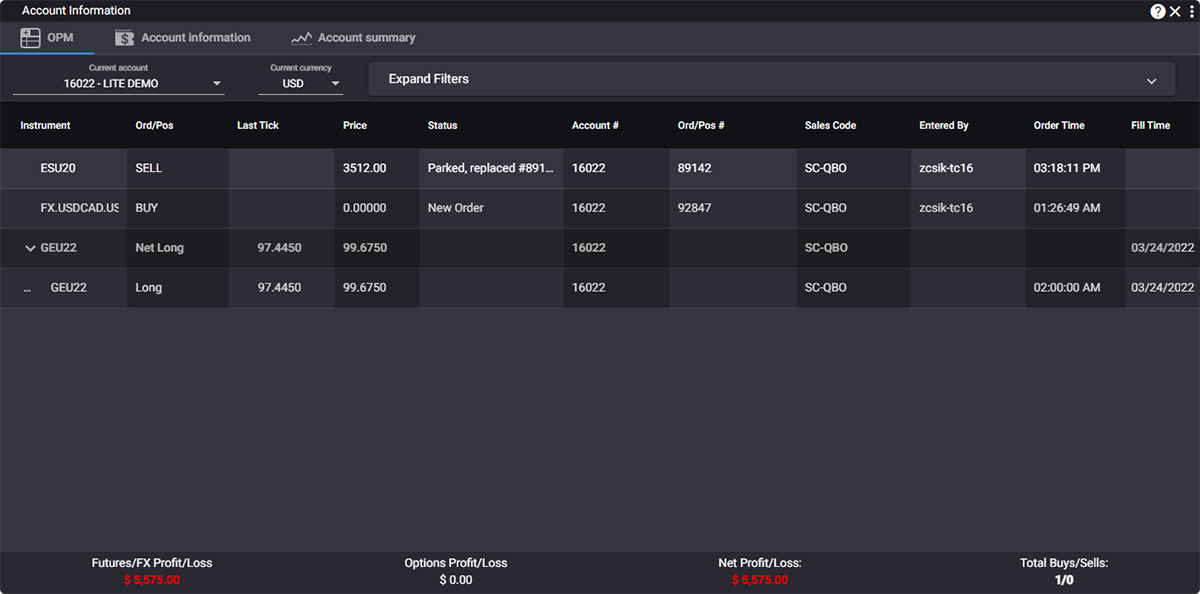

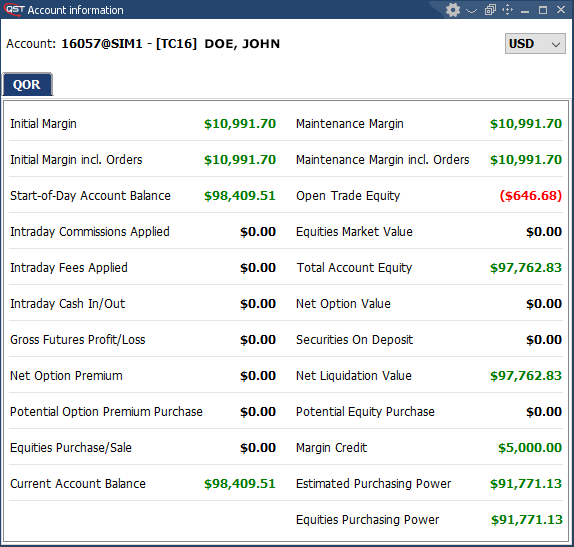

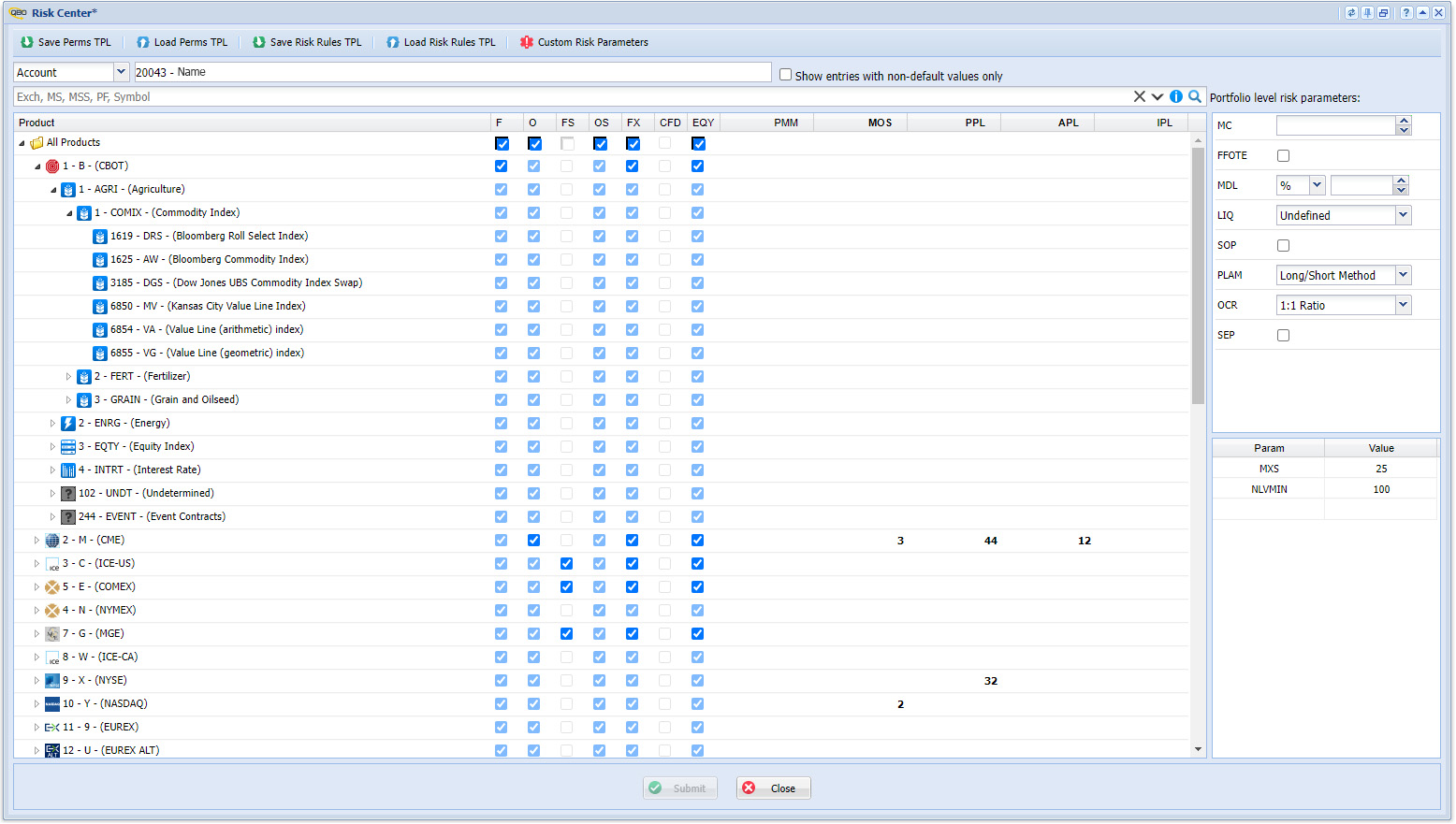

Real-time post-trade risk monitoring

Flexibility & diversity in stacking our software solutions to align with the institutional strategy

Multiple APIs including FIX, PBK, Excel RTD and Extensions API

Electronic order routing including comprehensive pre-trade risk

Internal Matching

For over 30 years, QST has been serving the needs of individual and trading professionals starting as a futures trading platform and expanding to cover equities, forex and CFDs trading from a single platform.

The power of QST into your platform

Build your customers trust with our accurate risk solutions, seamlessly integrated with our front-end platforms.

Brokerage firms with global market access require speed, security, and flexibility.

To best serve brokerage firms needs, QST offers:

White-labeled desktop, mobile, web front-ends

Electronic order routing

Real-time post-trade risk monitoring

Comprehensive middle/back office solutions

•

•

•

•

QST solutions for Brokerage Firms

Exchanges & liquidity providers need speed, security and flexibility to enable traders to access them.

QST serves the critical needs of exchanges and liquidity providers by offering:

Low latency matching engine including market data dissemination

Support for bilateral negotiated trades

Complete integration with the full QST Solutions providing "exchange in-a-box" functionality

•

•

•

•

•

•

QST solutions for Exchanges & Liquidity Providers

To execute trading strategies, proprietary trading firms must have speed, security, and flexibility

QST serves the critical needs of proprietary trading firms with:

Desktop, web, and mobile app front-ends

FIX, binary and web service APIs for both order routing and market data

Electronic order routing including comprehensive pre-trade risk

Real-time post-trade risk monitoring

Internal Matching

•

•

•

•

•

•

•

•

•

•

QST solutions for Proprietary Trading Firms

Quick Back Office

Powerful, real-time back-office trade management system that leverages the full strength of the QST solutions for intra- and end-of-day processing.

Quick Post-Trade Risk

Post-Trade risk management system utilizing a proprietary margin engine.

Engineered from the ground up for performance and accuracy.

Customize your

QST solutions

QST solutions

Powerful enough for professionals,

simple enough

for individual traders.

Tell us your trading needs and challenges and let QST recommend the solution that’s right for you.

QST is supported by a number of brokerages, clearing and execution firms world-wide.

Click for availability with your trading provider.

Customize your QST solutions

Tell us your trading needs and challenges and let QST recommend the solution that’s right for you.

QST is supported by a number of brokerages, clearing and execution firms world-wide.

Click for availability with your trading provider.