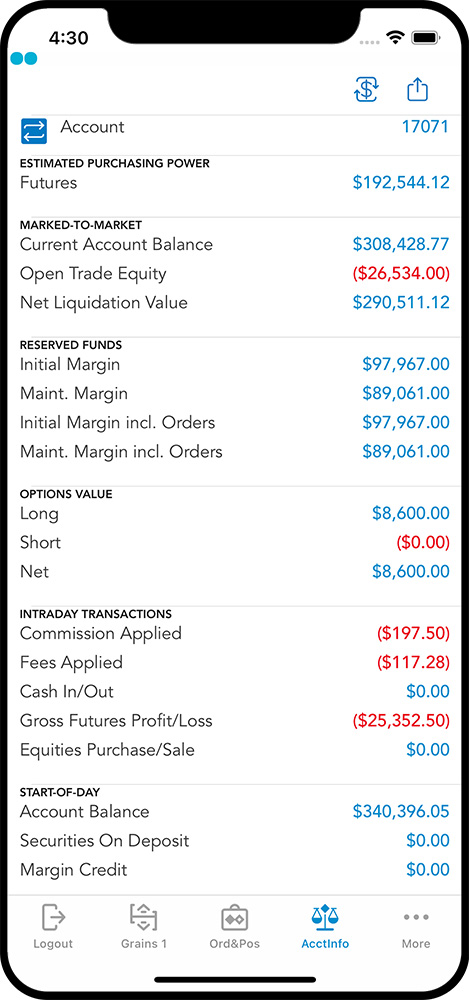

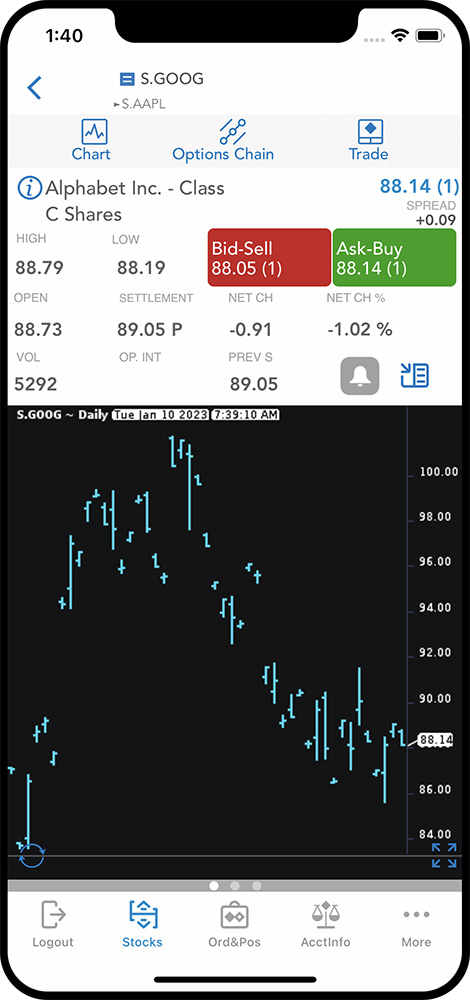

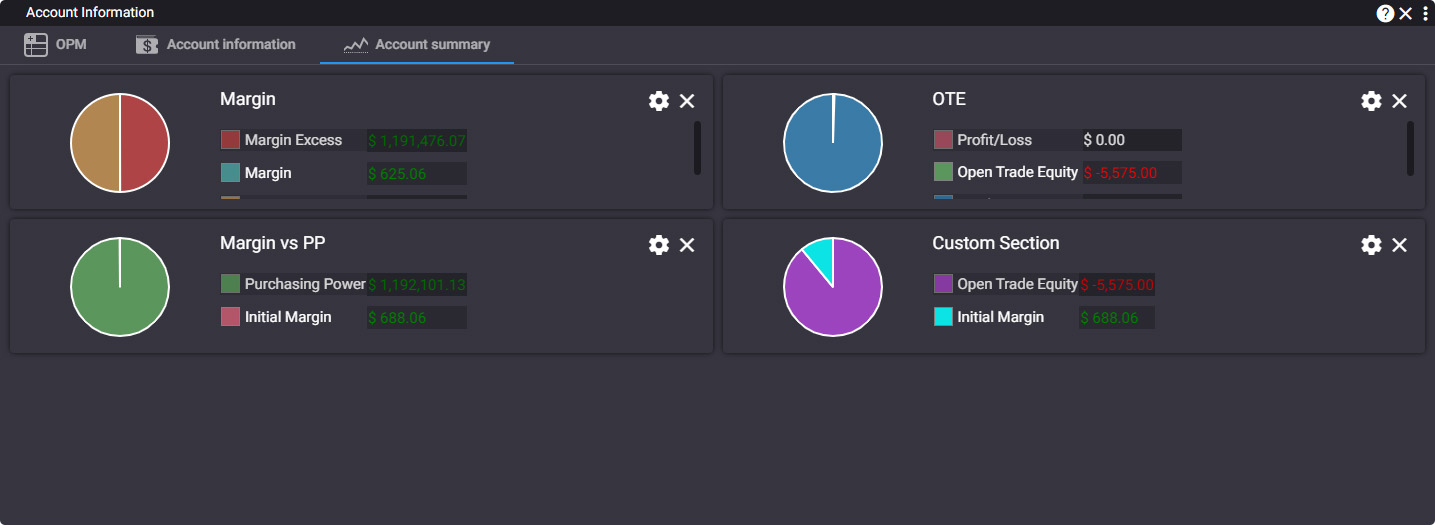

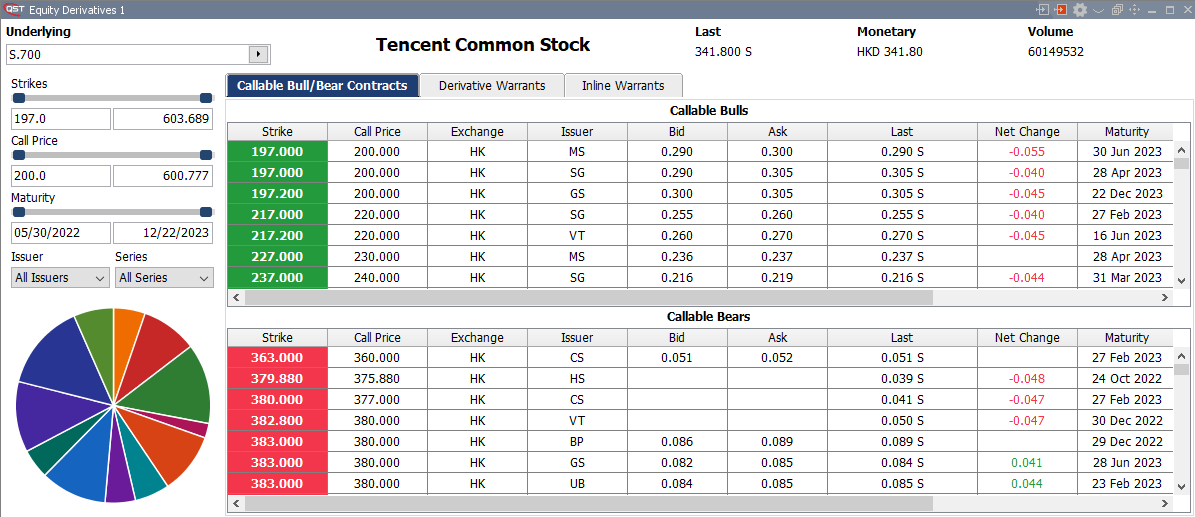

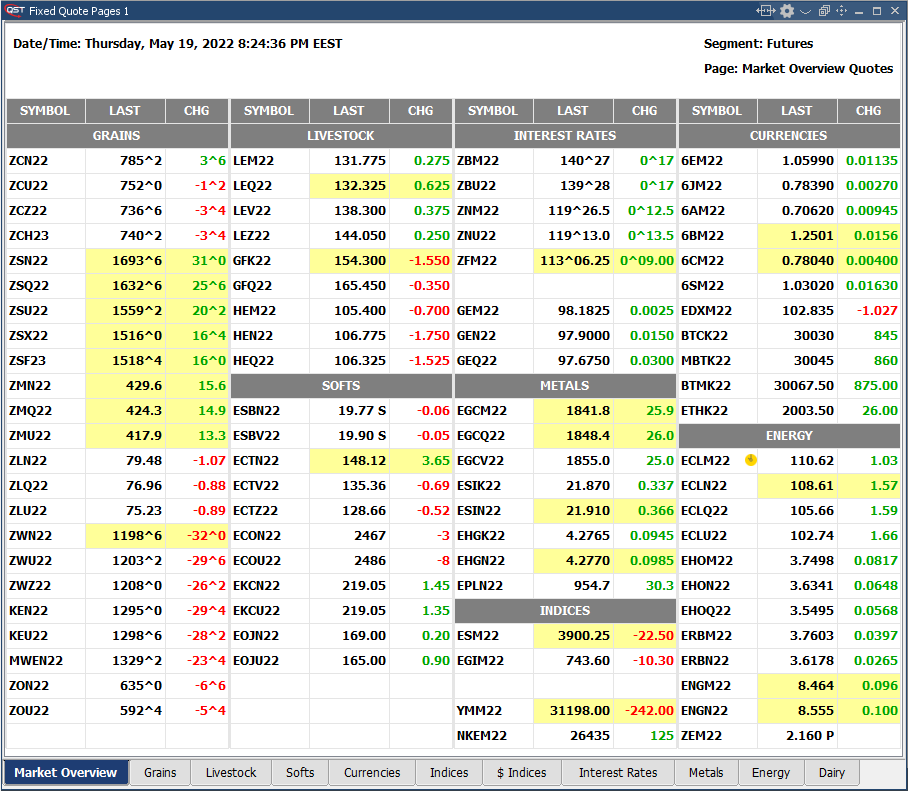

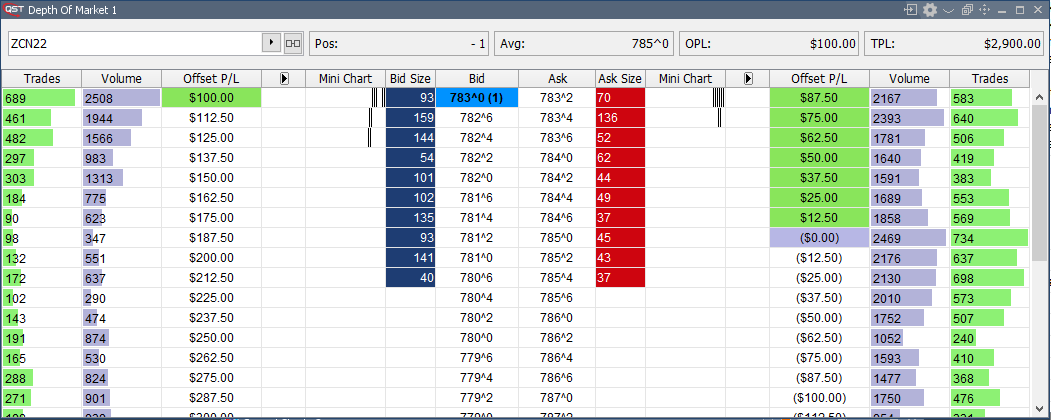

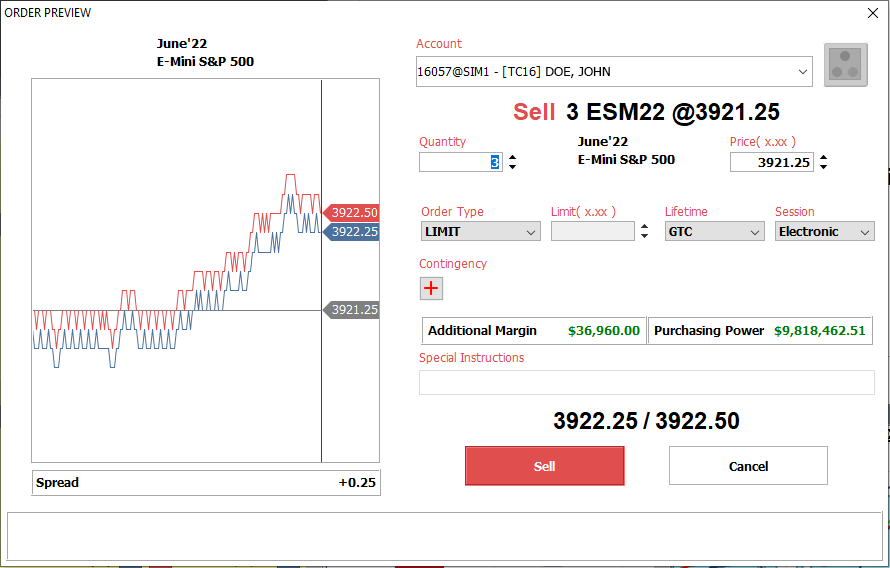

QPR utilizes a proprietary portfolio margin engine that has been engineered to maximize performance and accuracy

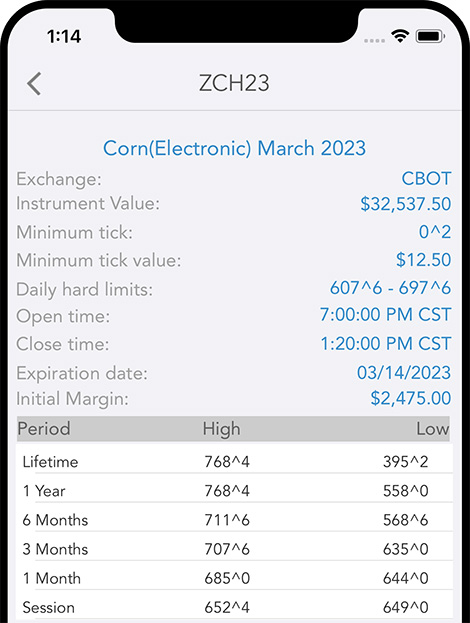

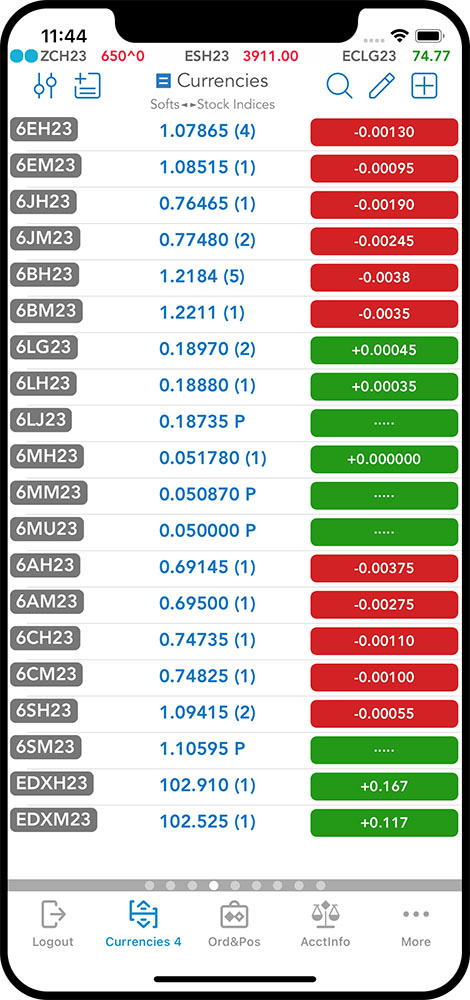

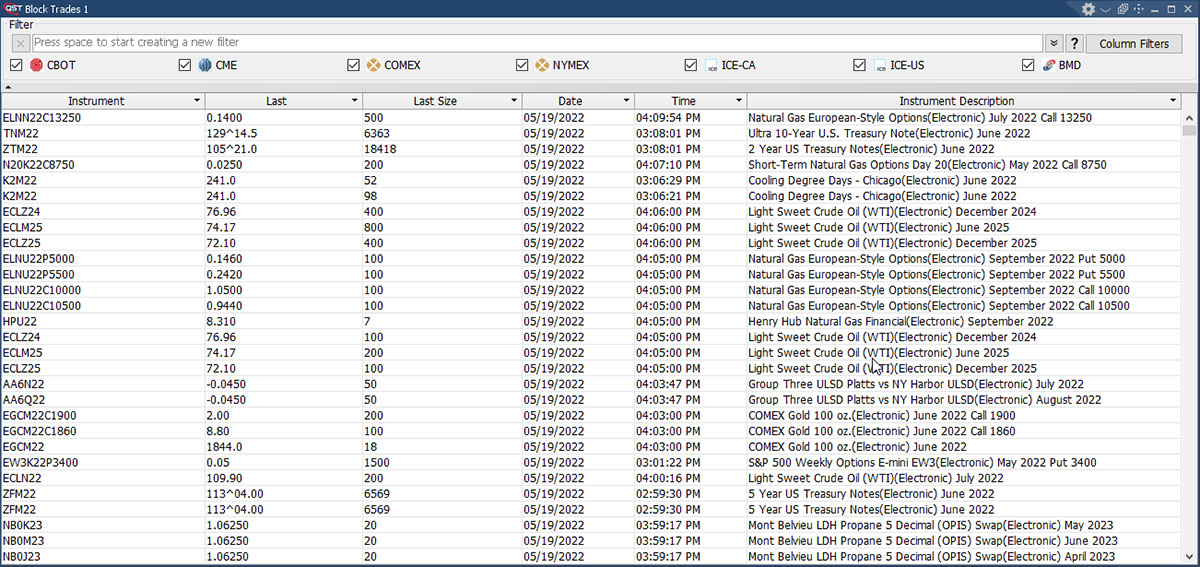

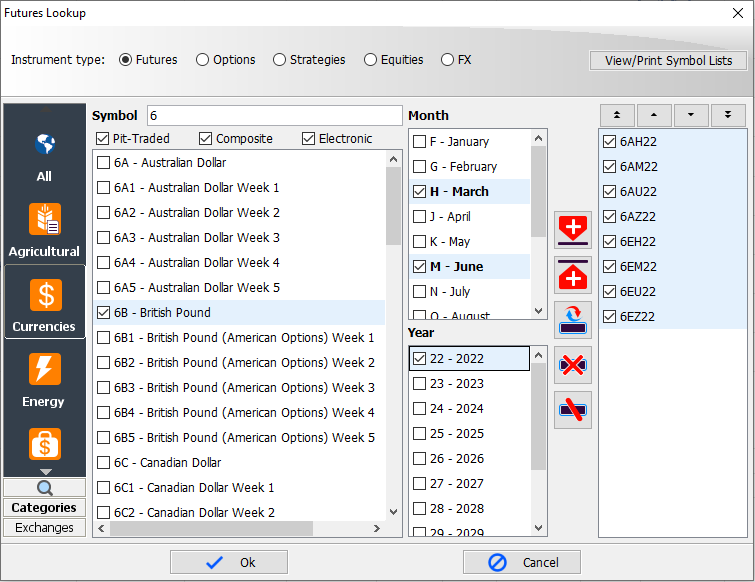

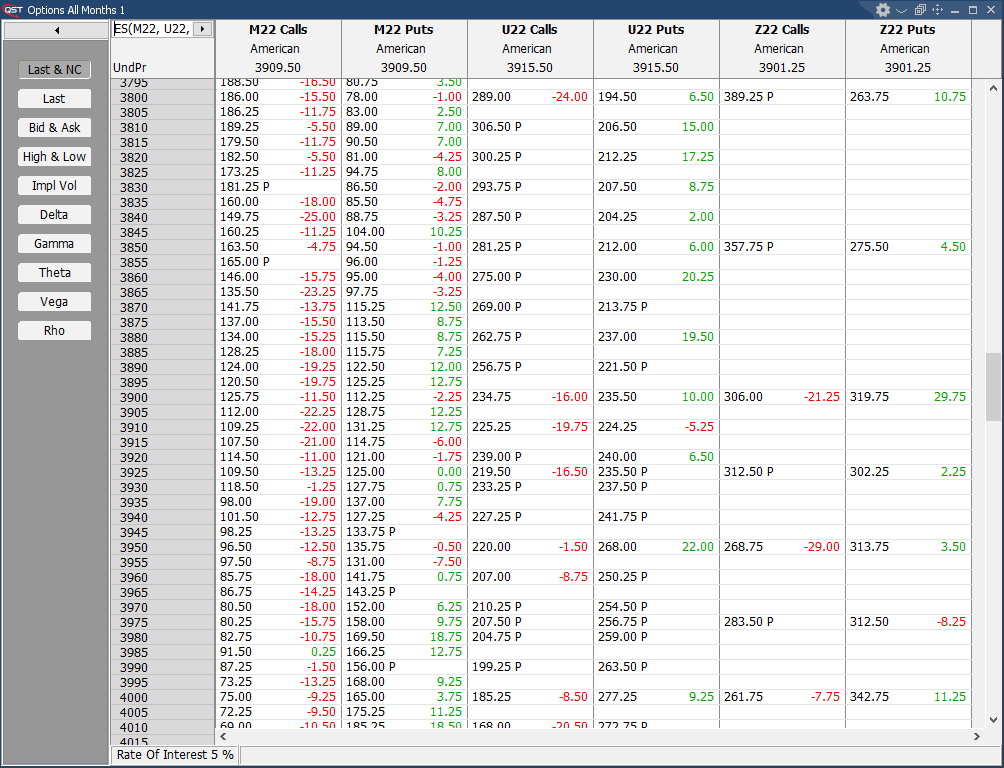

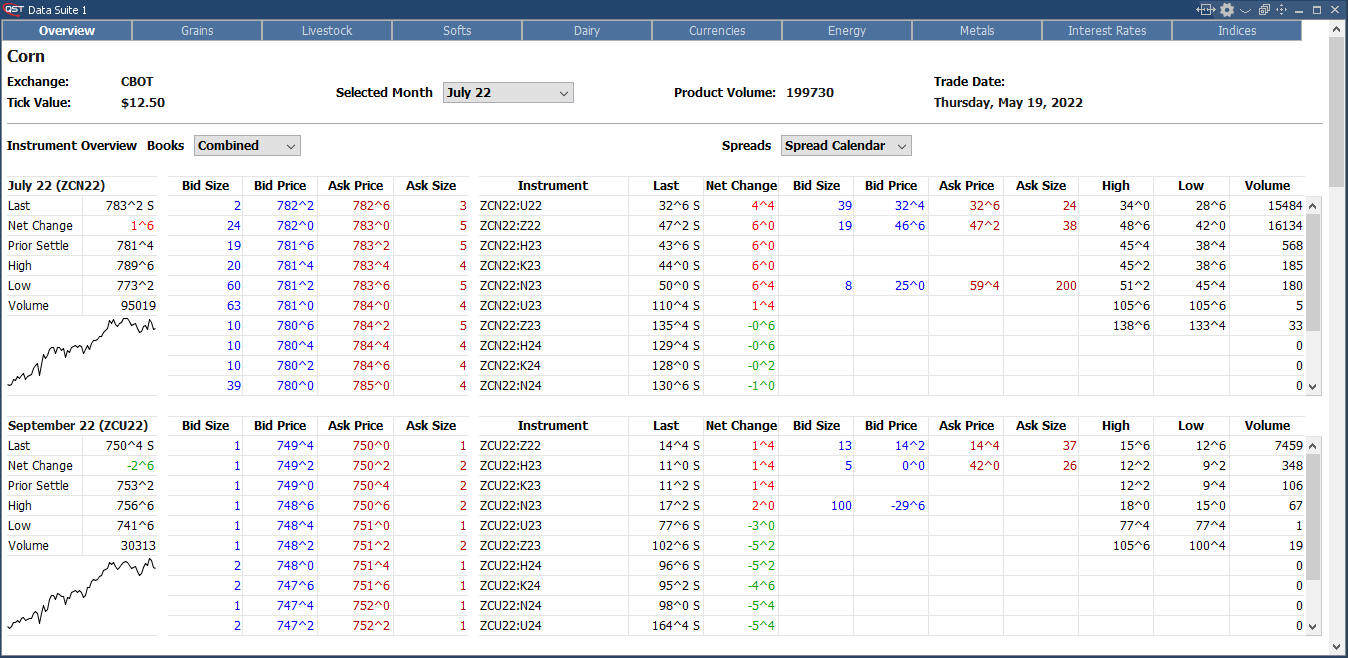

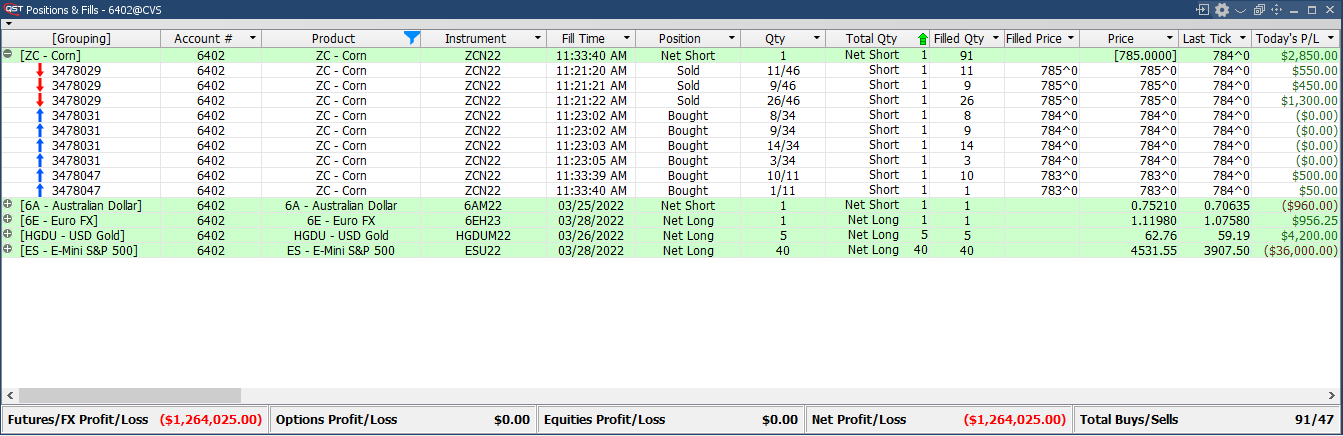

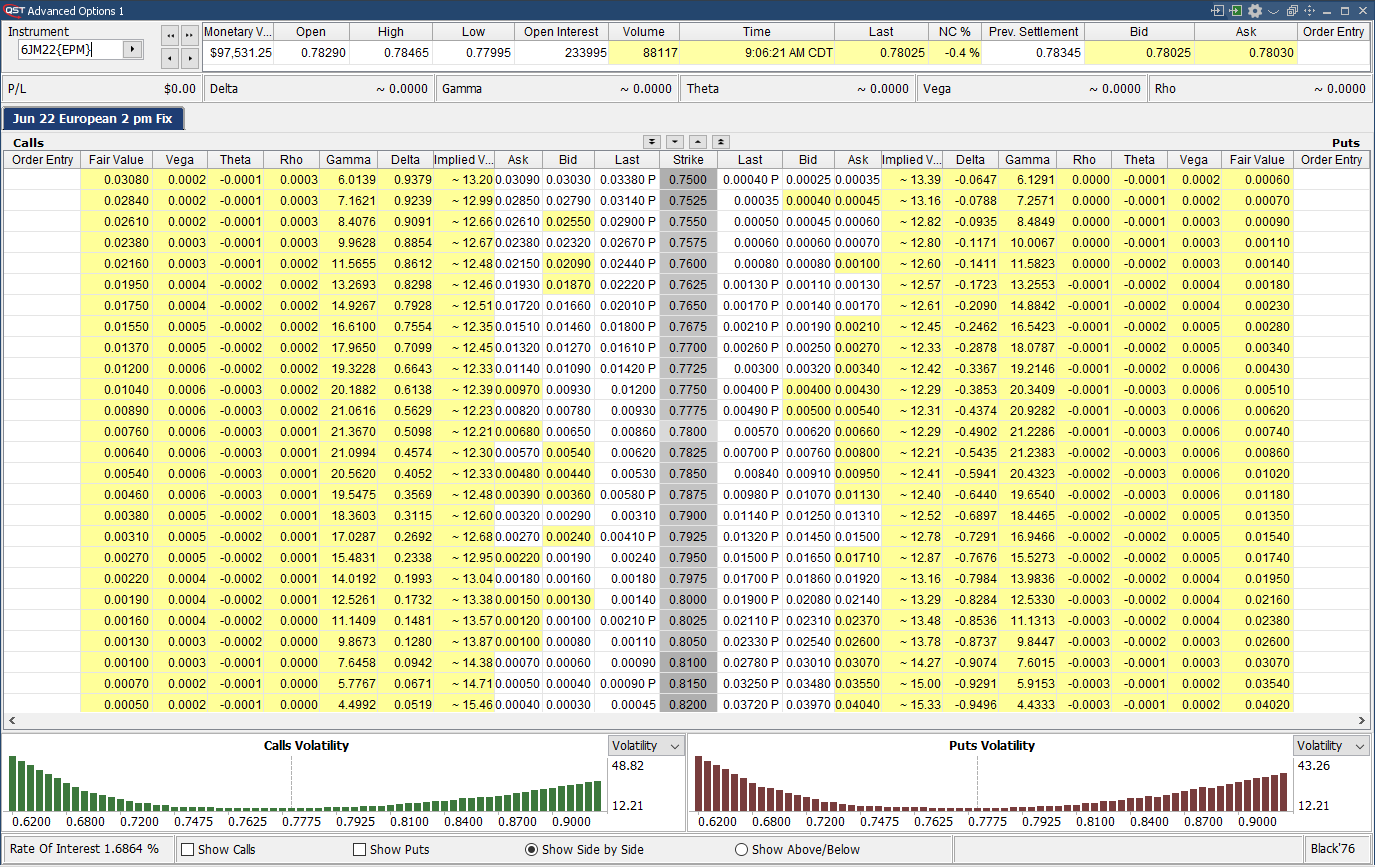

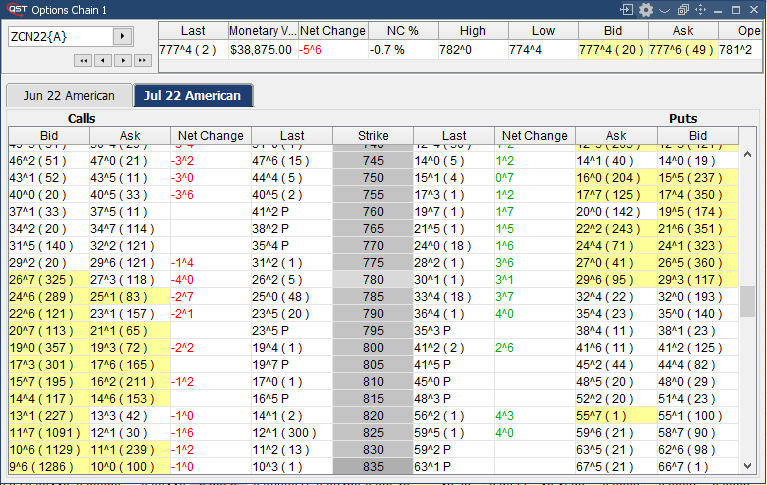

For accurate and comprehensive portfolio margining, QPR implements SPAN, PRISMA, and percentage-based and table-lookup margins

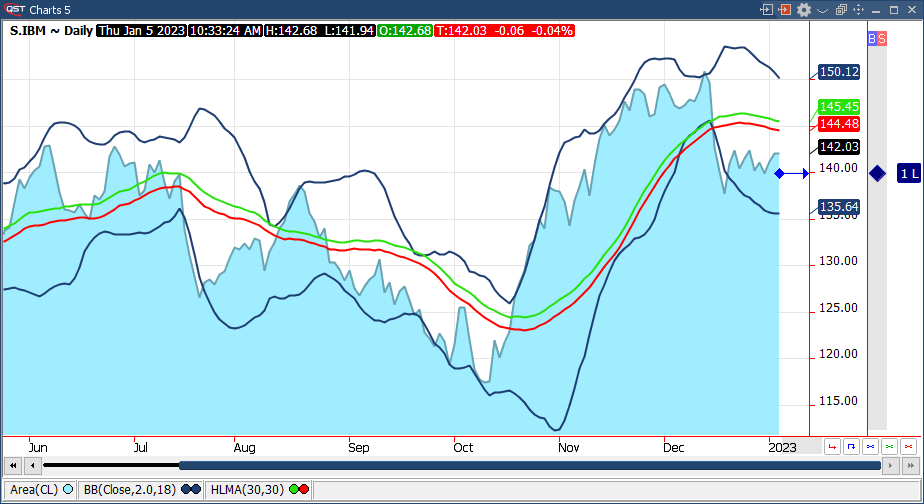

Accurate risk solutions

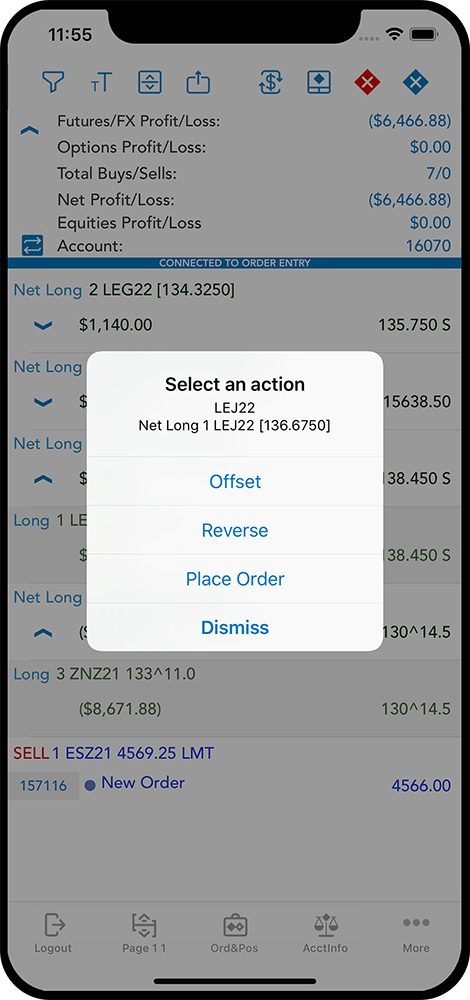

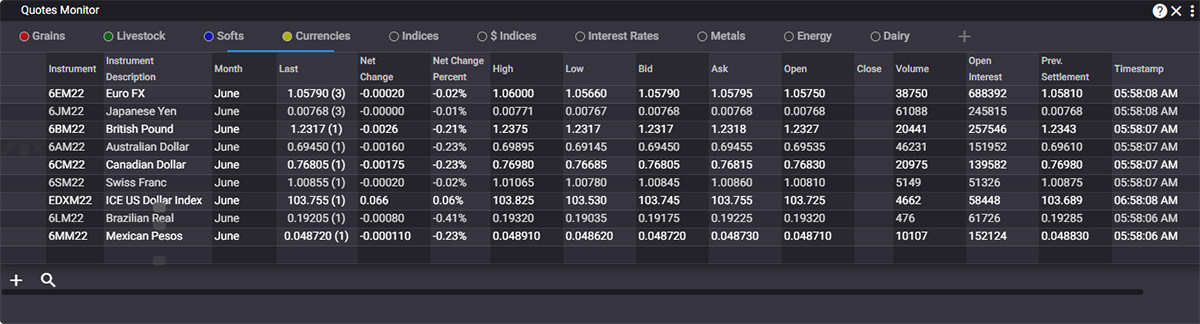

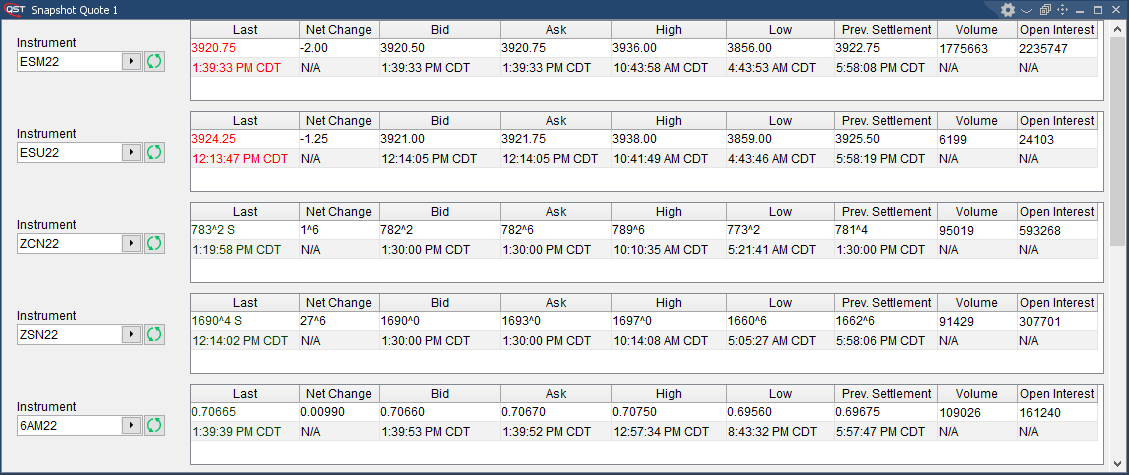

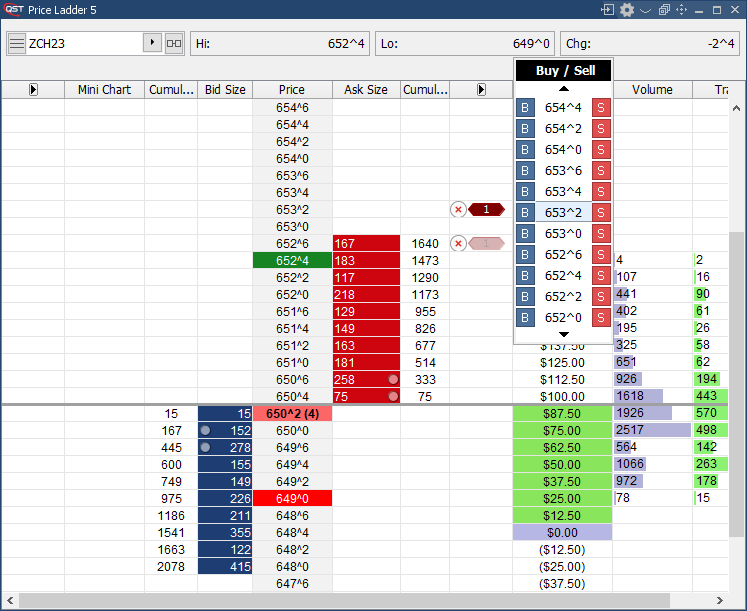

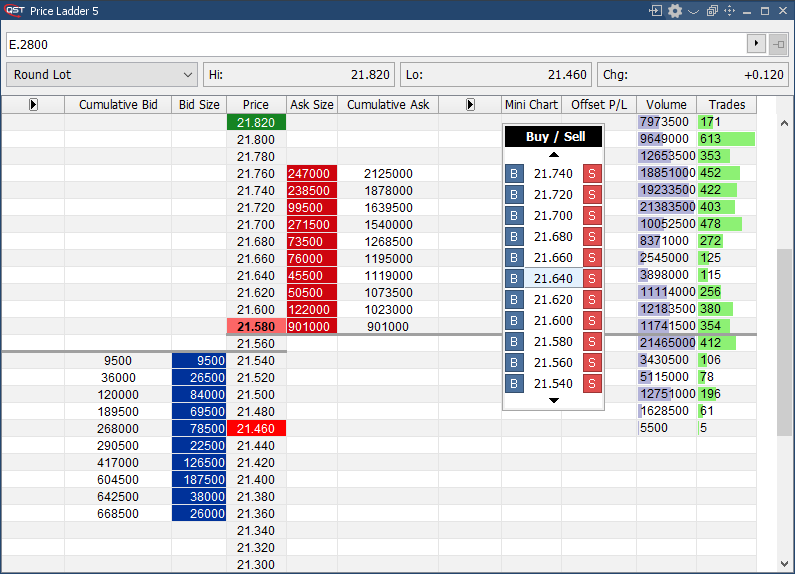

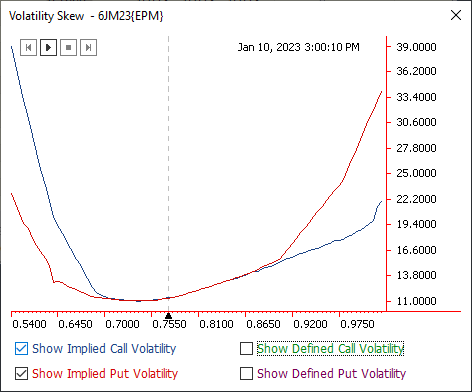

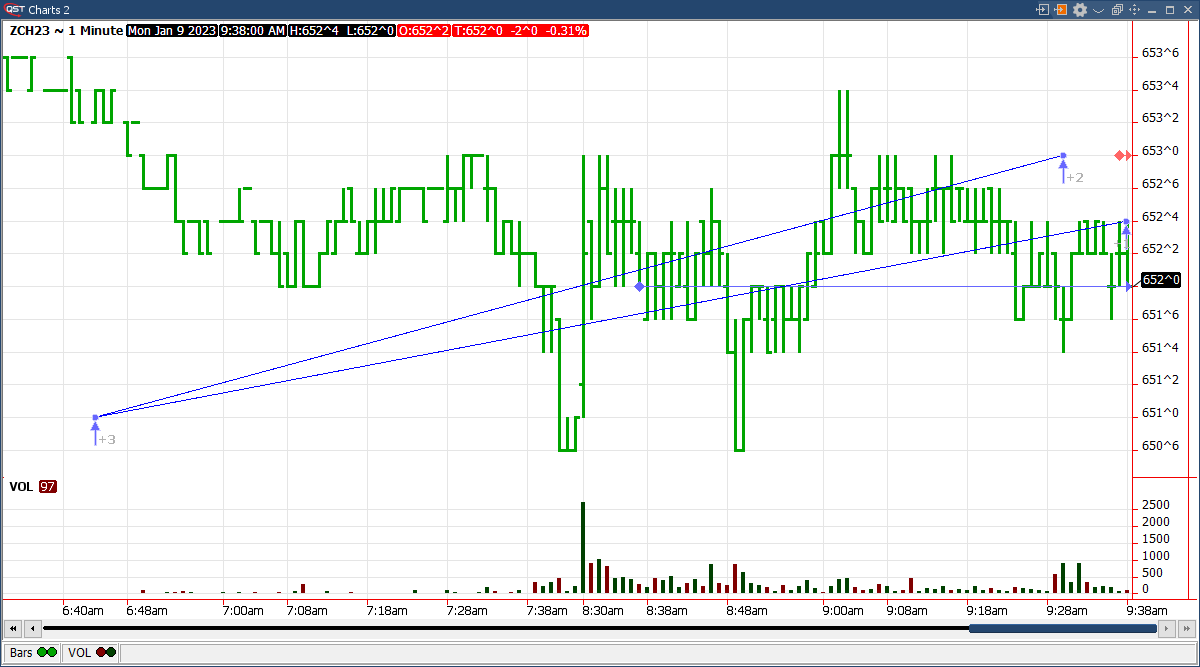

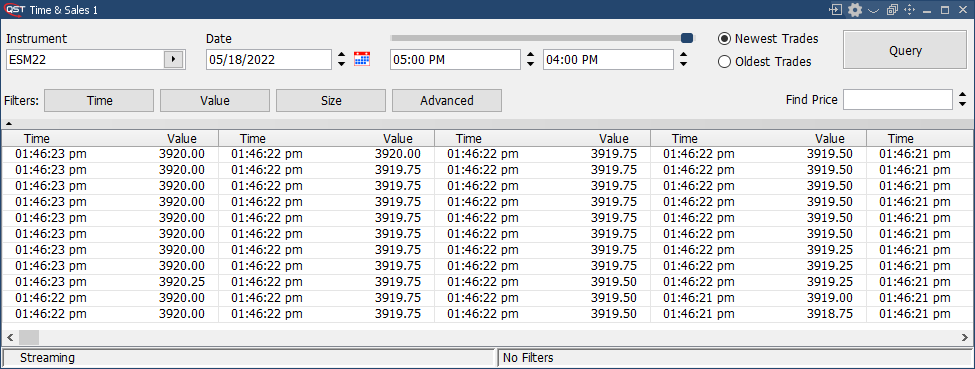

We leverage tried and true algorithms with our unified database of financial instruments and margin engine to automatically configure the orders-of-magnitude intervals in post-trade risk computations.

This gives risk managers the most accurate risk projection across various parameters such as price movement and volatility changes.

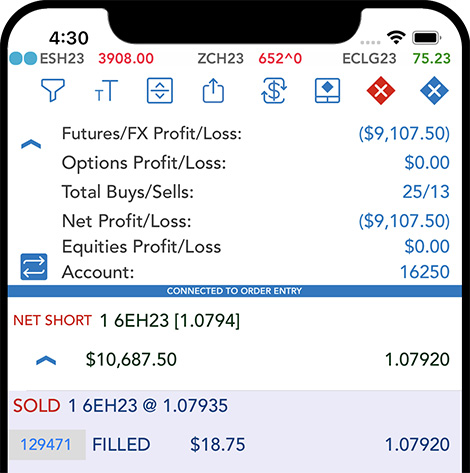

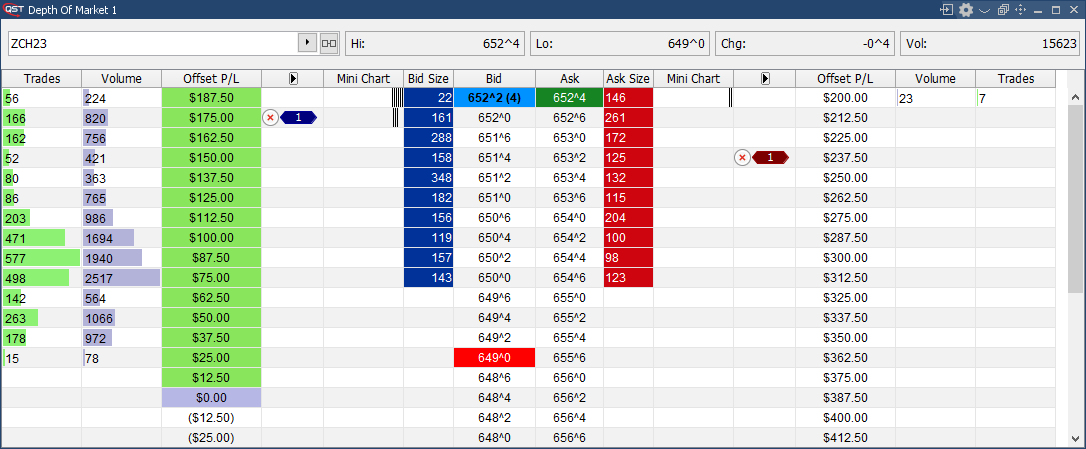

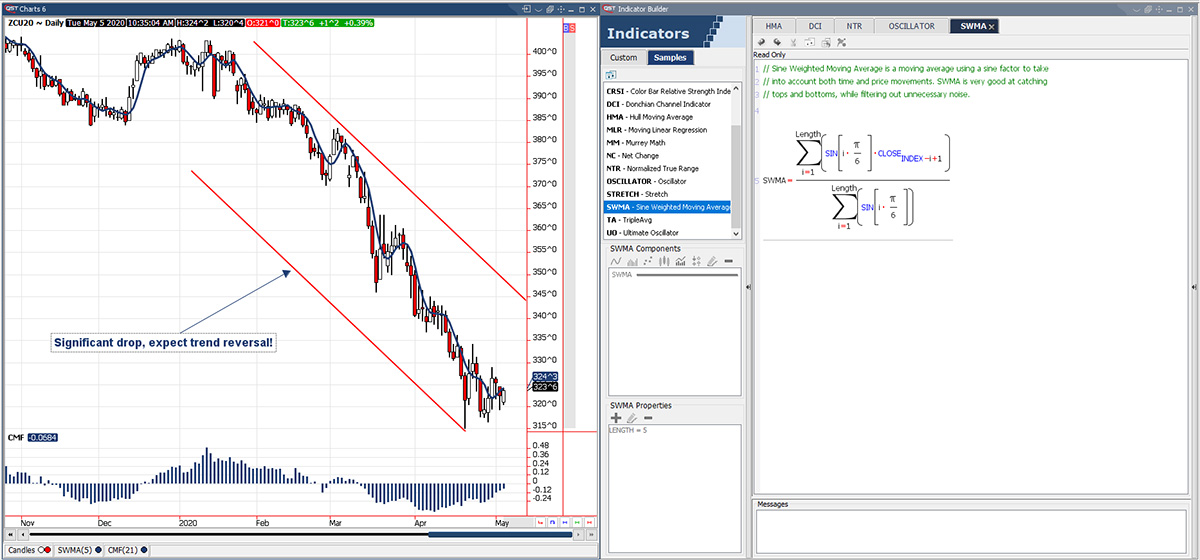

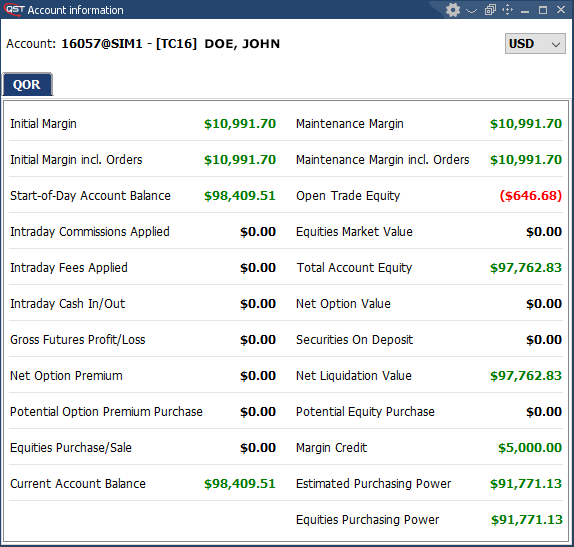

Simplicty & Fast calculations

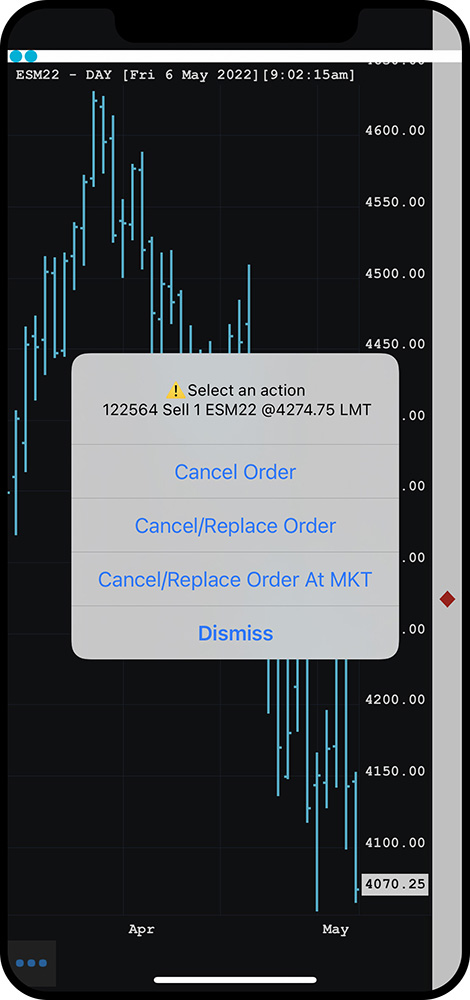

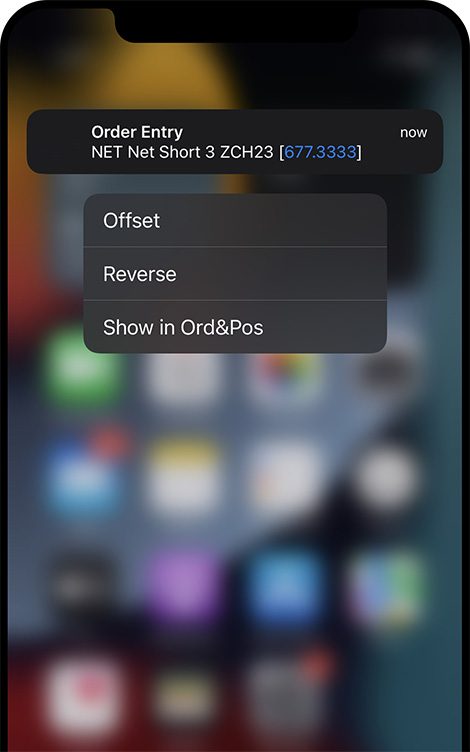

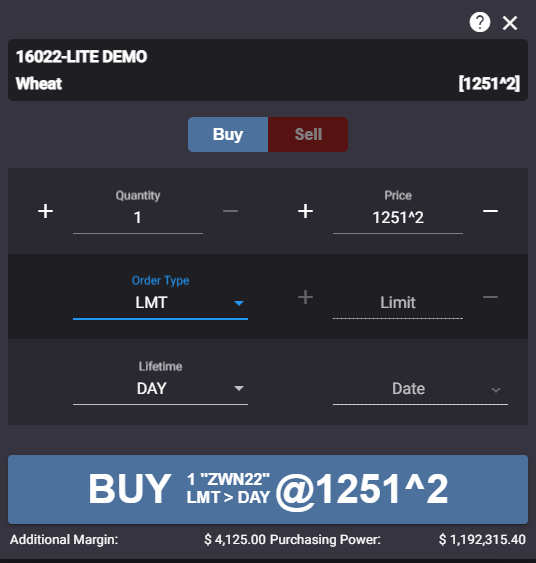

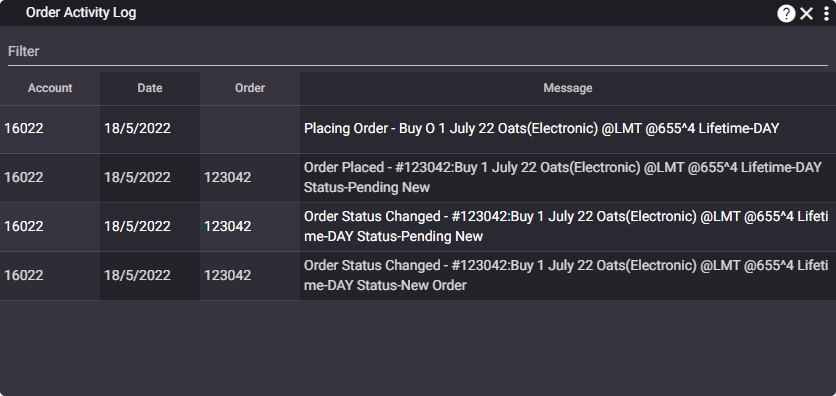

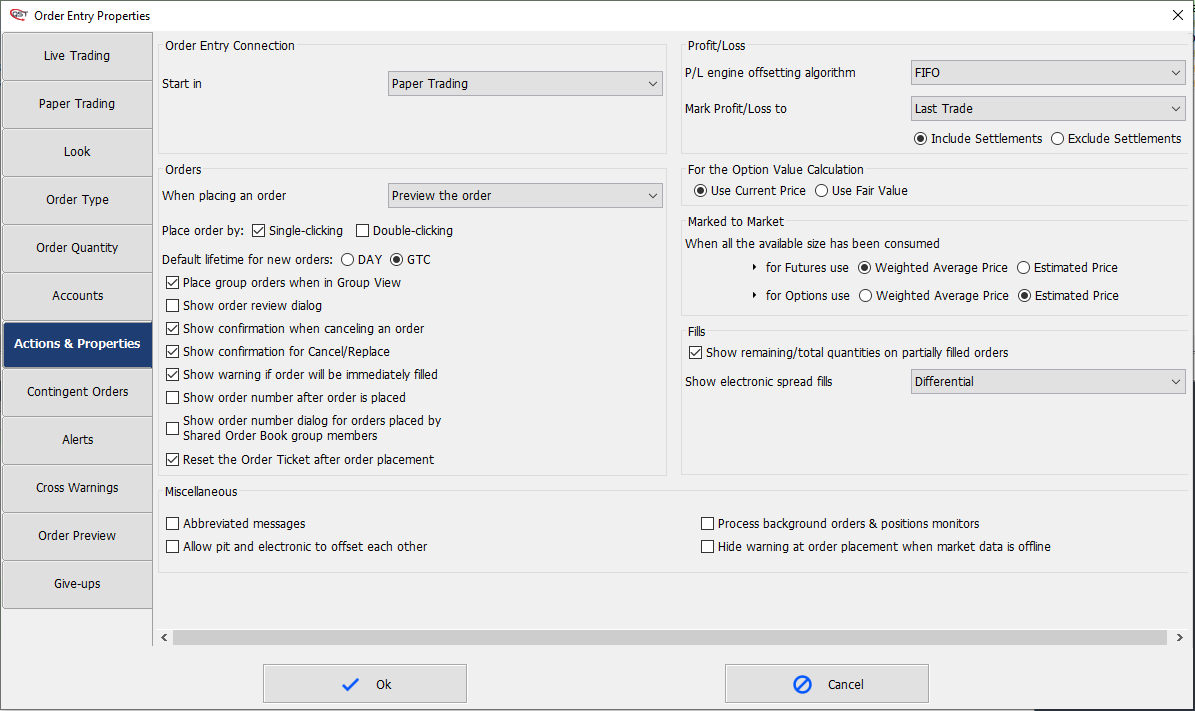

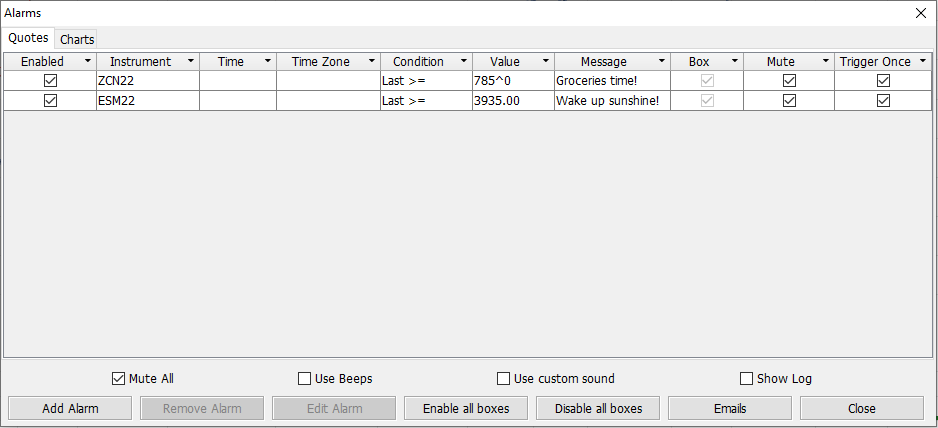

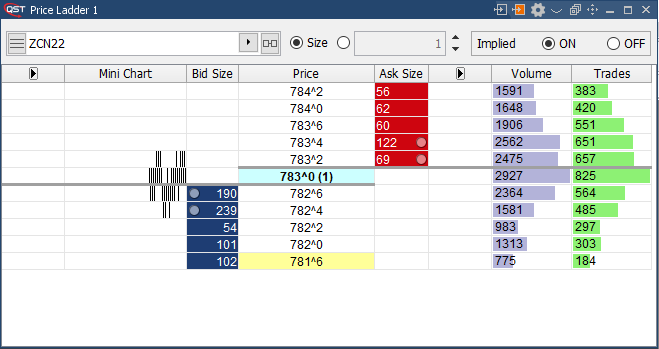

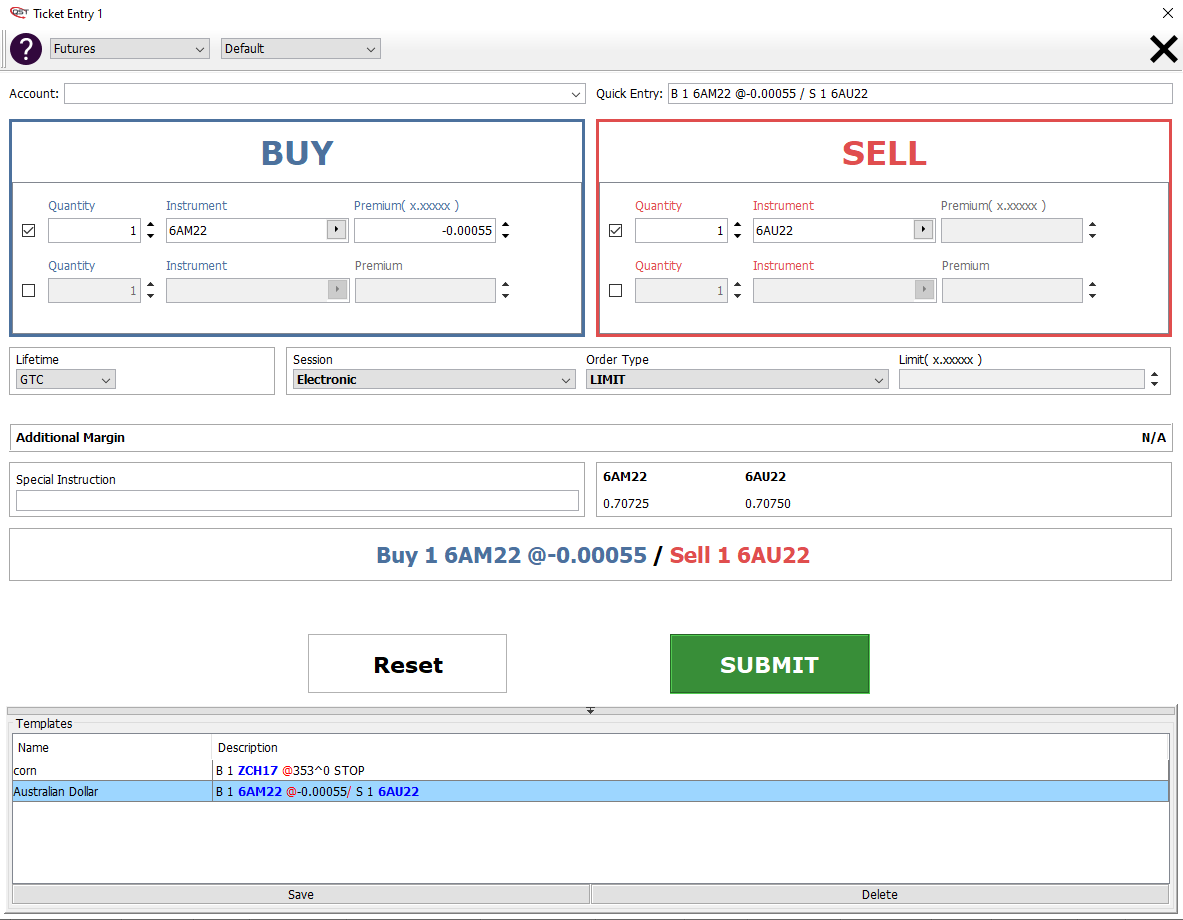

The margin engine can optionally include working orders to calculate “worst case” margins based on filled, partially filled, and unfilled orders.

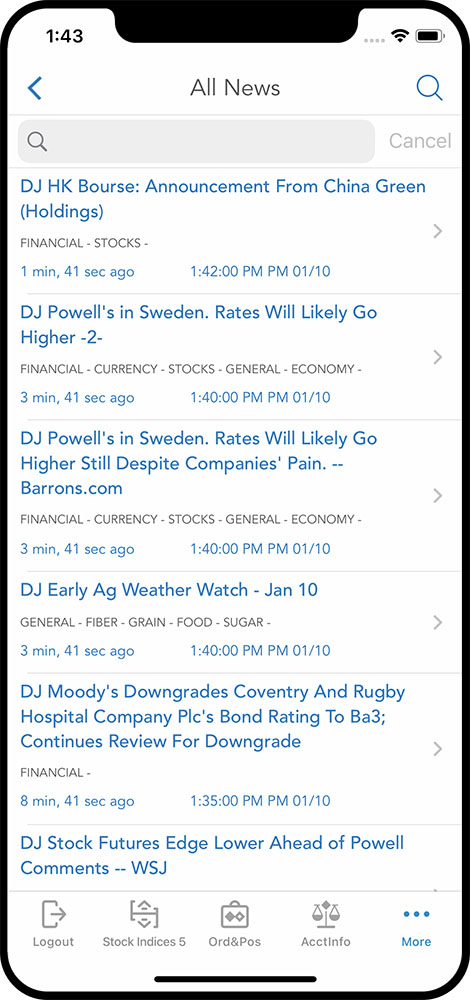

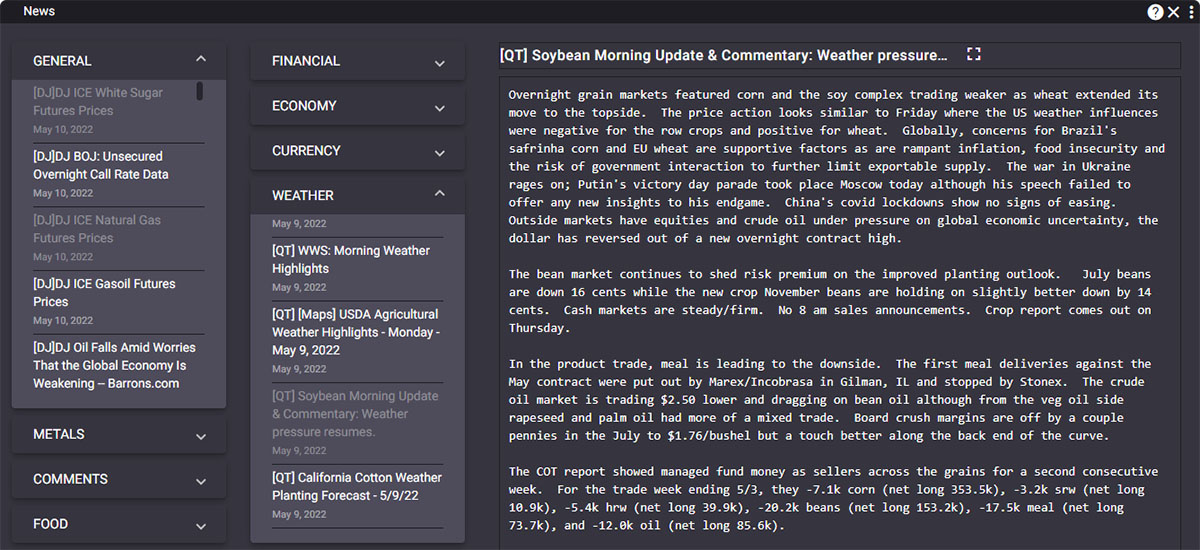

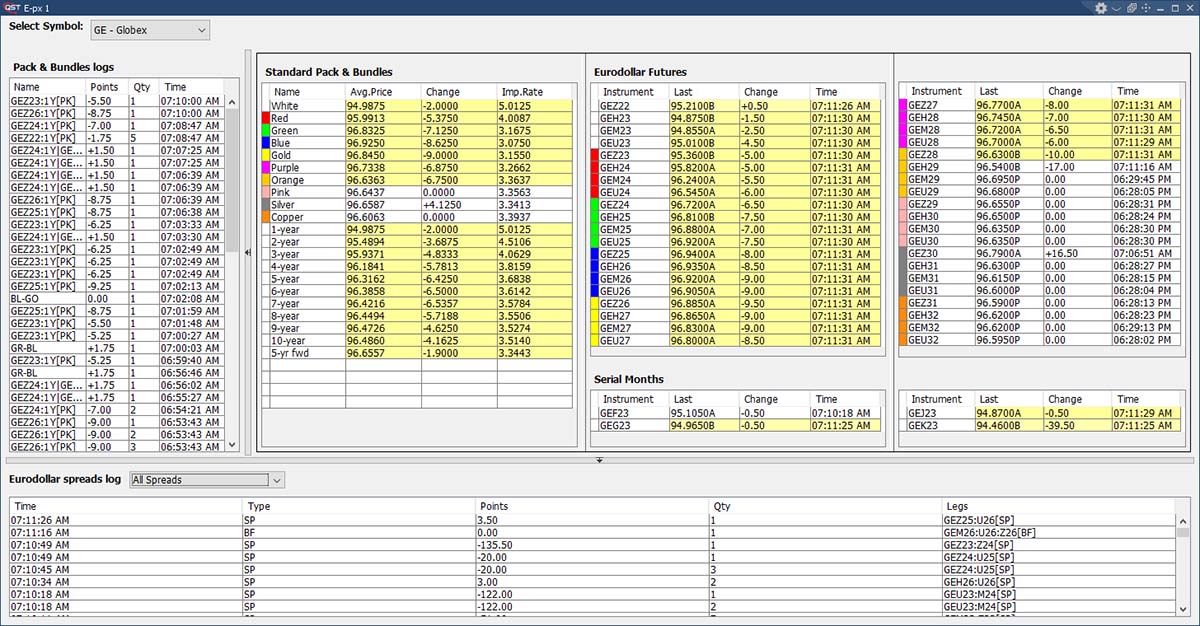

Our post-trade risk solution utilizes option pricing formulas used by some exchanges for calculating their daily settlement prices. Where current prices are not available, QPR supports a proprietary estimated pricing methodology based in part on implied values from nearby instruments that are quoted/traded.

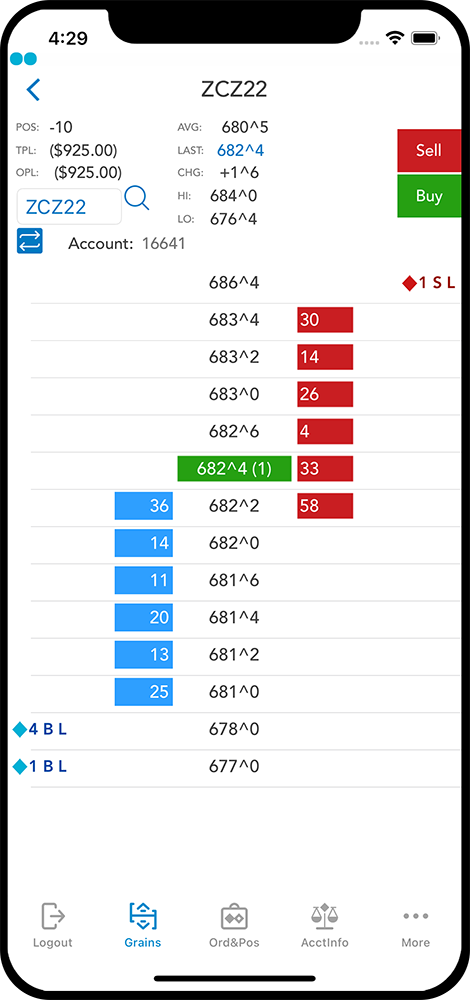

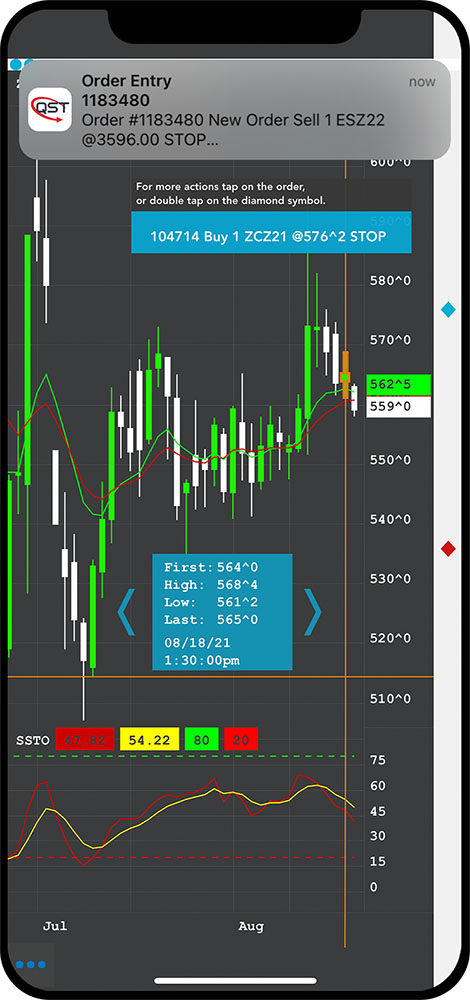

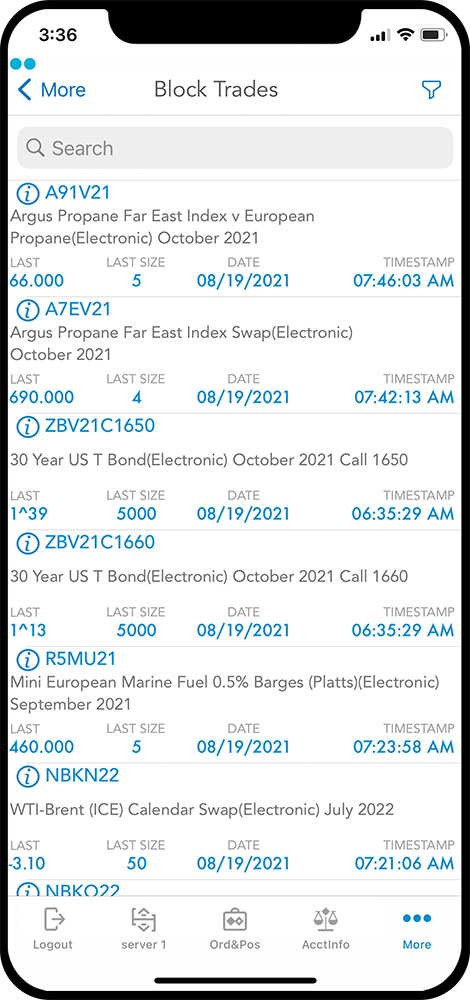

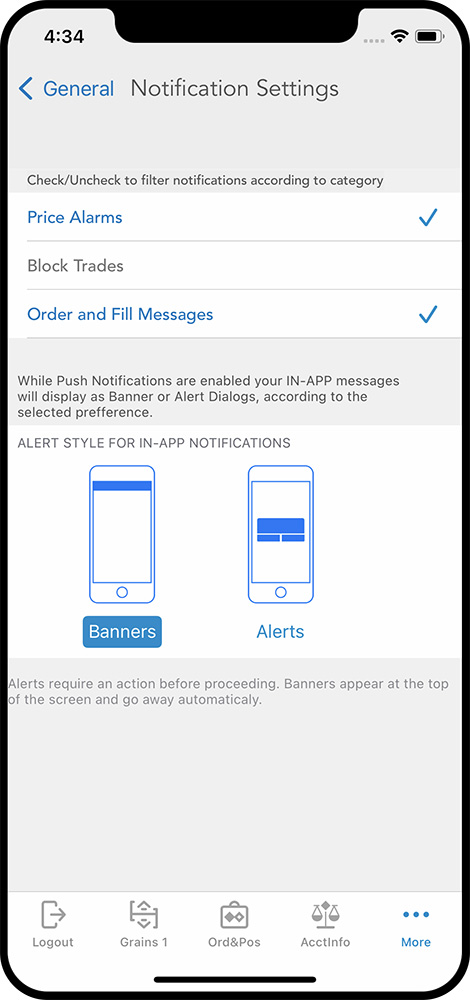

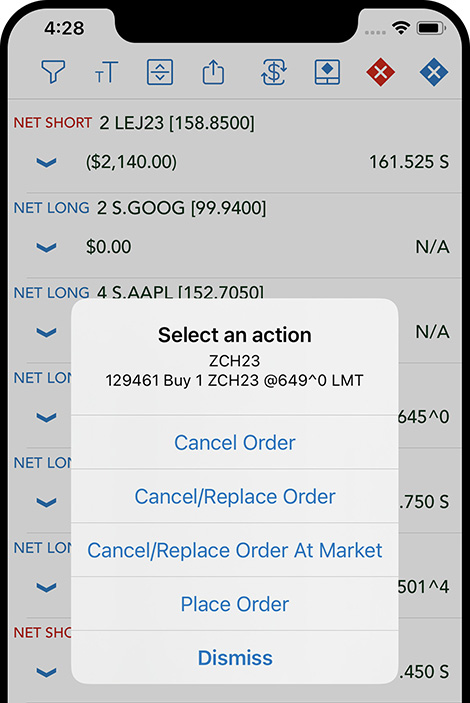

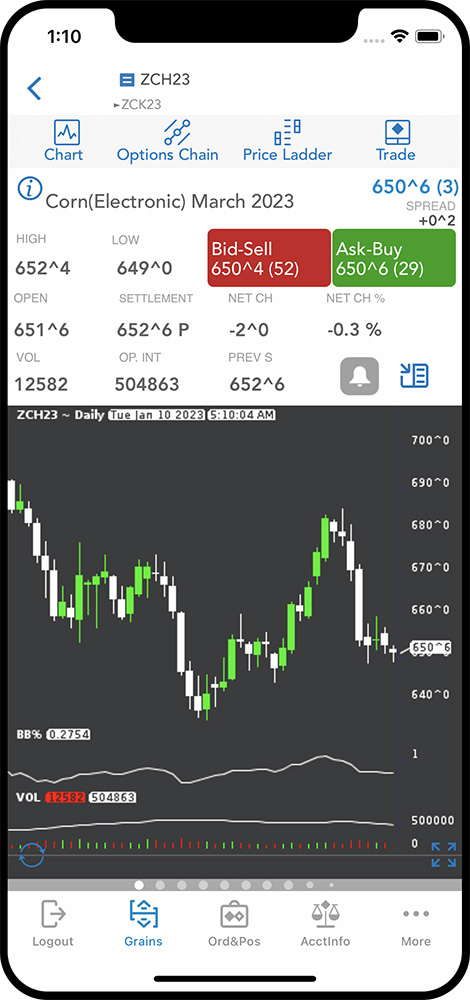

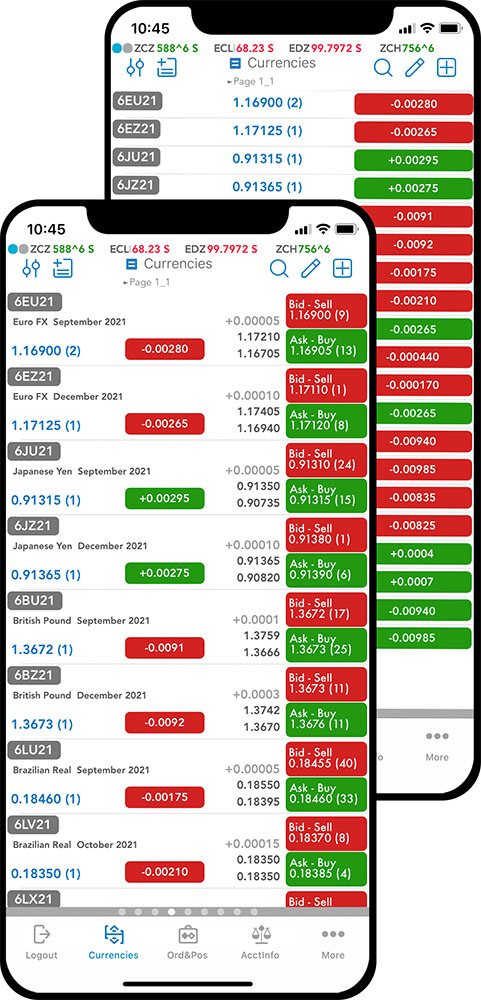

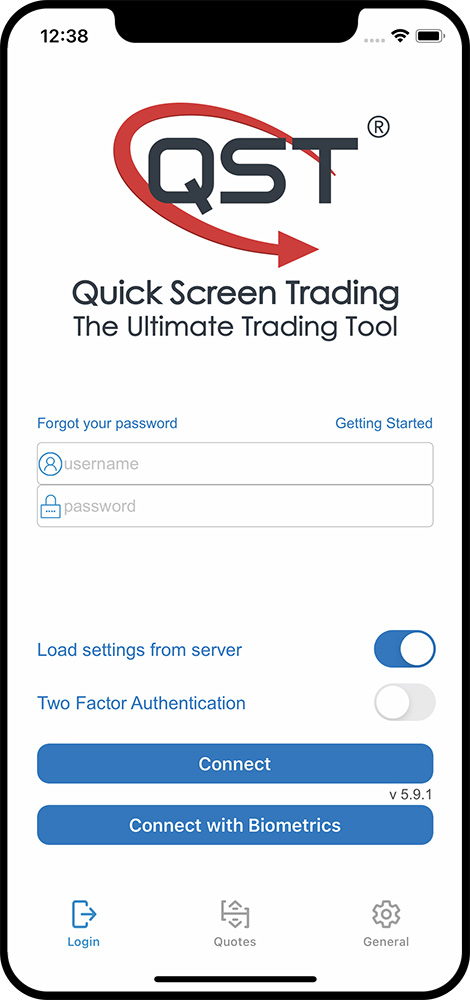

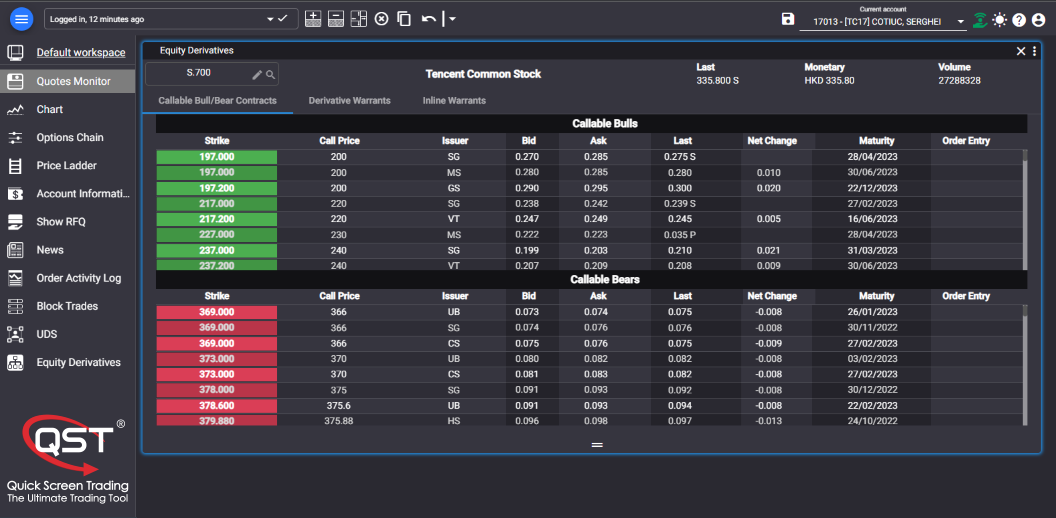

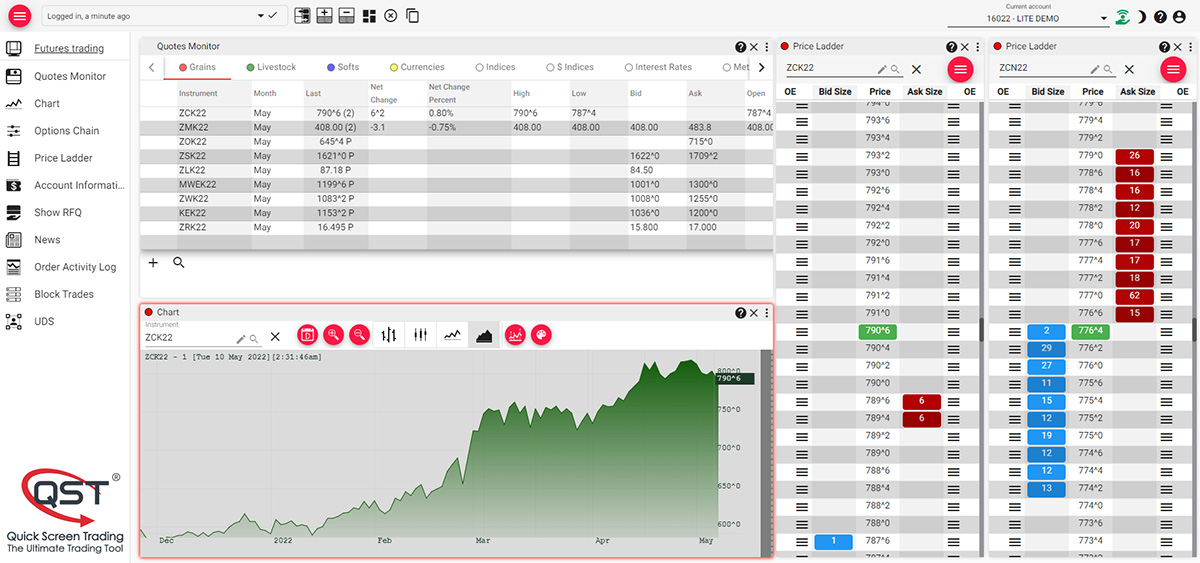

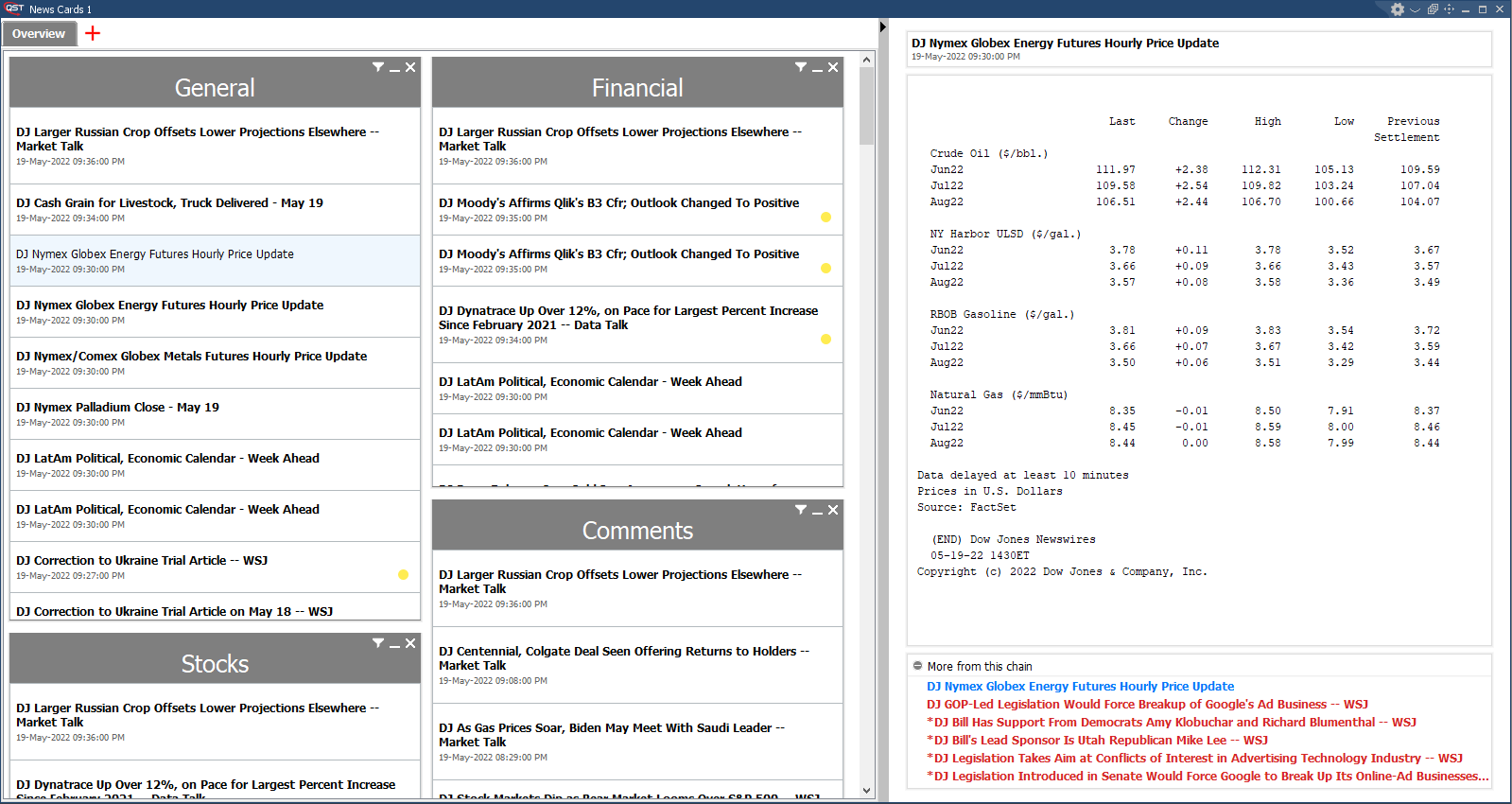

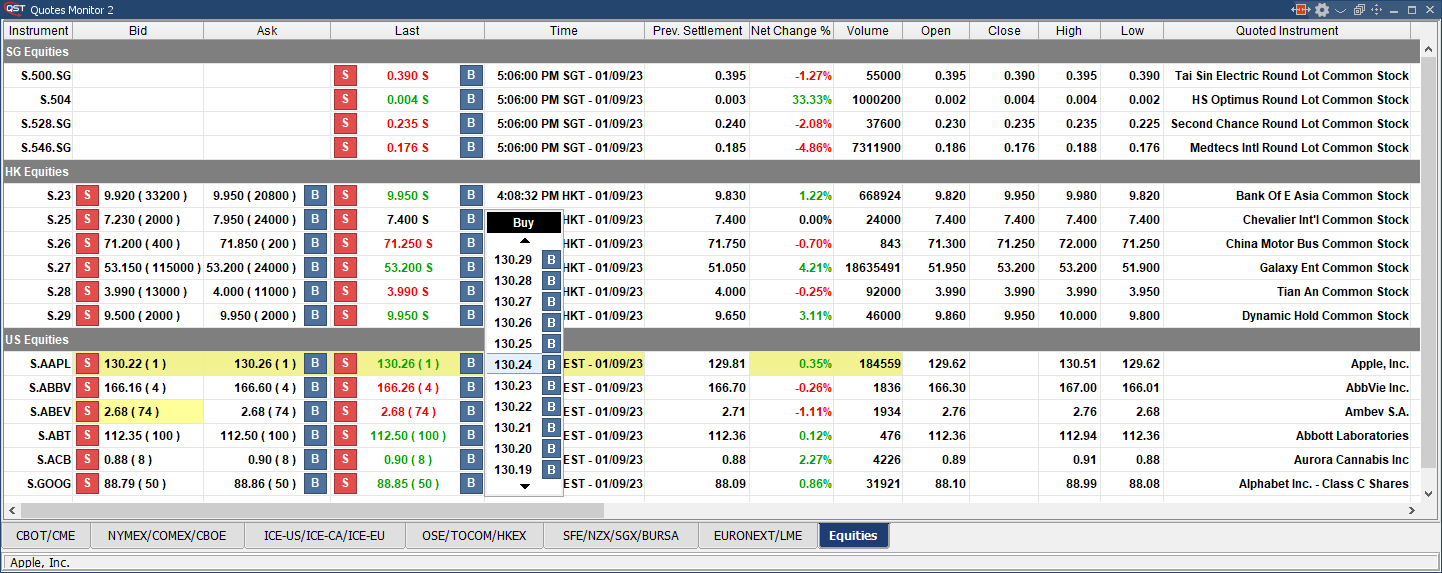

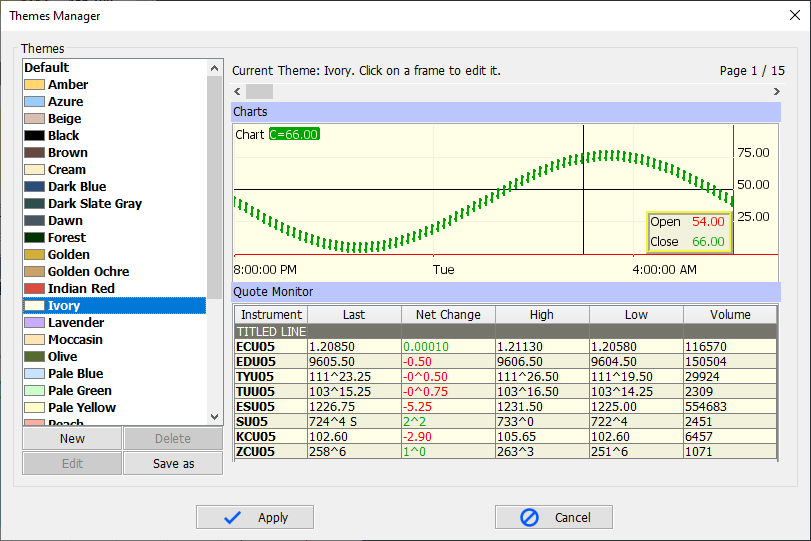

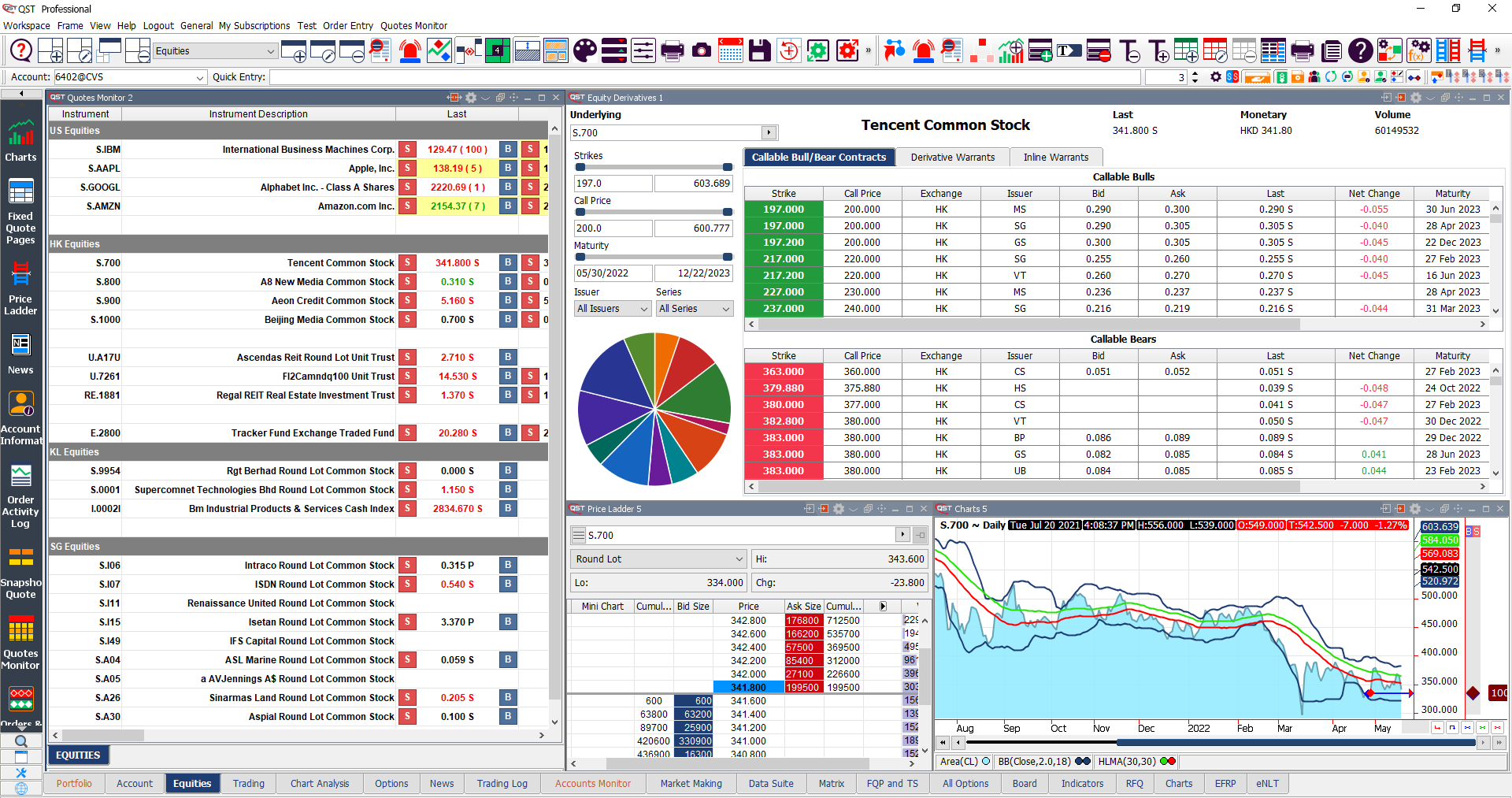

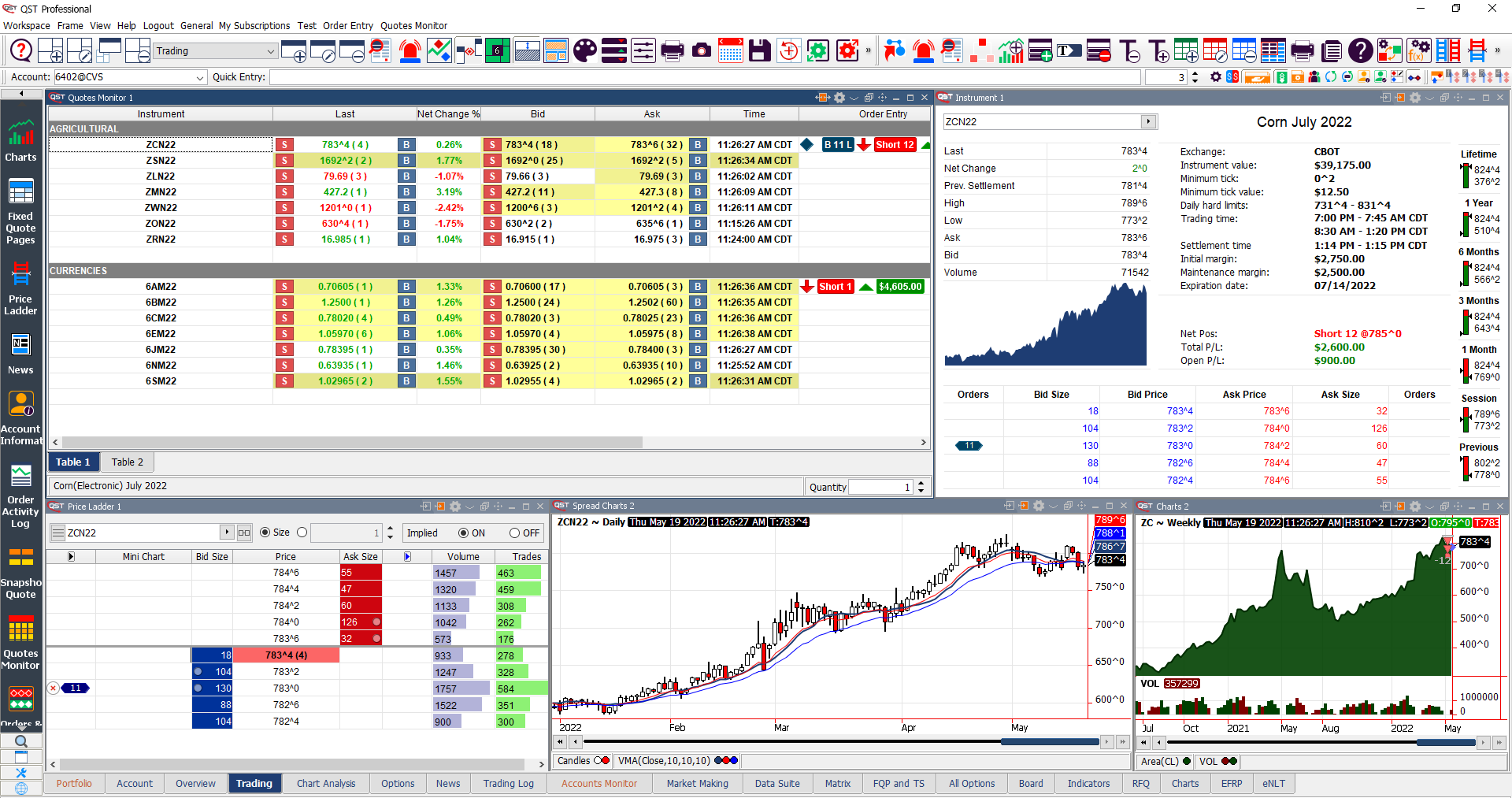

QPR is part of the QST solutions suite

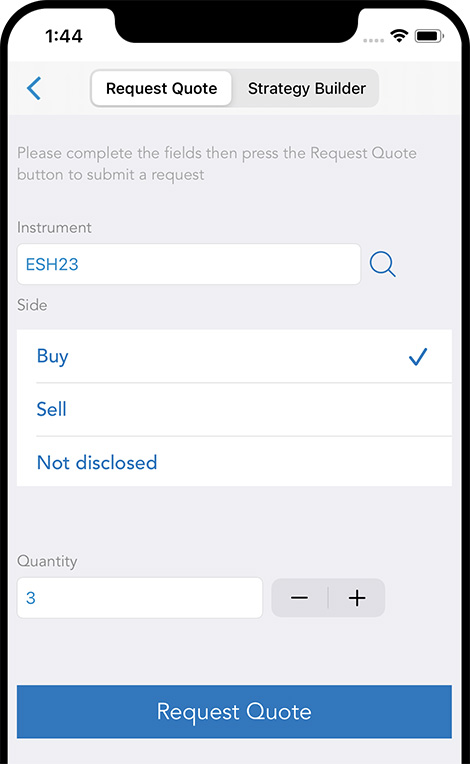

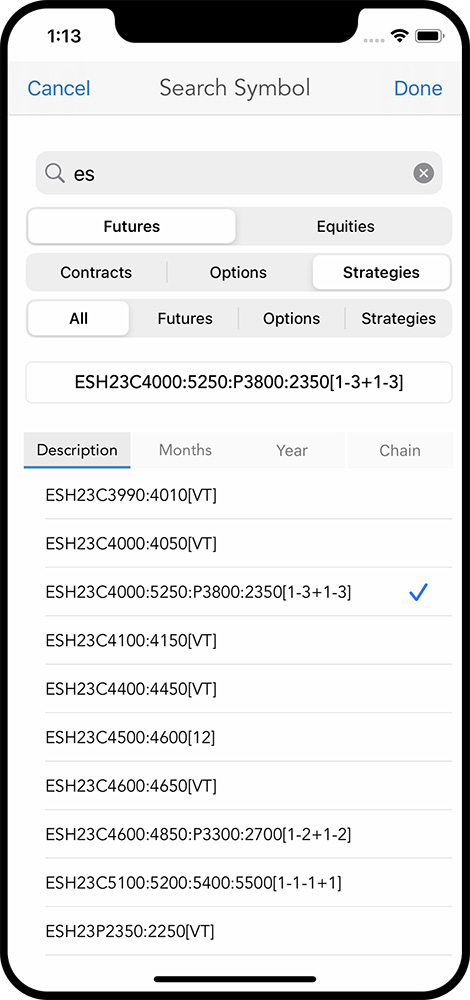

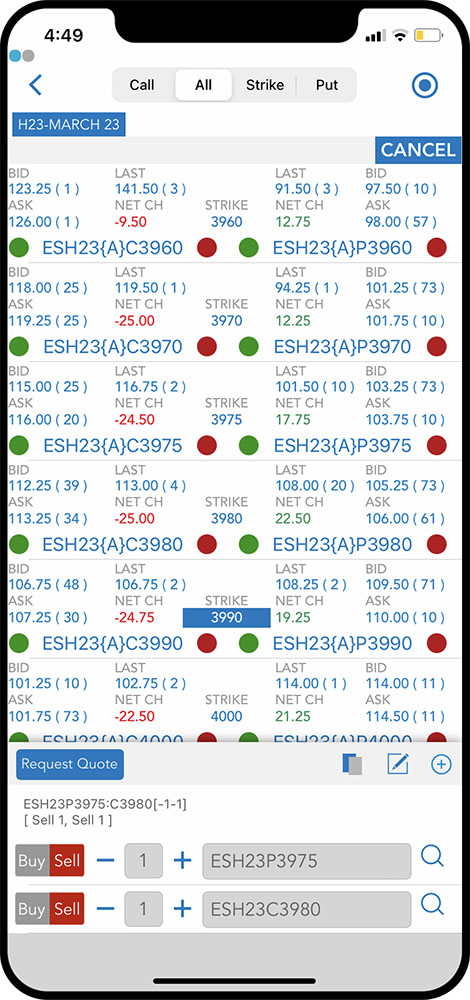

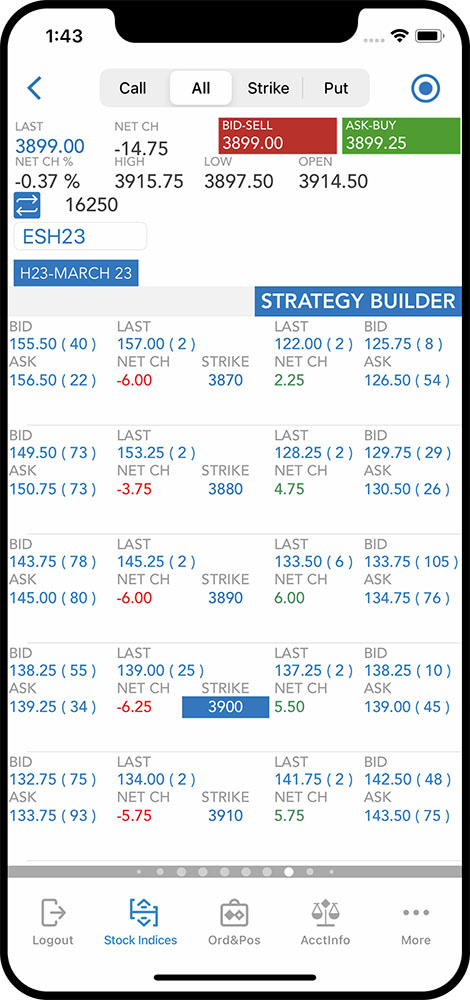

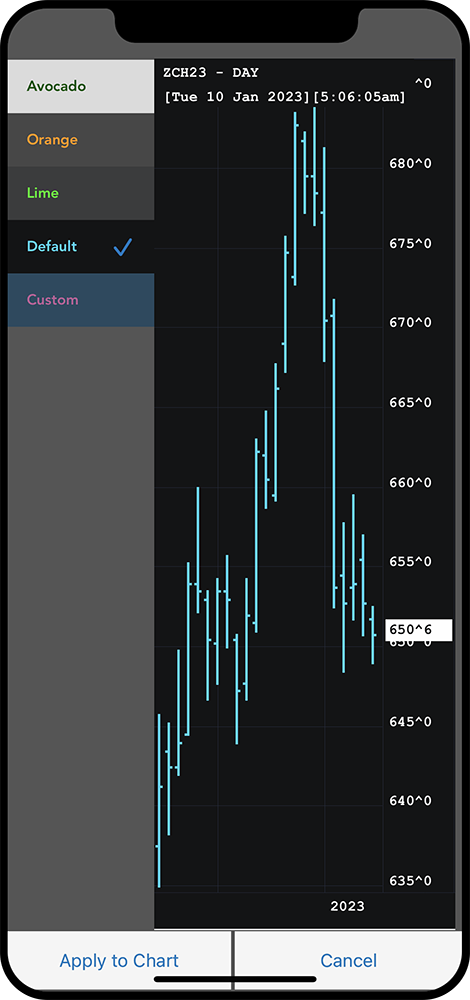

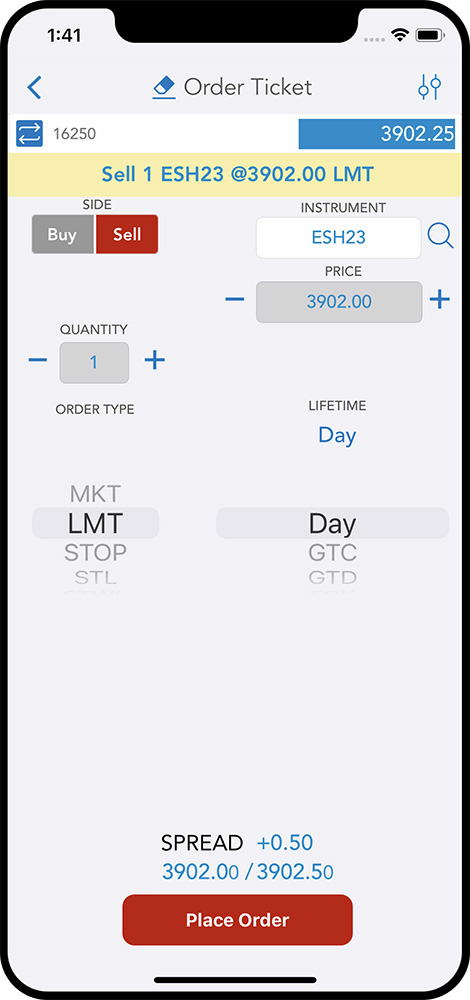

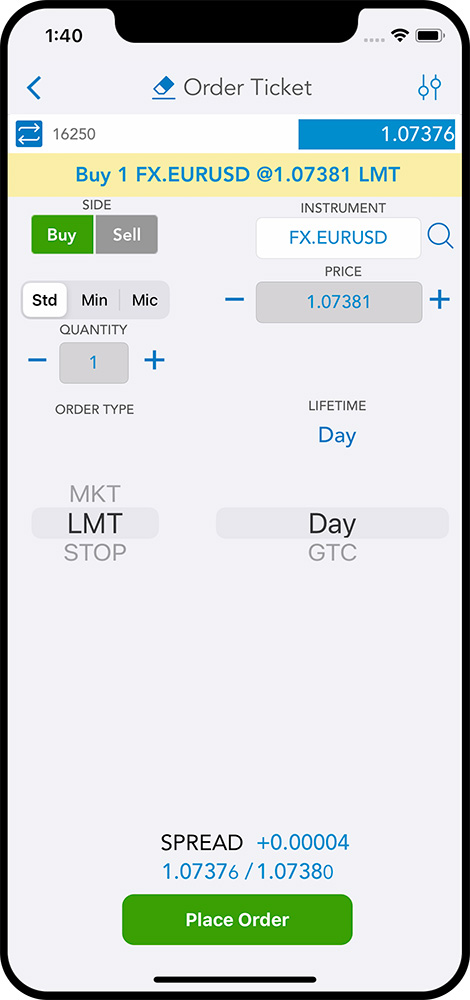

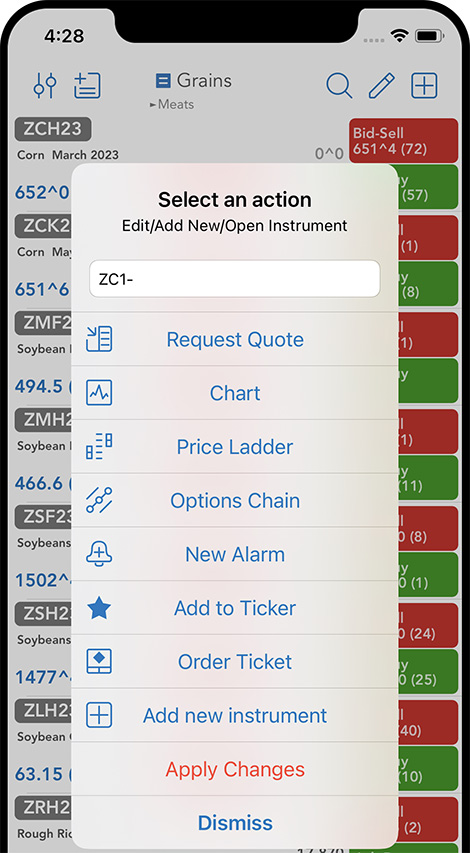

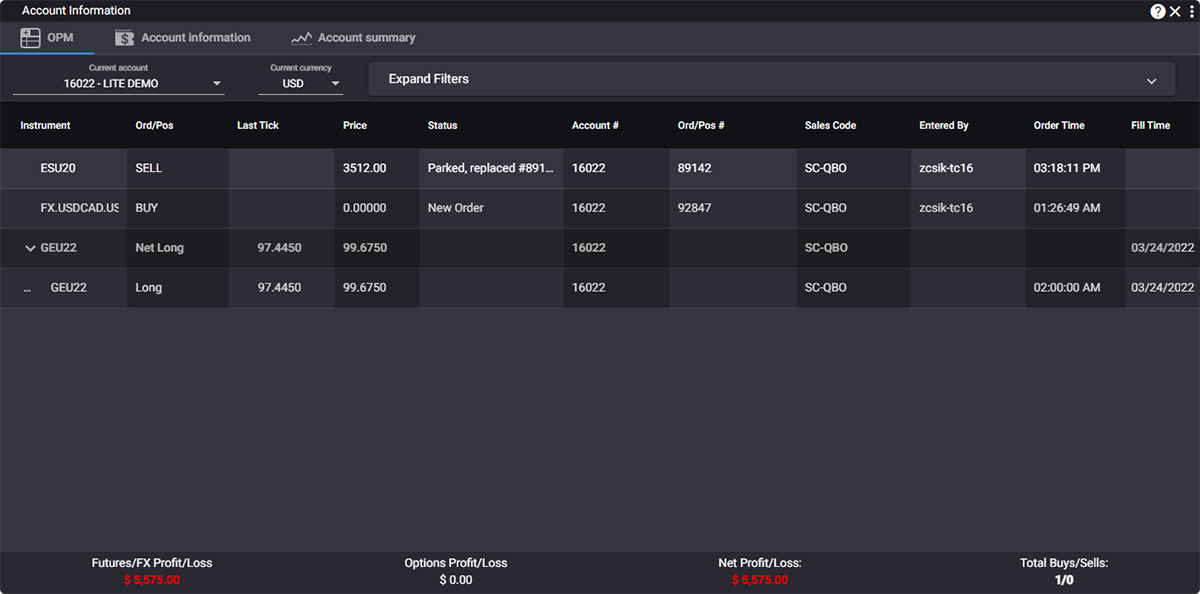

QPR integrates seamlessly with our front-end trading platform, back office and OMS